RIYADH: Placing environmental capital at the heart of their operations, The Red Sea Development Co. and AMAALA have resolved to protect the environment, invest in clean energy and preserve natural habitats, buildings and beaches around the coast.

Top officials connected with the project were determined to introduce the latest advancements in environmental technology to drastically reduce carbon emissions and protect the pristine waters along the west coast of Saudi Arabia.

TSRDC has already adopted a value-driven approach involving ecological services that ensure every step of the grand design is in harmony with nature.

“We explore opportunities provided by the natural environment and work with the design team to capitalize on them to enhance the design, maximize guest experience and protect our environmental capital,” Ruba Farkh, environmental assessment director at TRSDC, told Arab News.

The outcome is outstanding. Over 75 percent of the buildings in the area are targeting the LEED Platinum, the highest rating in Leadership in Energy and Environmental Design, the rating system used by the US Green Building Council to measure a building’s sustainability and resource efficiency.

The rest of the buildings are eyeing “Mostadam Diamond,” the highest rating in the Kingdom’s new green building rating system. These ratings ensure environmental preservation while developing assets and bring transparency to the projects due to their independent assessment.

“All our buildings meet the Saudi Building Code, including the Saudi Green Building Code (1001), which is aligned with the International Building Code,” she explained.

The project’s master plan has also factored in LEED for Cities and Communities, which revolutionizes how cities and communities are planned, developed, and operated to improve their overall sustainability and quality of life.

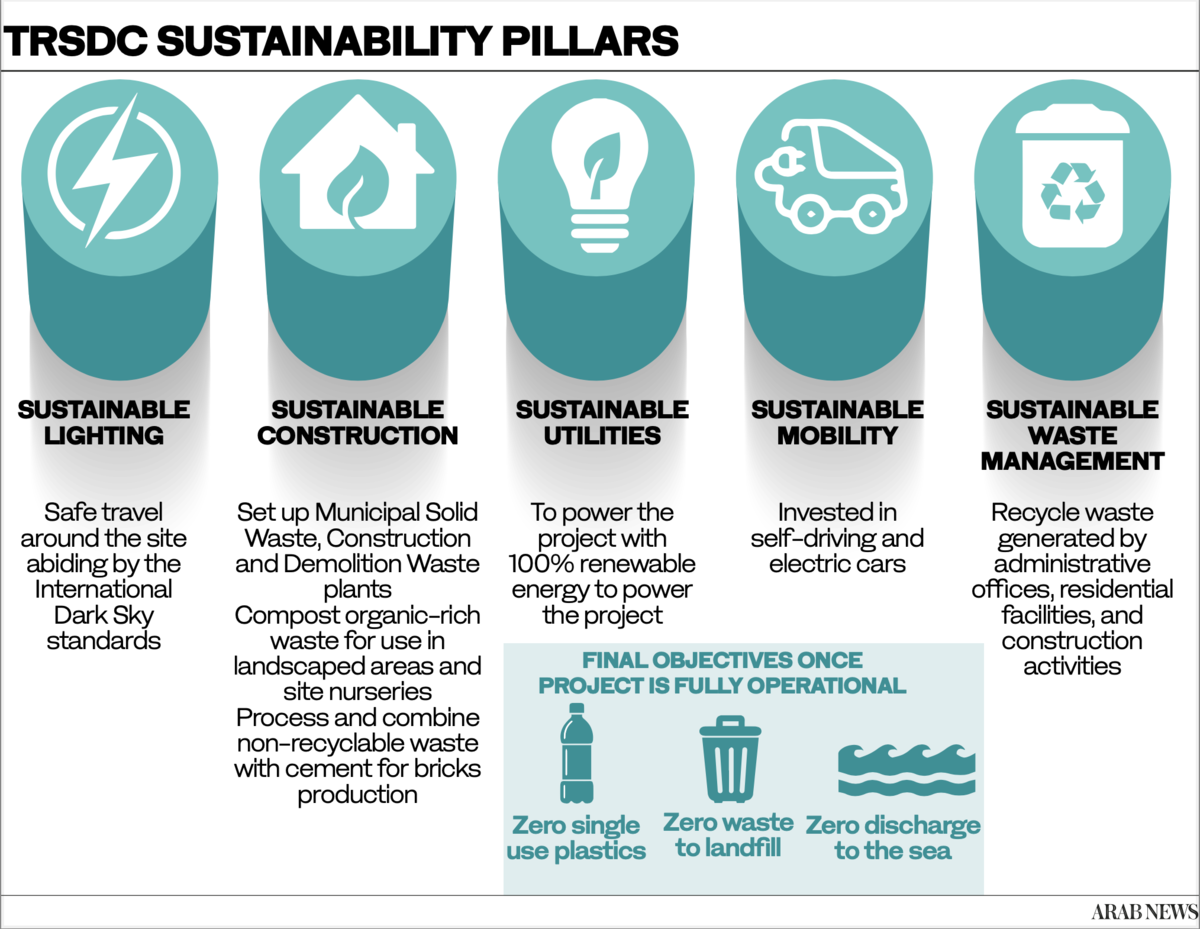

“For example, we will install and operate our own 100 percent renewable energy power supply to meet all utility demands across the entire project,” explained Farkh.

She added that all their assets were designed to meet stringent requirements for ecological lighting and dark sky access.

An impression of the cultural village at AMAALA (supplied)

The company is already pushing the envelope to ensure environmental assessments act as a beacon to design their master plans and minimize their impact on the ecosystem.

David McKenna, sustainability performance director at TRSDC and AMAALA, also shared the current and future measures taken to utilize the abundance of sunlight to generate electricity.

“We have abundant sunshine all year round, so we have harnessed it to power our resorts using centralized solar farms. This renewable energy approach is inherently a low-carbon design approach. We also applied strict standards to reduce our water consumption across our landscape.

One hundred percent of wastewater is treated and recycled for irrigation use on our landscaped areas,” McKenna said.

The company’s designs are also committed to minimize the use of concrete to ensure a low embodied carbon impact over their lifetime.

“For example, we are also finding ways to lower the carbon footprint of our concrete by focusing on all main ingredients to reach our Green Concrete goals,” said McKenna.

An impression of a feature of the AMAALA (supplied)

He said the company focuses on cement because many of these cement types contain fly ash or ground granulated blast-furnace slag, altering the compressive strength-time.

He added that prominent among the green goals are O Steel, which prioritizes recycling content, and O Aggregates, which focuses on local suppliers with good environmental management systems.

“We are strategically using modular design and lean constru tion approaches to lower person hours worked on-site, plus construction waste produced on-site. In addition, our logistics hub for the construction stage ensures efficient handling of materials, and it brings new standards for effective waste management in this region,” McKenna said.

Read more: TRSDC showcases starry night in bid to become world’s largest dark sky reserve

The other crucial component in achieving carbon neutrality is the mitigation of emissions from mobility.

“We have adopted a mobility strategy based on the use and utilization of electric vehicles, electric boats for all transport needs for the destination,” McKenna indicated.

While sustainability is not a want but a need of the hour, it will take giga-projects such as TSRDC and AMAALA to set an example for companies looking to make environmental consciousness a natural extension of their business priorities.