JEDDAH: Saudi Arabia is accelerating the development of its mining sector as a central pillar of economic diversification, with the Kingdom’s mineral wealth now estimated at SR9.4 trillion ($2.5 trillion).

The surge in value is driven by discoveries of rare earth elements, base metals, gold, phosphate, and titanium — a strong, lightweight metal with high-value applications in aviation and turbine manufacturing.

A major catalyst for this growth is the Northern Borders region, home to SR4.6 trillion in resources and a key hub for phosphate production. Developments in Waad Al-Shamal have helped position the Kingdom among the world’s top phosphate exporters.

In alignment with Vision 2030 and the National Industrial Development and Logistics Program, the mining sector is projected to boost its contribution to gross domestic product from $17 billion in 2024 to $75 billion by 2030. It generated $400 million in revenue in 2023 and is now backed by a $100 billion investment plan targeting critical minerals by 2035.

Speaking to Arab News, Saurabh Priyadarshi, a geologist and adviser for mining and metals at Geoxplorers Consulting Services, highlighted that Saudi Arabia’s substantial reserves of gold, copper, phosphate, rare earth elements, and lithium position it as a potential global leader in the industry.

“Saudi Arabia can foresee itself becoming a key player in the global minerals supply chain. Calling these minerals critical is a different matter altogether,” he said.

Priyadarshi added that one of the strongest diversification drivers is rising global demand for battery metals and industrial minerals that power electric vehicles and renewable energy infrastructure.

“As global markets push toward decarbonization, Saudi Arabia, too, can and should leverage its $2.5 trillion mineral resource base to power the next phase of industrial growth,” Priyadarshi said.

Saudi Arabia is also prioritizing domestic resources and talent, promoting public-private partnerships, and adopting Fourth Industrial Revolution technologies to drive sustainable, long-term growth.

Minerals central to 2030 plan

Mansour Ahmed, an independent economic adviser, described mineral development as a strategic cornerstone of Vision 2030. He said Saudi Arabia’s untapped reserves are “critical to the global energy transition.”

Ahmed stressed that growing the sector would expand non-oil GDP, generate employment, and drive regional development. He highlighted the importance of mining cities and downstream hubs “to maximize local value and build integrated, resilient supply chains.”

Both Priyadarshi and Ahmed noted Saudi Arabia’s alignment of mining with advanced manufacturing and innovation.

Priyadarshi pointed to Ras Al-Khair’s aluminum smelter and the planned battery chemicals complex in Yanbu, developed in partnership with EV Metals Group, as examples of the Kingdom’s industrial leap forward.

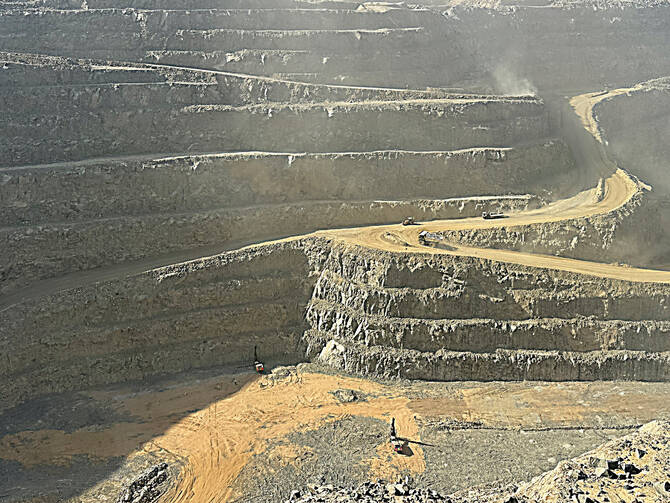

Investments in automated mining technologies, AI-driven exploration, and ESG-focused practices reflect Saudi Arabia’s ambitions to become a global hub for sustainable resource extraction.

Saurabh Priyadarshi, geologist and adviser for mining and metals at Geoxplorers Consulting Services

Saudi Arabia has also secured lithium processing capabilities, becoming the first Middle Eastern country to establish a battery materials supply pipeline.

“The government is leveraging its Public Investment Fund to finance mining and battery production, ensuring long-term supply chain resilience,” Priyadarshi said.

He also cited strategic global moves, such as acquiring stakes in Vale’s base metals division and developing domestic copper smelting, as reinforcing the Kingdom’s ambitions in critical minerals.

According to the Vision 2030 Annual Report for 2024, mining has been prioritized as a key sector for economic diversification. The report highlights significant reforms introduced to support this strategic shift, including the Comprehensive Mining Strategy and the Mining Investment Law — both designed to create a more attractive and transparent regulatory environment.

Institutional support was reinforced through the establishment of the Ministry of Industry and Mineral Resources. Furthermore, the Saudi Geological Survey and the National Geological Database were launched to strengthen geological mapping and resource assessment capabilities.

New entities such as Manara Minerals, the Mining Fund, and the Nuthree Exploration Incubator were also created to stimulate investment, innovation, and entrepreneurship in the sector.

ESG and AI integration

Priyadarshi emphasized that sustainability is integral to this transformation, with AI-driven exploration minimizing environmental impact, automation improving productivity and energy efficiency, and blockchain tools ensuring compliance with ethical, environmental, social, and governance standards.

Saudi Arabia is also investing heavily in renewables to power its industrial base. Priyadarshi pointed to the Kingdom’s $235 billion commitment to solar, wind, and hydrogen, including NEOM’s $5 billion green hydrogen facility and a $35 billion phosphate and bauxite processing expansion at Ras Al-Khair.

Ras Al-Khair Industrial City is home to Maaden’s phosphate and ammonia plants, aluminum smelters, and steel

production facilities such as Hadeed — showcasing the Kingdom’s ability not only to extract, but also to process and add value to its mineral resources. The city is rapidly emerging as a strategic node in global supply chains.

Priyadarshi noted that the Kingdom’s strategy extends beyond resource extraction. He underscored the importance of integrating mining with downstream industries such as aluminum smelting, phosphate processing, and electric vehicle battery production to reinforce supply chains and develop high-value sectors that move beyond the export of raw minerals.

“Investments in automated mining technologies, AI-driven exploration, and ESG-focused practices reflect Saudi Arabia’s ambitions to become a global hub for sustainable resource extraction,” he said.

When asked about the most strategically important minerals for the Kingdom, Ahmed identified phosphate, rare earth elements, and gold as critical.

He explained that phosphate is essential for food security and serves as a key driver of industrial exports, while rare earth elements such as neodymium, praseodymium, and dysprosium are vital for manufacturing EVs, wind turbines, defense technologies, and high-tech electronics — making them central to future-proofing the clean energy economy.

“Gold continues to hold significant financial value and remains an important mineral for the Kingdom. Copper and bauxite closely follow, given their growing importance in global electrification,” Ahmed added.

Global rankings

According to the Vision 2030 report, Saudi Arabia has achieved top international rankings in the mining sector.

The Kingdom secured first place for mining investment growth, as reported by MineHutte and the Mining Journal. It also ranks among the top 10 countries for mining financial policies and holds the second position globally for efficient license issuance — taking approximately 90 days to issue a mining license.

The report adds that Saudi Arabia’s advanced legislative framework has attracted significant interest, with 290 local and international companies operating in the sector as of 2024.

The National Geological Database has dramatically expanded its coverage from just 1.7 percent in 2021 to 51 percent by last year, enabling better resource identification.

Investor confidence remains high, with 30 proposals submitted for the Kingdom’s largest-ever mining tender in 2024, covering valuable mineral sites containing gold, silver, copper, and zinc.