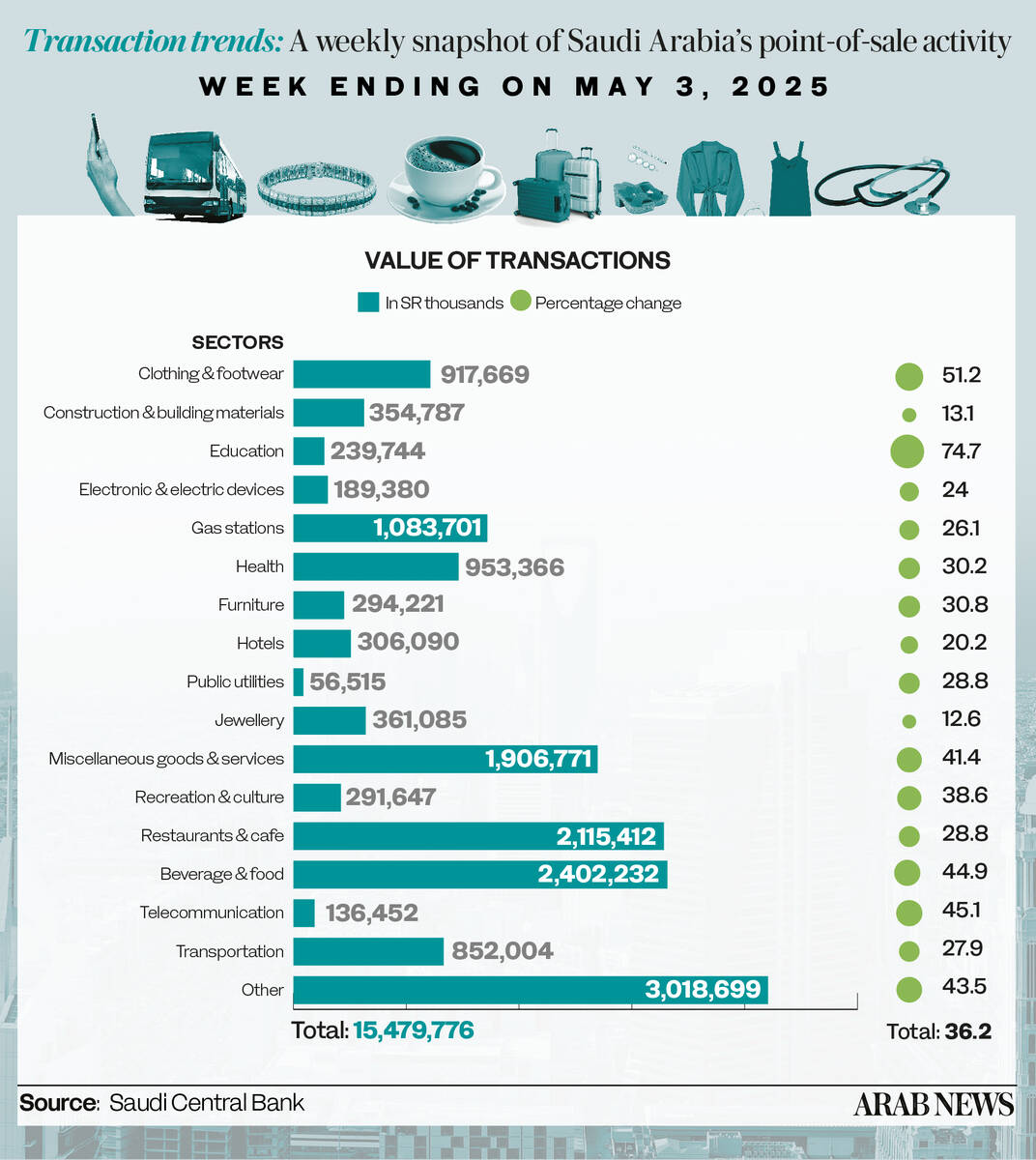

RIYADH: Saudi Arabia’s point-of-sale transactions climbed 36.2 percent to SR15.4 billion ($4.1 billion) in the week ending May 3, driven by increased spending across all sectors.

The latest data from the Kingdom’s central bank, also known as SAMA, showed that education led the growth, registering the largest jump in transaction value, up 74.7 percent to SR239.7 million. The sector also saw a 32.4 percent rise in the number of transactions, reaching 192,000.

The clothing and footwear sector followed, recording a 51.2 percent increase in transaction value to SR917.6 million. Telecommunication spending ranked next, rising 45.1 percent to SR136.4 million, with transactions up 37.3 percent to 3.4 million.

Food and beverages — the sector with the biggest share of total POS value — recorded a 44.9 percent increase to SR2.4 billion.

Transportation spending rose 27.9 percent to SR852 million, while restaurants and cafes saw a 28.8 percent increase, totaling SR2.1 billion and claiming the second-biggest share of this week’s POS.

The smallest spending gains were on jewelry, rising by 12.6 percent to SR361 million, and construction and building materials, which increased by 13.1 percent to SR354.7 million.

The health and public utilities sectors also saw upward changes, increasing by 30.2 percent and 28.8 percent to reach SR953.3 million and SR56.5 million, respectively.

Spending on electronics followed the trend, rising 24 percent to SR189.3 million, and recreation and culture edging up by 38.6 percent to SR291.6 million.

Miscellaneous goods and services claimed the third-largest share of total transactions value, with an uptick of 41.3 percent to SR1.9 billion.

The top three categories — food and beverages, miscellaneous goods and services, and clothing and footwear — accounted for 41.5 percent of the week’s total spending, amounting to SR6.4 billion.

Geographically, Riyadh dominated POS transactions, with expenses in the capital reaching SR5.2 billion, a 28.5 percent increase from the previous week.

Jeddah followed with a 27.2 percent rise to SR2.1 billion, while Dammam ranked third, up 28.1 percent to SR772 million. Hail saw the biggest increase, inching up 60.8 percent to SR268.9 million, followed by Tabuk with a 60.6 percent uptick to SR325.2 million.

Hail recorded 4.5 million deals in transaction volume, up 33 percent, while Tabuk reached 5.4 million transactions, rising 29 percent.