We are in the middle of one of the most savage stock market crashes in history. Shares across the world have been pummeled for the past two weeks, and nobody can honestly say where it will end.

But it will end, as I can vouch. As a journalist over more decades than I care to remember, I’ve covered the ups and downs of financial markets. There is always a recovery.

The media cynics say that “bad news is good news” in the newspaper industry, meaning that you can sell more copies and get the full attention of your readers when their livelihoods are threatened.

Certainly, as a financial journalist, stock market crashes are the events you live for. They are for us curmudgeons what general elections are for political journalists, the World Cup final for sports writers, the Oscar ceremony for Hollywood correspondents.

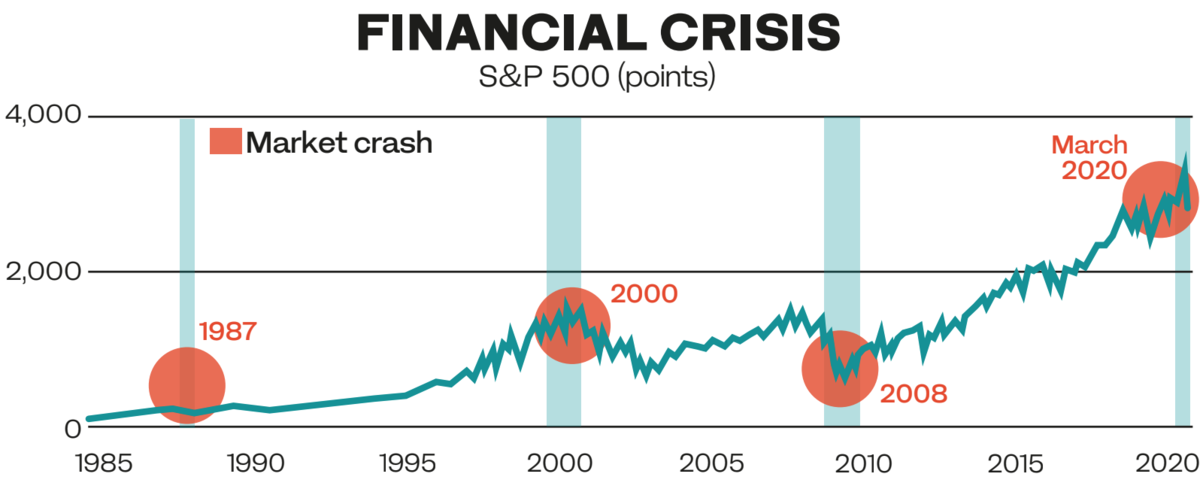

The current crash is different from others, in a way that I’ll come to later, but each of the previous big ones I lived through and reported on — in 1987, 2000 and 2008 — was different in its own way.

I guess too that they were all different from the other famous event in financial history — the Great Crash of 1929 — which still frames the popular crash memory. Plunging stockbrokers and soup queues are probably most people’s immediate reaction to news of a market crash.

But in 1987, those images were far from my mind as I struggled to get to work in central London on the morning of Oct. 19 — Black Monday. The city had been hit over the weekend by a genuine hurricane, and fallen trees and damaged buildings made the journey difficult.

It was a good time to be a financial journalist in London. Share prices had been rising most of the decade, and it was the Gordon Gekko era of sensational takeover battles. The stories virtually wrote themselves: “Profits and dividends up” and “XYZ Corp. bids for ABC Inc” were the default headline.

The next 48 hours changed the way I viewed financial markets. Markets, it turned out, were not just booming — they were massively overvalued and riding for a fall. On that Monday, the London indices fell 11 percent in a matter of hours, and billions of pounds in value was wiped off share values.

The damage would have been even greater but for the fact that many stockbrokers had not made it to the office through the hurricane-ravaged city, and were unable to sell. Quaintly, this was before the age of remote working, or even of mobile phones.

The absent traders made up for it the next day, when they managed to get to work and sold off another 13 percent of share value. It was carnage, the biggest two-day drop in London stock market history, and seemed an epoch-defining event.

It wasn’t though. Life went on pretty much the same after Black Monday, and indices began an upward climb that continued more or less steadily through the 1990s, until the Dotcom bust of 2000.

I was more experienced by then as a financial journalist, and determined I would never be caught out again as I was in 1987. I was on the lookout for warning signs as markets forged ever upwards, inflated by the first breath of the Internet revolution that promised to bring a “new paradigm” to the investment world.

I remember precisely the moment that I knew it would all end in tears. It was in one of those City of London clubs where sophisticated businessmen would gather to discuss the day’s market news before heading off to a decent dinner.

All pin-stripes, cufflinks and perfectly coiffed silver hair — except for one young man in his twenties dressed in chinos and casual shirt. He was seated in a big leather armchair explaining an investment proposition to one of the pinstripes, who was concentrating hard but obviously, judging by the number of times he asked the same question, failing to understand the deal. Regardless, they shook hands.

It had all the makings of a disaster. The venerable older man had just committed millions of pounds worth of investment to a scheme he obviously did not comprehend. Over the coming months, as the indices went into a long decline, it was obvious that scene had been played out on a grand scale: Wealthy old men who should have known better, betting the farm on the “new paradigm” that they did not understand.

Their pain was compounded in 2001 when the 9/11 terrorist attacks in New York hit the heart of global capitalism, and set off another tsunami of selling.

But again, stock markets recovered, buoyed up by soaring prices in real estate around the world. By now, I was living and working in the Middle East, and was amazed by the quality of life in my new home, Dubai.

In 2006, when I moved there, it seemed each day brought another stupendous development, from the Palm Jumeirah to the under-construction Burj Khalifa. Dubai was the “Switzerland of the Middle East” for the quality and reliability of its financial industry, and life was good.

But somewhere — London or New York probably — a smart financier had an idea that was to eventually dent the Dubai

dream — and for a time threaten

a global financial collapse. That idea was the collateralized debt obligation (CDO), a complex financial instrument that allowed bankers to pool together and sell assets, notably mortgages and other forms of securities.

The problem, as the world discovered in 2008, was that all sorts of risky assets had been mixed in with the good ones, corrupting the whole.

In September that year, toxic CDOs led to the collapse of Lehman Brothers in New York, and suddenly every bank in the world looked vulnerable. I remember going on a Dubai radio station and declaring it to be “the financial equivalent of 9/11,” for which I got a certain amount of criticism as a scare-monger, but I like to think subsequent events at least partially justified my hyperbole.

Towards the end of 2009, the strains that had been building up in Dubai could no longer be confined, and Dubai World — the builder of the glamorous Palm and lots of other Dubai icons — announced it could no longer pay back its debts and was seeking a “standstill” on repayments.

Dubai, and the rest of the world got through it, of course. The Economist coined one of its legendary headlines about the emirate — “Standing still, but still standing” — which summed up the situation. With reliance, determination and a little help from your friends, you can get through anything — even a global financial meltdown.

Which brings me to the current situation. This one, it seems to me, is different in a number of significant ways from previous crashes. The past collapses were all, at bottom, to do with some defect in the financial system, coinciding with inflation of asset values over a number of years.

Certainly, there has been a period of soaring prices in world markets ever since the 2009 crash. The world got over that disaster pretty quickly, and embarked on a 10-year spending spree for shares and other assets, especially related to technology and the digital sector. It also loaded up with debt again in a big way.

But, before the coronavirus outbreak, most experts thought this would continue for much longer, or at best would only suffer some minor “corrections” before taking off again. What has happened now is that, because of the severe dislocation to global trade and national economies because of the virus, huge chunks of economic activity have been effectively shut down. It is the reverse of previous crashes. This one started in the real world of national economies and spread to financial systems.

The other difference, of course, is that this time it is not only livelihoods that are threatened, but lives too, on a potentially catastrophic scale. With this threat over us, it seems heartless, almost irrelevant to watch the share prices or the financial indices.

But we will all need some distraction, and some hope, in the weeks and months ahead. Searching for the first sign of the inevitable recovery in global stock markets could be a valuable therapy. Whoever spots if first, and backs their judgment with cash, will be ahead of the curve when times get better — as they surely will. We always recover from crashes.