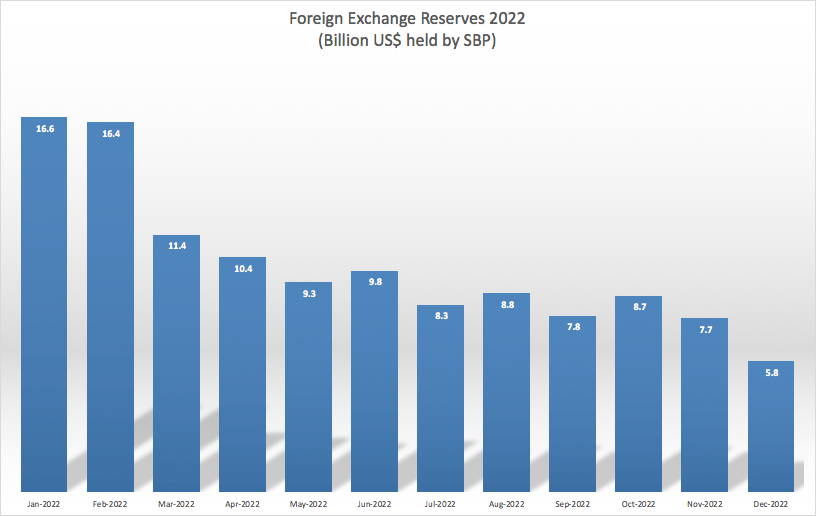

KARACHI: Pakistan witnessed a massive drop of 65 percent in its foreign exchange reserves to $5.8 billion during the outgoing year 2022, according to official data and experts, which exposed the South Asian country to a risk of default on its international financial obligations.

Pakistan headed into 2022 with its foreign exchange reserves standing at $16.60 billion. However, the country saw a drastic reduction in official forex reserves as the inflows slowed down and outflows paced up.

“The major cause of Pakistan foreign exchange reserves depletion was the higher amount of outflows or repayments as compared to the inflows that exerted pressure on the forex position,” Samiullah Tariq, a research director at the Pakistan-Kuwait Investment Company, told Arab News.

“Key contributing factors were higher current account deficit due to costly imports, global interest rate hike, and we are out of the IMF (International Monetary Fund) program due to which we could not arrange financing.”

A major drop in reserves was seen in the first quarter of 2022, when the country’s foreign currency stockpile shrank by over $6 billion to $10.4 billion by April 2022.

Source: State Bank of Pakistan

“When the coalition government assumed the charge, forex reserves were already down to $10 billion in April and had dropped by over $5 billion by March 2022,” former finance minister Miftah Ismail told Arab News.

The month of April brought political instability in Pakistan as former prime minister Imran Khan was ousted from power in a parliamentary no-trust vote and it negatively impacted the country’s economy.

The new government of PM Shehbaz Sharif took various measures to stop dollar outflows, including import restrictions, but the reserves continued to drop and hit an 8-year low of $5.8 billion in December 2022, barely enough to cover for a month of imports.

“Our payments have increased substantially and if we control the current account deficit, the repayments are so enlarged that it is not being controlled,” Ismail explained.

A major outcome of the depleting forex reserves was increased pressure on the national currency, which depreciated by more than 21 percent during the year 2022. The United States (US) dollar closed at Rs226.43 against the rupee in the interbank market on the last trading session of the year on December 30.

Financial experts say the measures taken by the government to restrict dollar outflows have resulted in the overall economic slowdown as industrial activities subsided.

They link the depletion of foreign exchange reserves with delays in progress of the $7 billion IMF program.

“The inflow of reserves was slow and the outflow increased in addition to the delay in the IMF program review and disbursement,” Dr. Sajid Amin, a deputy executive director at the Islamabad-based Sustainable Development Policy Institute (SDPI), told Arab News.

Pakistan and the IMF are currently engaged for the 9th review of the program, but a deadlock still persists between the two sides as Islamabad is reluctant to implement “harsh” IMF conditions, including market-based exchange rate and energy price adjustments.

Amin said the specter of default looms large amid the depleting reserves position and the IMF program delays.

“The depletion of foreign exchange reserves, coupled with the deadlock on the 9th review with the IMF, has increased the country’s default perception,” he said.

The financial expert believes that Pakistan could only be brought back from the verge of a default through a successful IMF program review.

“The IMF is not standing between us and the default,” he said. “We should restore the IMF program in any case and the government should not play politics on it.”

Besides the IMF program, Amin suggested, Pakistan should engage with friendly countries through diplomatic means to secure cash deposits and rollovers and “let the rupee adjust according to the market conditions.”

Pakistan has to repay around $8 billion over the next three months in repayment of loans and the country faces a tough situation given the existing reserves position.

But Ismail is confident that Islamabad would have the IMF program revived and the United Arab Emirates (UAE) would roll over its $2 billion deposits, which would help stabilize the reserve position.

The former finance minister, however, warned that “next 3 to 4 years would be difficult for Pakistan due to large repayment obligations.”