RIYADH: Saudi private sector investments in Africa are expected to reach $25 billion in the next 10 years as economic and trade cooperation between the Kingdom and the continent strengthens, said a top minister.

Speaking at the Future Investment Initiative New Africa Summit in Riyadh, the Kingdom’s Finance Minister Mohammed Al-Jadaan said that Saudi Arabia is actively involved in shaping the future of Africa by lending aid for philanthropic activities and guiding the continent toward economic diversification.

The New Africa Summit aims to connect international investors and business leaders, showcasing the unique opportunities available on the African continent and fostering cross-border investment, according to the FII website.

Saudi Arabia has spearheaded several initiatives to develop the African continent, with the latest one being a memorandum of understanding signed in April. The agreement was between the Saudi Fund for Development and the African Development Bank Group to provide funding for emerging economies in the continent.

“The relationship between the Kingdom and Africa is not only governed by the geographical location — we are partners with a joint history and a joint future. Our shared history goes beyond economic ties. We have different commonalities in our culture, geographies, and common denominator factors between our people,” said Al-Jadaan.

He added: “It is expected that Saudi Arabia’s private sector investments in Africa will reach $25 billion in the coming 10 years. Since the summit (Saudi-Africa Summit), within less than a year, we are working on $5 billion of these investments.”

During his speech, the finance minister also highlighted some of the major initiatives the Kingdom took to propel the socio-economic conditions in Africa, including $10 billion provided by the Saudi EXIM Bank to deliver financing products in Africa in the coming 10 years.

He added that the EXIM Bank has already allocated $1.5 billion out of this $10 billion.

“The recent Saudi-Africa summit that was held last year marked a new chapter. Saudi Arabia has dedicated $1 billion from the Custodian of Two Holy Mosques’ Philanthropic initiative in Africa.

Second, $5 billion from the PIF (Public Investment Fund) has been allocated to diversify economic projects in Africa in the next 10 years, and it has already started,” said Al-Jadaan.

The minister added that the Kingdom is also helping Africa in various frontiers, including digitalization, and aiding the continent to establish its position in the global landscape.

“The Kingdom was one of the first countries that requested that the G20 give permanent membership for the African Union, and also called for establishing a chair for Africa in the executive body in the World Bank,” said Al-Jadaan.

He added: “One of the most important challenges faced by several African countries is the sustainability of the debts and this urges serious global cooperation to help these countries deal with sovereignty debts. Saudi Arabia is working with IMF, World Bank, and other groups to handle debts of African nations, especially countries which have less income.”

According to the finance minister, Saudi Arabia is addressing urgent solutions for African nations and is also working to establish a lasting framework to enhance economic flexibility and financial stability across the continent.

During the inaugural ceremony, Richard Attias, CEO of FII Institute, said the New Africa Summit is a gathering dedicated to investing in the boundless potential of the continent.

“Africa’s resilience, diversity, and reality are inspiring. From the lively markets to the solar farms, and endless savannahs symbolize ‘Infinite Horizons’, our FII8’s main theme,” said Attias.

According to the CEO, the New Africa Summit is not aimed at discussing the future of the continent, instead, it intends to reshape it by introducing new narratives and exploring the continent’s untapped resources.

“Our commitment here today is to empower African voices, foster sustainable growth, and embrace the unique vision Africa brings to the world’s stage. Together, we will illuminate the path forward, creating partnerships that transcend borders and crafting an impact that future generations will inherit with pride,” said Attias.

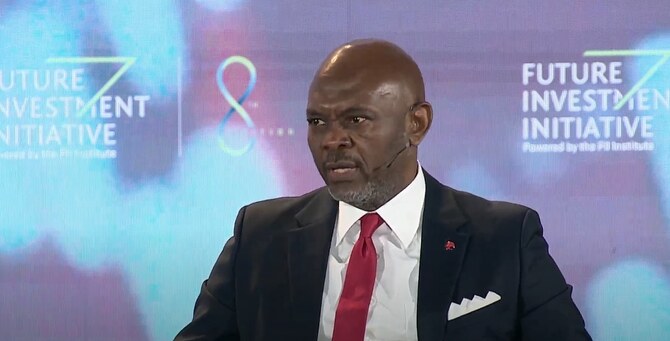

In a separate panel discussion, Tony Elumelu, chairman of the United Bank for Africa, said that the continent, with 60 percent of its population under the age of 30, is evolving as a startup hub in multiple sectors.

He added that startups in Africa are tackling multiple challenges, and the failure rate among these companies has gradually decreased over the past several years.

“We are seeing a young population in the tech sector startup landscape, we are seeing women in agriculture. The startup ecosystem is improving now. There’s room for improvement in the continent, but the good news is that, from where we started years ago, I have seen more progress than ever before,” said Elumelu.

He added that the African continent has successfully bridged the gender gap over the past few years and said several companies have females in their top leadership.

Elumelu also invited investors to come and invest in Africa and said the continent is open to new business.

“The opportunities are there, the challenges are there. That’s what entrepreneurs always do; we try to navigate challenges for the betterment of all. So, Africa is open for business, we do have challenges. You can navigate those challenges,” he concluded.