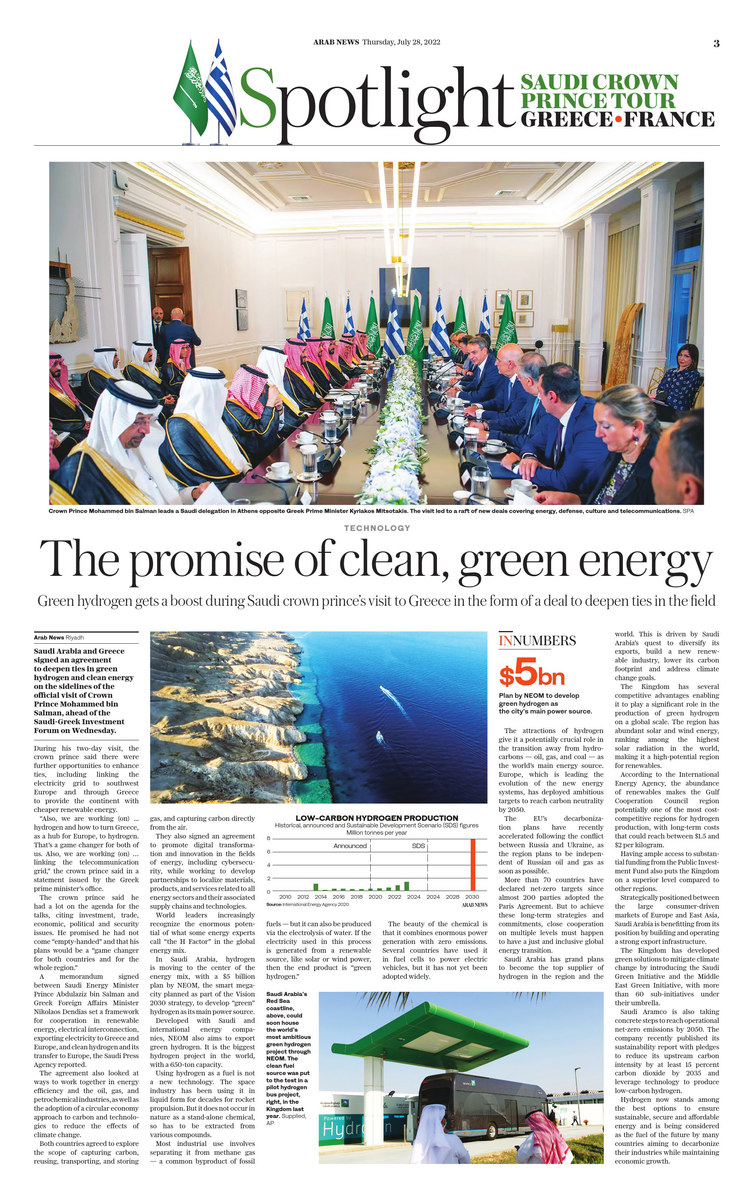

RIYADH: Saudi Arabia and Greece signed an agreement to deepen ties in the area of green hydrogen and clean energy on the sidelines of the official visit of Crown Prince Mohammed bin Salman ahead of the Saudi-Greek Investment Forum.

The Crown Prince will also discuss helping the European country establish an electrical interconnection network.

Calling the relationship between both the countries “historical,” the Crown Prince said there are further opportunities that can be finalized during his two-day visit, including linking the electricity grid to south-west Europe, through Greece, to provide the continent with cheaper renewable energy.

“Also, we are working (on)...hydrogen and how to turn Greece as a hub for Europe to hydrogen. That’s a game changer for both of us. Also, we are working (on)...linking the telecommunication grid,” the Crown Prince said in a statement issued by the Greek prime minister's office.

The Crown Prince said he has a lot on the agenda for the talks, citing investment, trade, economic, political, and security issues. He promised he had not come “empty-handed” and his plans would be a “game changer for both countries and also for the whole region.”

He also mentioned a “big item that we cannot announce today” as he talked up the relations between Saudi Arabia and Greece.

A memorandum was signed between Saudi Minister of Energy Prince Abdulaziz bin Salman and Greek Minister of Foreign Affairs Nikolaos Georgios Dendias. (SPA)

The memorandum signed between Saudi Minister of Energy Prince Abdulaziz bin Salman and Greek Minister of Foreign Affairs, Nikolaos Georgios Dendias, sets a framework for cooperation in the fields of renewable energy, electrical interconnection, exporting electricity to Greece and Europe, clean hydrogen and its transfer to Europe, Saudi Press Agency reported.

The agreement will also look at working together in the areas of energy efficiency and the oil, gas and petrochemical industry, while adopting the circular economy approach to carbon and technologies to reduce the effects of climate change.

Both countries will also explore the scope of capturing carbon, reusing, transporting and storing the gas, as well as capturing carbon directly from the air.

The two also signed an agreement to promote digital transformation and innovation in the fields of energy, including cyber security, while working to develop qualitative partnerships to localize materials, products and services related to all energy sectors and their associated supply chains and technologies.

The Crown Prince and the Greek Prime Minister also witnessed the signing of the agreement to establish the Saudi-Greek Strategic Partnership Council.

Connecting East to West

A strategic partnership was announced between the Saudi and Greek private sectors on the sidelines of the Crown Prince's visit to build a data cable project linking the East to the West.

This cable will ensure the smooth digital supply of data worldwide at a time when the data traffic is growing by more than 30 percent, SPA said.

This comes through the leadership of the Saudi Telecom Co. on the submarine cable project in partnership with the Greek Telecom Co., the General Energy Co. of Greece and the Cyprus Telecom Co.

STC Group announced that its subsidiary MENA Hub will cooperate with the Greek telecom firm TSSA to build a data corridor that extends from the Kingdom to Europe through a modern, high-capacity network of terrestrial optical fibers under the sea and will connect Europe with Asia.

The project aims to position the two countries as an eastern digital station for Europe to reach the Middle East, the continents of Africa and Asia.

Once completed, the project will also contribute to accelerating the growth of the global digital economy, which is estimated to reach $15 trillion, reported SPA. The project will also contribute to supporting new industries and emerging markets based on innovative business models.