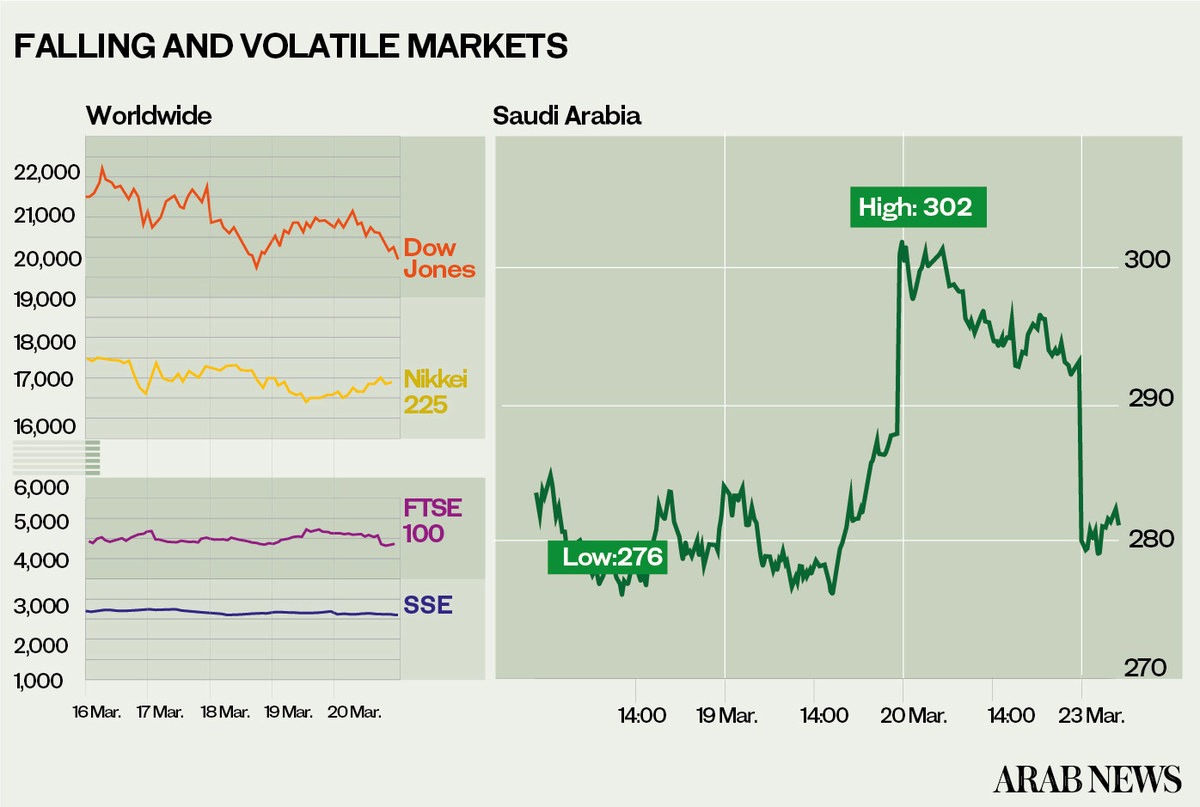

Last week was devastating for equity markets. Amid volatility, the Dow Jones lost 8 percent of its value, with a high on Monday of 21,210 and a low point on Wednesday of 19,919. The FTSE 100 and the Nikkei 225 did not fare any better. The STOXX Europe 600 and Shanghai Composite showed smaller losses, as did the Tadawul.

The Saudi exchange lost 3.2 percent between its high last Thursday and mid-morning on Monday. It came amid falling oil prices that reached 17-year lows, with no rapprochement between Russia and Saudi Arabia in sight, nor an agreement between OPEC and US shale producers.

Heavy losses continued into Monday with the Dow losing 2.6 percent amidst huge volatility, the FTSE losing 4.3 percent and the Shanghai Composite 3.2 percent. The Tadawul lost 2.9 percent.

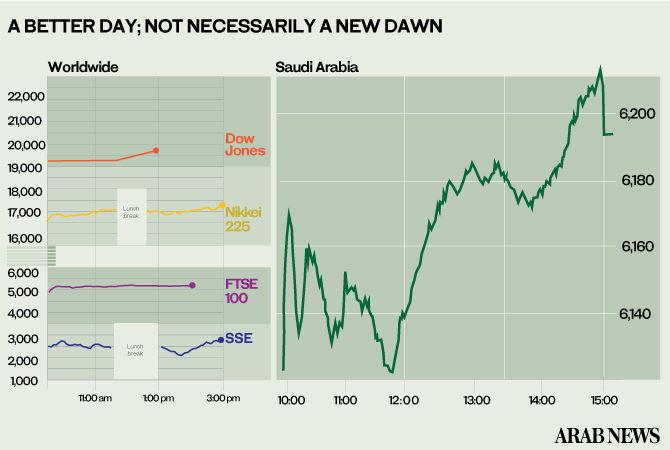

Similar to last week, volatility is king. Markets were sharply up by mid-morning Tuesday in Europe, the FTSE rose by 5 percent, the Nikkei by 7 percent and the Tadawul had gained 3.1 percent. When the Dow Futures were up by 930 points, they hit 5 percent and with it the circuit breaker, which meant that trading had to be suspended temporarily.

The FTSE was particularly interesting, because it put the old wisdom of buy on the rumor and sell on the fact on its head. People sold expecting a lockdown in the UK and bought after British Prime Minister Boris Johnson announced the lockdown.

Why it happened

As country after country went into lockdown, the coronavirus disease (COVID-19) brought to a standstill most major economies as well as transportation, except for freight containing essential goods.

Such an abrupt halt of all economic activity is unprecedented at any time — let alone in peacetime. Oil has been particularly hard hit, with international oil companies such as Shell halting share buy backs and slashing capital expenditure to $20 billion.

Uncertainty creates risk aversion, which has been reflected in the flight from equities.

Uncertainty also creates opportunism, which is why we saw markets up on Tuesday morning. It is too early though to interpret these markets gains as a new dawn. They are a sign of volatility and we have to watch how events unfold and what the various stimulus programs have in store.

Economists agree that we are on the way to a recession, if not a depression. In a research note, Morgan Stanley predicted that the US economy would shrink by 30 percent. James Bullard, the CEO and president of the Federal Reserve Bank of St. Louis, went further, predicting it could contract by 50 percent if Congress failed to swiftly agree on the priorities and disbursement mechanisms for a near $2 trillion emergency package. Lawmakers could still not reach agreement on Monday.

Country after country is employing fiscal firepower in an attempt to combat the effects of the halt of economic activity. Germany, for instance, abolished its edict to balance the budget, the so-called “black zero,” and was preparing to borrow 350 billion euros to deal with the fallout from shutting down the economy.

If you overlay the high corporate indebtedness on top of the economic devastation, the picture looks even more grim. In Asia alone, the outbreak threatens $32 trillion of corporate debt.

Where do we go from here?

What has happened in equity markets, and the economy at large, is worse than a classic bear market, which is defined by a market downturn of 20 percent. The Dow is down by more than 30 percent since the start of the year. As previously noted, a total global shutdown of all economic activity is unprecedented, even in wartime.

The main issue now is the uncertainty over how long the shutdown will last, and how the pandemic will develop.

People working in small- and medium-sized enterprises, the self-employed, and members of the gig economy are being particularly hard hit, as they live from order to order or paycheck to paycheck. Governments need to ensure that these workers can keep a roof over their heads and put food on their tables. When this is all over, economies will look different and unemployment will be a major issue.

For those with investment portfolios, panic sales might not be the best option. When all this is over, publicly listed companies with good products, sound balance sheets and competent management will have the best chance to weather the storm — albeit with reduced profitability.

The COVID-19 pandemic is a demand shock on an epic scale, and anyone who expects a V-shaped recovery might be overly optimistic. It is imperative that government programs are sufficient and efficiently deployed. We shall discuss that tomorrow.

In the meantime, stay safe and stay healthy.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairman and CEO of business consultancy Meyer Resources. Twitter: @MeyerResources