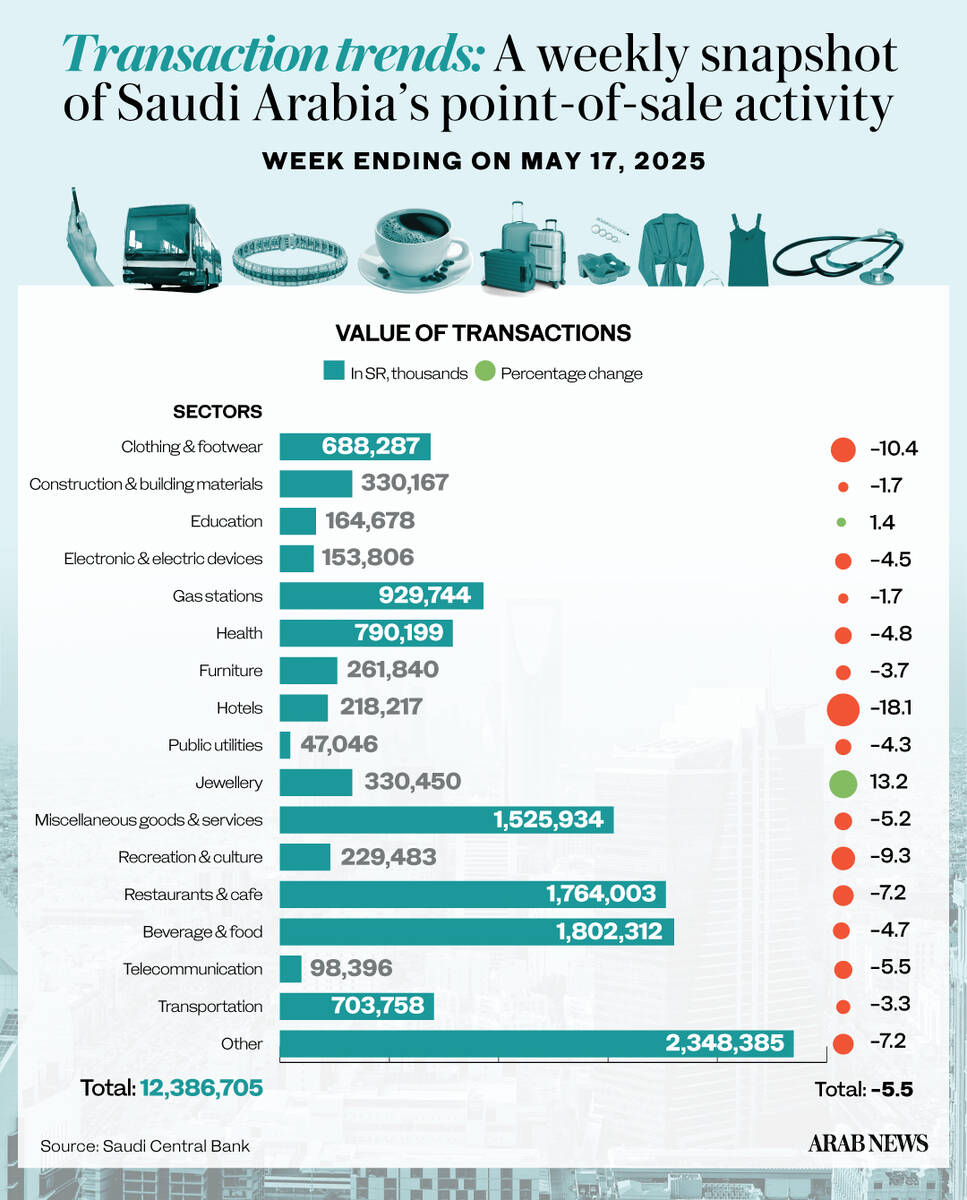

RIYADH: Jewelry spending in Saudi Arabia rose by 13.2 percent between May 11 and 17 compared to the previous week, adding SR330.4 million ($88 million) to point-of-sale transactions during this period.

The latest data from Saudi Arabia’s central bank, SAMA, revealed that it was one of only two sectors to record growth during the period, with education also posting an increase of 1.4 percent to SR164.6 million.

The Kingdom’s overall POS transactions saw a 5.5 percent dip to SR12.3 billion in the seven-day period, driven by decreased spending across most of the sectors.

Hotels spending saw the biggest drop, dipping by 18.1 percent to SR218.2 million. Clothing and footwear expenditure followed, falling by 10.4 percent to SR688.2 million, while recreation and culture saw a 9.3 percent decrease, totaling SR229.4 million.

The smallest expenditure drop was in spending on construction and building material and gas stations, down by 1.7 percent each to SR330.1 million and SR929.7 million, respectively.

The health sector declined by 4.8 percent to SR790.1 million, while public utilities dropped 4.3 percent to SR47 million.

Electronics followed the trend, dropping 4.5 percent to SR1653.8 million, and furniture edging down by 3.7 percent to SR261.8 million.

The telecommunication sector dropped by 5.5 percent in transaction value to SR98.3 million. Food and beverage spending decreased by 4.7 percent to SR1.8 billion, accounting for the largest share of the week’s POS.

Restaurants and cafes accounted for the second-biggest share at SR1.7 billion, followed by miscellaneous goods and services at SR1.5 billion.

The top three categories accounted for 41.1 percent of the week’s total spending, amounting to SR5 billion.

Geographically, Riyadh dominated POS transactions, with expenditure in the capital reaching SR4.5 billion — a 3.4 percent decrease from the previous week.

Jeddah followed with a 7 percent dip to SR1.7 billion, while Dammam ranked third, down 5.7 percent to SR640.5 million.

Makkah saw the biggest decrease, inching down 20.6 percent to SR393.3 million, followed by Abha with a 9.7 percent downtick to SR153.5 million.

In transaction volume, Hail recorded 3.7 million deals, down 2 percent, while Tabuk reached 4.7 million transactions, up by 0.2 percent.