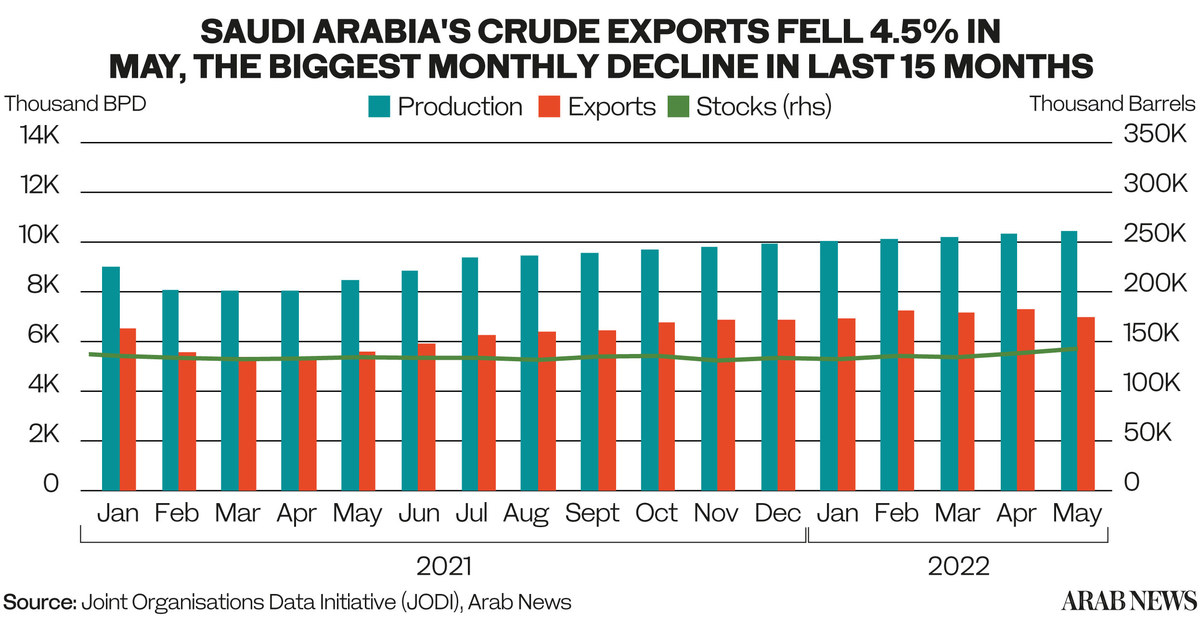

RIYADH: Crude oil exports from Saudi Arabia fell by 332,000 barrels per day in May on a monthly basis, the Joint Organisations Data Initiative has revealed.

The data showed that 7.05 million bpd were exported, down 4.5 percent from April. The decrease is the biggest in the past 15 months.

Crude oil production grew by 97,000 bpd month-on-month to 10.538 million bpd in May. Production rose by 0.9 percent from 10.441 million bpd in April.

However, Saudi Arabia’s crude oil exports increased by 1.401 million bpd year-on-year, a 24.8-percent rise from its 5.649 million level in May 2021.

As for the production of crude oil, it saw an annual increase of 1.994 million reaching 10.538 million bpd this month, a 23.3 percent growth from 8.544 million bpd last year.

This May, the Kingdom’s refinery intake increased by 211,000 bpd to 2.773 million bpd, an 8.5 percent monthly surge from its 2.538 million bpd in April.

The direct crude oil burned for electricity increased by 185,000 bpd, from 397,000 bpd in April to 583,000 bpd in May.

When looking at crude stocks, Saudi Arabia's crude stocks rose by 4.842 million barrels to 144.421 million barrels in May, from their previous value of 139.579 million barrels in April.

The net monthly increases in both direct use of crude and the stock levels are seen highest in months.