JEDDAH: In the four years since the resumption of movie screening across Saudi Arabia, the country has experienced an explosion of investment, filmgoing and box-office takings, establishing it as West Asia’s foremost cinema market.

Box office revenues in the MENA region as a whole are expected to grow by 4 percent compound annual rate to $1 billion between 2019 and 2024, compared with a 2.4 percent decline worldwide, according to data from market tracker Ventures ONSITE.

This regional growth is mainly due to the creation of a sizable new market following the resumption of movie screening in April 2018 after a decades-long ban. The Kingdom far outstrips its neighbors in market size, revenue per user, and growth rate.

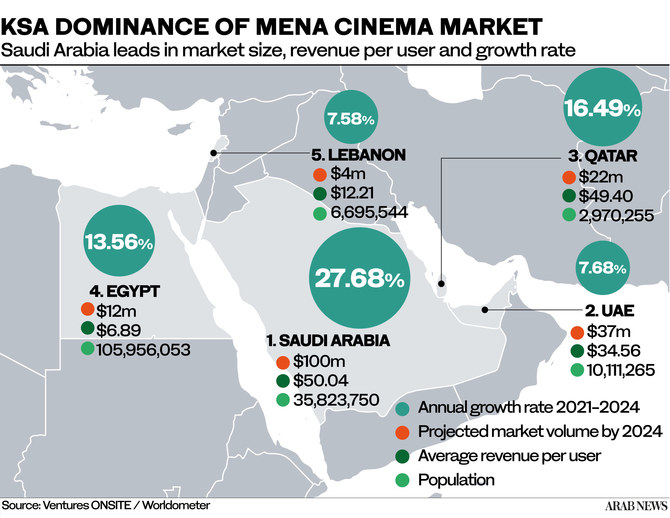

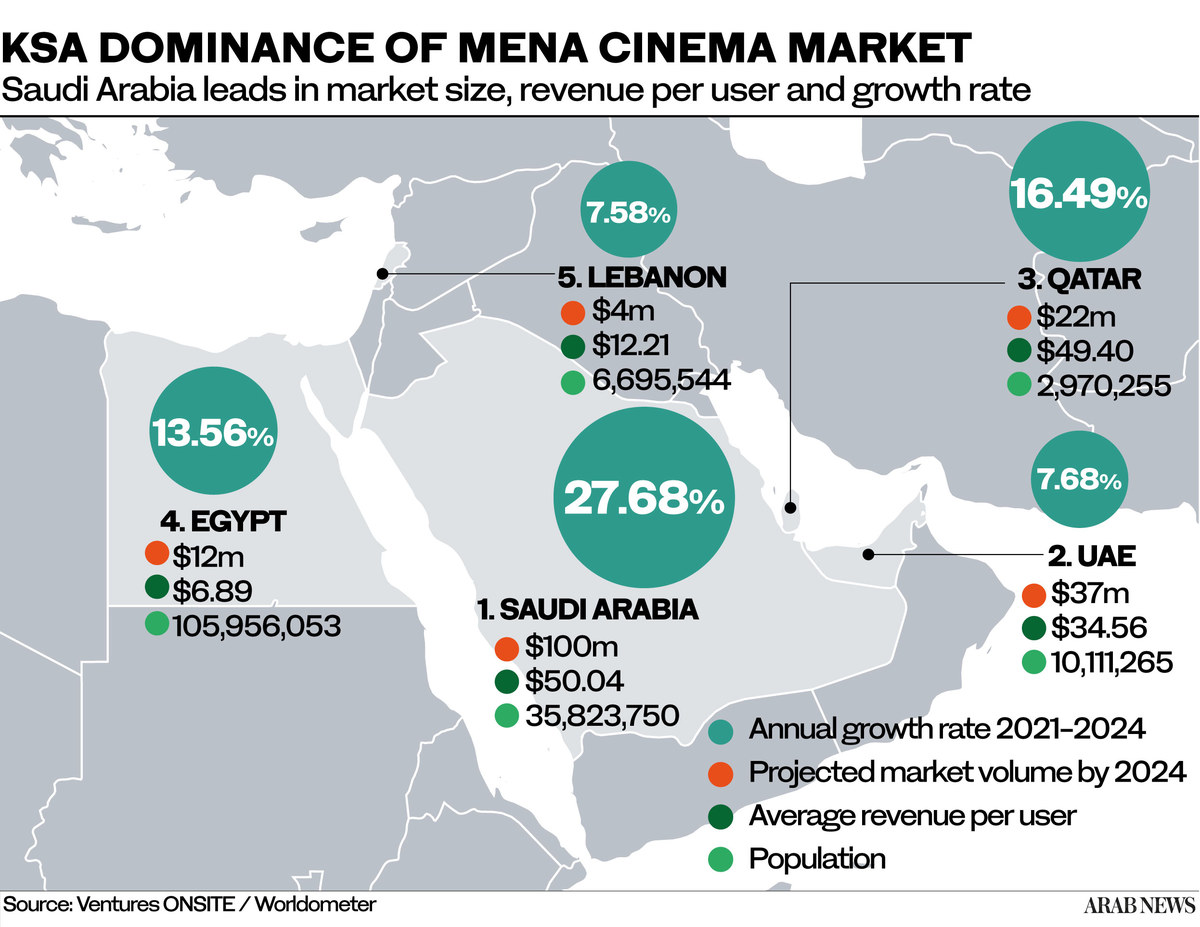

Revenues in the Kingdom are expected to show an annual growth rate of 27.68 percent resulting in a projected market volume of $100 million by 2024, while the average revenue per user is expected to amount to $50.04.

This compares favorably with the UAE, which already has a very well-established cinema industry, where revenues are expected to show a smaller annual growth rate of 7.68 percent resulting in a projected market volume of $37 million by 2024 and an average revenue per user of $34.56.

Outside the Gulf region, market growth is forecast to be far smaller. In Egypt, revenues are expected to show an annual growth rate of 13.56 percent resulting in a projected market volume of $12 million by 2024 and an average revenue per user of $6.89.

For crisis-hit Lebanon, meanwhile, revenues are expected to show an annual growth rate of 7.58 percent resulting in a projected market volume of $4 million by 2024 and an average revenue per user of $12.21.

The lifting of the prohibition on cinema was first announced by Crown Prince Mohammed bin Salman in 2017 as part of the Vision 2030 reform agenda, with a view to improving overall quality of life and diversifying the economy away from oil.

If the revenues alone are anything to go by, the policy shift has been a resounding success. Since cinemas officially reopened, box office sales have exceeded 30.8 million tickets, the Saudi Press Agency reported on April 18.

INNUMBERS

56 Theaters licensed in 20 cities since resumption of movie screening.

4,439 Jobs created for young Saudi men and women in the sector.

2,600 Screens expected to come up in the Kingdom by 2030.

$950m Projected box office revenue in the Kingdom in 2030.

In 2021 alone, the industry saw box office-market grow to $238 million — a 95 percent increase over the previous year’s takings of $122 million — far outstripping the UAE’s 2021 total of $130 million, according to a recent report in Variety magazine.

Several analysts believe Saudi Arabia is on pace to become a billion-dollar movie market in the next few years. The professional services network PwC estimates the Kingdom’s industry could be worth $950 million in 2030.

Taking into account non-admission revenues, including advertising and concessions like food and beverages that typically comprise 35 percent of overall takings, the sector could generate $1.5 billion in 2030.

Meanwhile, the General Commission for Audiovisual Media, one of the governing authorities established to regulate and operate cinemas in the Kingdom, estimates there will be 2,600 movie screens in Saudi Arabia by 2030 in an industry worth around $1.2 billion.

Saudi men arrive at a cinema theater in Riyadh Park mall after its opening for the general public on April 30, 2018 in the Saudi capital. (AFP file photo)

According to the Film Commission, a Saudi government body affiliated with the Ministry of Culture, established in February 2020, the sector has already created jobs for 4,439 young Saudis, fulfilling a core goal of the Kingdom’s Vision 2030 reform agenda.

Variety magazine confirmed in a November 2020 report, citing figures released during the META Cinema Forum exhibitors’ conference, that Saudi Arabia had overtaken the UAE to become the region’s top-grossing territory, with more than $73 million in theatrical movie ticket sales over the past 40 weeks — a roughly $2 million increase in box office returns compared with the same period in 2019.

The UAE during the same period in 2020 had generated about $51 million, roughly a quarter of its 2019 box-office takings , the magazine said.

“We believe that Saudi Arabia is the only cinema market globally to have expanded in 2020,” Cameron Mitchell, CEO of prominent Middle East exhibitor VOX Cinemas, was quoted by Variety as saying. This despite the fact that, due to the pandemic, cinemas were shuttered in the Kingdom between March and the middle of June.

Saudi youth are driving cinema ticket sales, with admissions in 2030 expected to total 60-70 million. (AFP)

Mitchell said that as a theatrical market, the Middle East in 2019 was worth $600 million, of which Saudi accounted for a $110 million share and the UAE roughly $250 million.

Much of Saudi Arabia’s remarkable box-office success in the space of just four years is attributable to the huge investments the Kingdom has seen in the form of multiplex cinemas.

Under Vision 2030, the Kingdom aims to attract domestic and international investors, increase household spending on entertainment from 2.9 percent to 6 percent, and develop a market worth SR30 billion ($1.9 billion) in recreational services.

In April 2018, coinciding with the resumption of movie screening, the Kingdom’s Development Investment Entertainment Company opened its first cinema in the King Abdullah Financial District in Riyadh.

Since then, 56 theaters with 518 screens have been licensed in 20 cities, according to the Film Commission. In that time, 1,144 movies in 22 languages from 38 countries have been shown, including 22 Saudi films.

According to a recent Variety magazine report, citing data from US marketing analysis firm Comscore, the number of multi-screen movie theaters in Saudi Arabia grew from 33 locations at the start of 2021 to 53 venues by December 2021 — an increase of 20 new locations.

With Saudi Arabia’s population forecast to be 39.5 million by 2030, analysts believe the Kingdom has the potential to absorb up to 2,600 screens.

Top 10 box office hits in Saudi Arabia, 2021

-

1. “Waafet Reggaala,” Empire, $15.08 million

-

2. “Spider-Man: No Way Home,” Sony, $11.2 million

- 3. “Cruella,” Disney, $9.1 million

- 4. “Wrath of Man,” Eagle Films, $8.3 million

- 5. “Mesh Ana,” N Stars, $8.2 million

- 6. “No Time to Die,” Phars, $8 million

- 7. “Fast & Furious 9,” Universal, $7.8 million

- 8. “Venom: Let There Be Carnage,” Sony, $6.7 million

- 9. “A Quiet Place 2,” Paramount, $6.1 million

- 10. “Mama Hamel,” Empire, $5.9 million

Depending on how rapidly the Kingdom’s market evolves, it could potentially generate 60 to 70 million admissions in 2030.

Saudi-owned Muvi Cinemas operates the highest number of local cinemas, followed by (Dubai-based) VOX Cinemas, US theater chain AMC, the world’s largest cinema operator, Lebanon’s Empire Cinema, and Mexican-owned Cinepolis.

Prior to the pandemic, VOX set out plans to invest $533 million in the Kingdom to open 600 screens, including at least four multiplexes in partnership with IMAX, creating 3,000 new jobs over a period of five years.

Cinepolis and Al-Tayer Group have partnered with Al-Hokair Group, while iPic Entertainment is exploring opportunities with BAS Global Investments Company to develop 25 to 30 sites over the coming decade.

Meanwhile, India’s PVR Limited is exploring options with the UAE-based Al-Futtaim Group, while CJ 4DPLEX has signed a deal with Cinemacity.

Kuwait National Cinema Company and Dubai-based distributor Front Row Filmed Entertainment expect to develop 12 multiplexes through their subsidiary Cinescape, while Al-Rashed Empire Cinema consortium has received a license to enter the Kingdom’s marketplace.

Infrastructure and investment are not the only reasons for the Saudi success story. Understanding the audience and knowing what films to screen has also been integral.

Around one third of Saudi Arabia’s total population is made up of expatriates, including 3 million Indians, concentrated in the provinces of Riyadh and Makkah.

Market analysts say a strategy that offers filmgoers a mix of Hollywood, regional, Bollywood and local content is a surefire way to pull audiences into cinemas.

To cater for such a broad array of tastes and interests, some 340 new feature films were released into Saudi cinemas in 2021 alone — up from 222 in 2020.

Of course, what Saudi officials would like to see in the coming years is homegrown movies making the top box-office rankings.