RIYADH: Saudi Arabia’s point-of-sale transactions rose to SR12.3 billion ($3.2 billion) in the week ending April 12, driven by a sharp 2412.9 percent surge in spending on education.

POS transactions in this sector reached SR256.8 million, up from SR10.2 million in the previous week, according to the latest figures from the Saudi Central Bank, also known as SAMA.

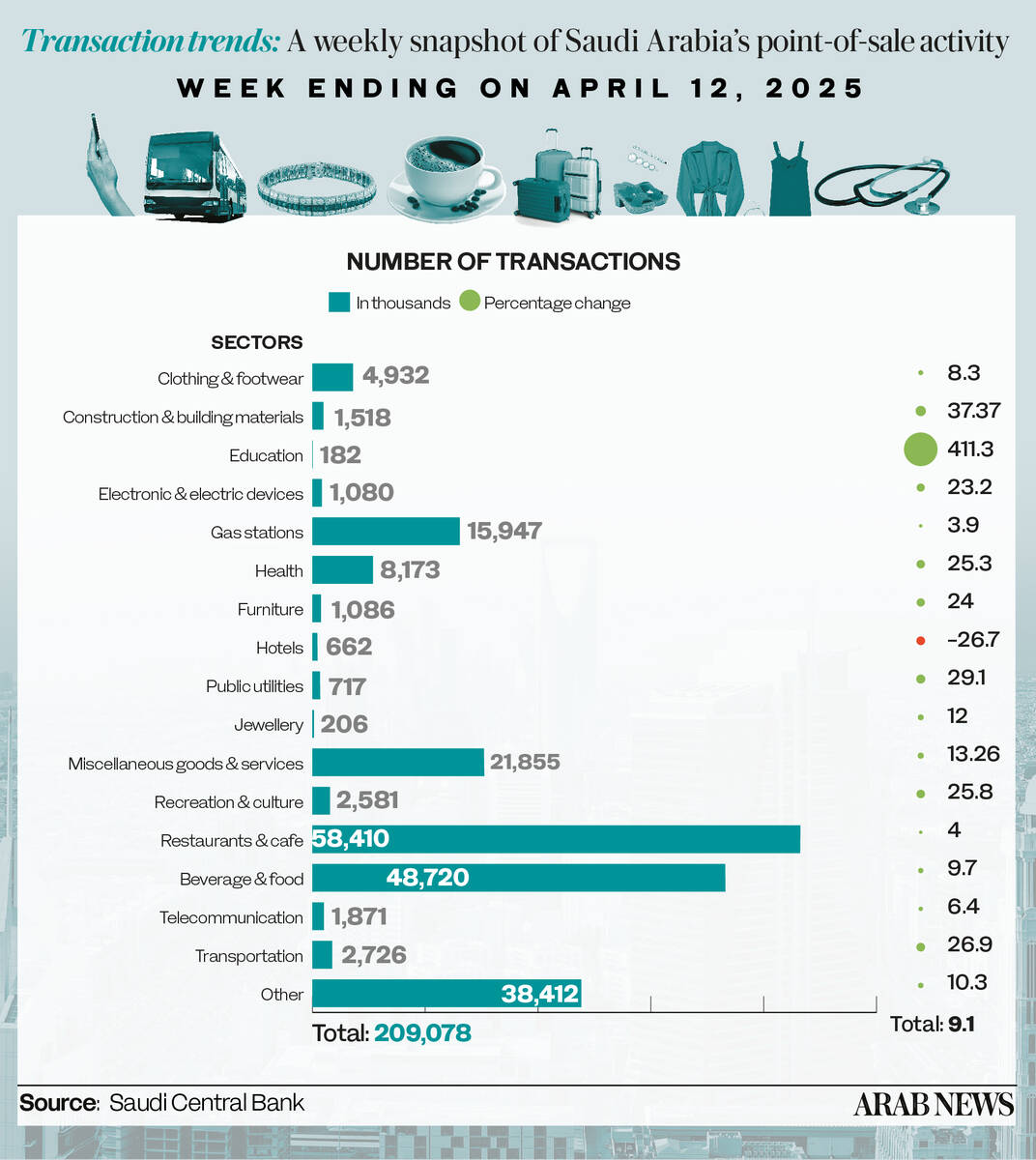

During that seven-day period, spending on transportation saw the second-largest increase at 115 percent to reach SR693.9 million, with the number of transactions surging by 26.9 percent to 2.7 million.

Spending on construction and building materials followed with a 109.3 percent uptick to SR311.5 million.

Spending on electronics reached SR154.9 million, as transaction volume in the sector rose by 23.2 percent. Health and furniture also saw notable increases, up 63.4 percent to SR778 million and 62 percent to SR228.5 million, respectively.

Among the top three categories by overall value, food and beverages led with SR1.8 billion, marking a 10.3 percent week-on-week increase. Despite a 21.4 percent decline, restaurants and cafes came second at SR1.7 billion.

Miscellaneous goods and services accounted for SR1.51 billion in POS spending, a 34.5 percent rise, making it the third-largest category.

Combined, these three segments represented approximately SR5 billion, or 41.3 percent, of total POS activity during the week.

Meanwhile, spending in recreation and culture declined by 5.5 percent to SR250.5 million, and hotel transactions dropped 21.9 percent to SR288.6 million.

Geographically, Riyadh dominated POS transactions, representing around 34.9 percent of the total, with expenses in the capital reaching SR4.3 billion — a 34.5 percent increase from the previous week.

Jeddah followed with a 17.9 percent increase to SR1.7 billion; Dammam came in third at SR635.3 million, up 32.8 percent.

Makkah experienced the most significant decrease in spending, dropping by 5.8 percent to SR485.5 million. Madinah followed with a 4.3 percent reduction to SR494.3 million.

Tabuk and Dammam saw the largest increases in terms of number of transactions, surging by 25.8 percent and 19.8 percent, respectively, to 4.5 million and 8.7 million transactions.