RIYADH: The GREAT Futures Initiative Conference is set to begin on Tuesday in King Abdullah Financial District with the mission of enhancing economic relations between Saudi Arabia and the UK.

“Today the largest UK business delegation in over a decade lands in Riyadh for GREAT FUTURES, with over 400 delegates from the UK traveling to Saudi Arabia, 70 percent of whom have never visited the Kingdom,” British Ambassador to Saudi Arabia Neil Crompton told Arab News.

“Over the next two days, senior leaders from both our kingdoms will forge partnerships that span our economies, from cultural institutions to cutting-edge technologies,” he said. “These partnerships build on existing bonds in the fields of security and energy. The UK is committed to playing its part in the transformational Vision 2030.”

The GREAT Futures Initiative Conference is a joint project organized by the UK government’s GREAT Britain and Northern Ireland campaign in partnership with the Saudi government.

The conference is part of the Saudi-British Strategic Partnership Council, co-chaired by Crown Prince Mohammed bin Salman and UK Prime Minister Rishi Sunak.

British Deputy Prime Minister Oliver Dowden will represent the UK at the conference.

“The GREAT Futures Initiative Conference is an important opportunity to build partnerships between the business sectors of both countries, keeping pace with the future, innovation and creativity,” Dowden said. “It also allows British companies to familiarize themselves with relevant business regulations, incentives, and advantages for conducting business in Saudi Arabia.”

The conference will welcome 800 participants from the two kingdoms’ public and private sectors.

UK Ambassador Neil Crompton posted a video on X social media platform in the lead-up to the conference.

“This festival marks a significant event in the British calendar, as it takes place once every two years in a city around the world,” Crompton said. “This year, we chose to hold it in Riyadh due to the widespread British interest in the positive changes and opportunities, which came as a result of the success of Vision 2030.”

The ambassador said that the embassy would be hosting a British delegation comprising representatives from 400 companies, under the patronage of the British deputy prime minister.

“I am looking forward to meeting athletes, artists, celebrities, and entrepreneurs from both our kingdoms. I would like to extend my thanks to our partners in the Saudi government for cooperating with us on this joint project,” he said.

The two-day conference, from May 14 to May 15, will feature 47 sessions and workshops with 127 speakers from both public and private sectors.

The conference aims to enhance cooperation and economic partnership in 13 sectors such as tourism, culture, education, health, sports, investment, trade, and financial services.

Agreement signings are also expected in education and training, tourism, and real estate development.

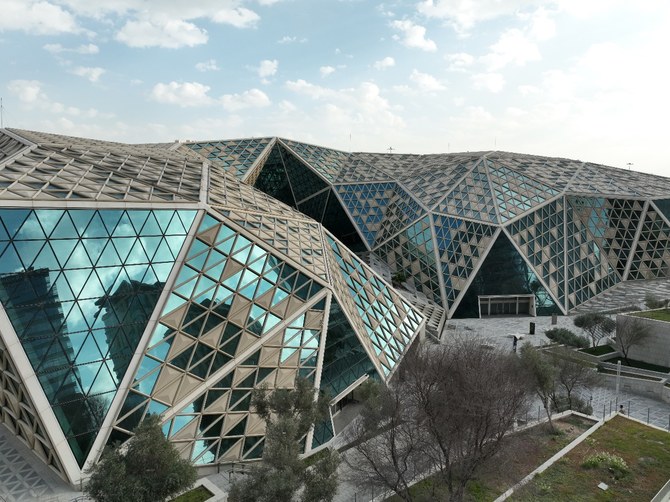

KAFD’s centrally located business district will host the two-day conference in its 28,000 sq. m venue.

Gautam Sashittal, CEO of King Abdullah Financial District Development and Management Co., highlighted the significance of the conference being hosted in KAFD.

“Holding a spectacle of this magnitude can never be classified as a roadshow held by British stakeholders for their Saudi counterparts to hop on and make millions if not billions,” Sashittal said. “On the contrary, this event is just a kickstarter for a year-long campaign aimed at creating an everlasting collaboration that reimagines key domains while unearthing hidden jewels rooted in both countries’ glorious pasts.

“As one of the few places where the Kingdom’s exciting next phase is getting written, it was quite natural for the choice to fall on KAFD and its architectural marvel, which is otherwise known as the conference center,” he said.

In 2023, bilateral trade between Saudi Arabia and the UK increased by 68 percent, amounting to $17 billion, according to the chairperson of the Saudi British Joint Business Council, Jennie Gubbins.

The increase in trade could not be attributed to the oil sector alone, Gubbins said, pointing to the effectiveness of the Kingdom’s economic diversification efforts and the development of other industries, primarily in the tech field.

The Saudi Ministry of Commerce will participate in the conference and through its sub-entities will facilitate meetings of leaders of the business sectors in the two countries.

As a part of the conference, accompanying events will be held over the next 12 months to enhance partnerships in promising and emerging fields between the two countries.

The ministry aims to inform the British business sector of the economic reforms that the Kingdom has accomplished to improve the business environment and facilitate the start and practice of economic activities.

The “GREAT Futures” also aims to be a platform for exchanging qualitative experiences and learning about the latest practices across sectors.