ISLAMABAD: Pakistani president Dr. Arif Alvi on Monday “strongly” rejected the advice of Prime Minister Shehbaz Sharif to remove a key ally of former premier Imran Khan from the post of governor of the province of Punjab, bringing deep political divisions to the fore.

Omar Sarfraz Cheema, a member of Khan’s Pakistan Tehreek-e-Insaf party since 1996, was appointed governor Punjab last month amid a no-confidence motion filed against Khan in parliament, which saw many of his allies, including then governor Chaudhry Mohammad Sarwar, jumping ship and joining the opposition.

Khan was subsequently ousted from office in the no-trust vote and Sharif appointed the new PM by parliament.

Last week, the Sharif-led government sent a summary to the president, also a close Khan aide, to remove Cheema, nominating a senior ruling party leader Baligh-ur-Rehman as his replacement.

“President Dr. Arif Alvi strongly rejects Prime Minister’s advice to remove Governor Punjab,” Alvi’s office tweeted. “The President has conveyed to the Prime Minister of Pakistan that Governor Punjab cannot be removed without his approval.”

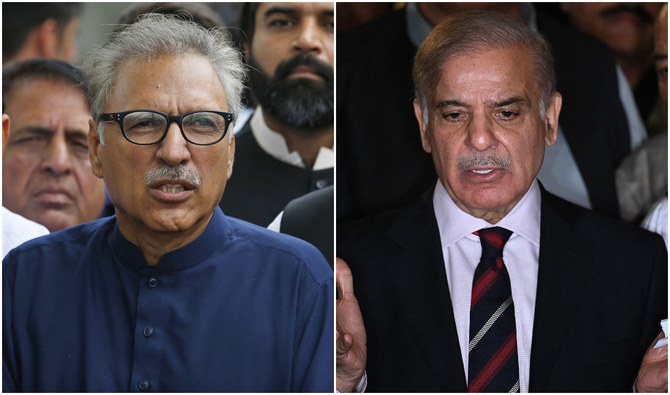

The file photo shows Pakistan's President Dr. Arif Alvi (left) meeting Governor of Punjab province Omar Sarfraz Cheema in Islamabad, Pakistan, May 7, 2022. (@OmarCheemaPTI/Twitter)

A governor in Pakistan is the appointed head of state of a province. He or she is appointed by the president on the advice of the prime minister and can serve for a tenure that lasts up to five years.

“Referring to clause 3 of Article 101 of the Constitution, he [Alvi stated that ‘the Governor shall hold office during the pleasure of the President’,” the president’s tweet said. “The incumbent governor cannot be removed as there was neither any allegation of misconduct nor conviction by any court of law or of any act committed by him contrary to the Constitution of Pakistan.”