SAINT-DENIS., France: The heated rivalry in cricket has been well documented. Now, India and Pakistan are competing against each other in the javelin throw at the Olympics, too.

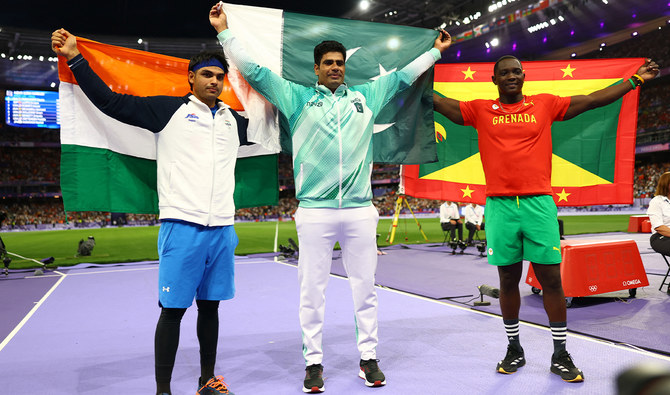

When Arshad Nadeem of Pakistan and defending champion Neeraj Chopra of India finished 1-2 at the Paris Olympics on Thursday, fans from the subcontinent were in abundance at the Stade de France.

“There’s no doubt about the cricket rivalry. Now this javelin is also there,” Nadeem said through a translator. “People back home in Pakistan and even in India, they were eager to see us both throwing the javelin and beating each other. I’m happy to see Chopra earning silver.”

Nadeem set a new Olympic record with a throw of 92.97 meters (305 feet) in his second attempt, smashing the old mark of 90.57 set by Andreas Thorkildsen of Norway in 2008.

Chopra took silver at 89.45 meters, a season best, and Anderson Peters of Grenada took the bronze at 88.54.

“When I threw the javelin, I got the feel of it leaving my hand, and sensed it could be an Olympic record, inshallah (God willing),” Nadeem said. “God indeed made it an Olympic record.”

It was the first ever gold medal in track and field for Pakistan which, along with India, can contend for gold in cricket four years from now when that sport joins the Olympic program in Los Angeles.

Chopra fouled on all five of his other throws and said he’s been in a funk the last few years.

“I’m always injured,” said Chopra, who has been slowed by a groin injury. ”Nadeem threw really well. Congratulations to him and his country. “

Chopra became a superstar in India when he won India’s first ever gold medal in track and field three years ago. But there were no fans in Tokyo because of the coronavirus pandemic.

The Indian diaspora made sure Chopra felt the full support of his nation of 1.4 billion this time.

Spectators draped in the orange, white and green Indian flags could be spotted all over stadium. There were Pakistani fans, too.

“It’s never been a sport that’s been very big and he’s captured the imagination of a lot of people to look at javelin again,” said Varun Mathur, who traveled from London on Thursday morning with his partner, Sujata Ravi, to see Chopra.

At last year’s world championships, Nadeem took silver behind Chopra.

“It’s going to be a good rivalry,” Mathur added.

Another Indian, Kishore Jena, competed in javelin qualifiers but didn’t advance to the final.

“He’s an example of how people are taking it up further,” Mathur said. “Hopefully a lot more people come through.”

Devansh Kumar, a 20-year-old from Delhi studying in Edinburgh, Suksham Chahar, a 23-year-old from Haryana studying starting her PhD in Austria, and Ishan Maheshwari, a 27-year-old living in London, traveled to Paris to see Chopra.

They didn’t know each other but met earlier in the day while watching India’s field hockey team win a bronze medal. All three had tickets to track and field, too, so they came to the stadium together — new friends united by their support of Chopra.

“He’s a star,” Kumar said. “We are hoping that any Indian listeners and people who have power, they put more money into sports, remove the politics so we can get better athletes for all sports.”

India is planning to bid for the 2036 Olympics.

“There would be no shortage of people watching the Olympics, that’s for sure,” said Pranay Dey, a 30-year-old from Delhi who is a breast cancer researcher at the Swiss Federal Institute of Technology. “But regarding infrastructure, there’s still a long way to go.”

Nadeem was Pakistan’s flag bearer during the opening ceremony in Paris. He played age-group cricket at the state level until he took up throwing sports, starting with shot put and discus.

“Not becoming a cricketer was the best thing that happened to me,” Nadeem said. “I wouldn’t be in the Olympics otherwise.”