RIYADH: Saudi domestic tourism has exceeded expectations during the pandemic, despite the UN World Tourism Organization (UNWTO) describing 2020 as “the worst year on record in the history of tourism.”

The latest figures from the UNWTO revealed that destinations welcomed 900 million fewer international tourists between January and October compared with the same period in 2019 — a 72 percent year-on-year slump.

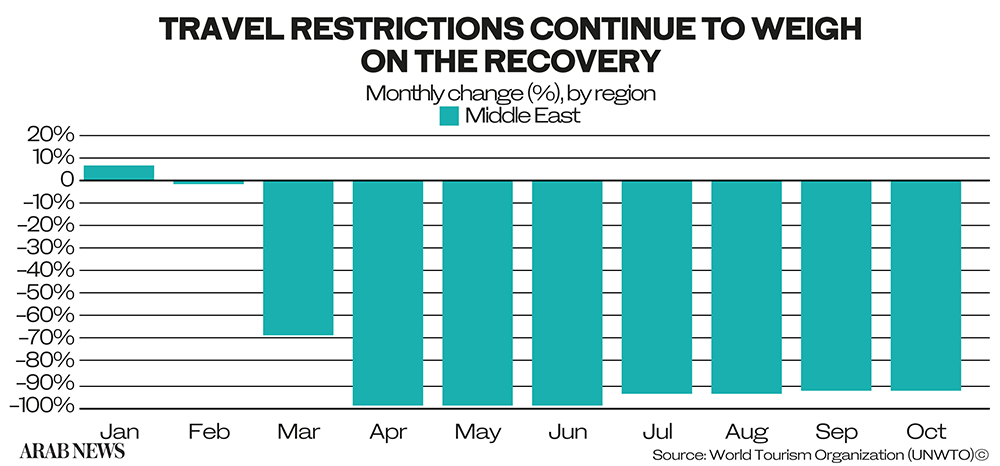

This translates to a loss of $935 billion in export revenues from international tourism, more than 10 times the loss in 2009 amid the global financial crisis. There was a 73 percent decline in international arrivals in the Middle East compared with last year. The worst months in the region were April (down 98 percent year-on-year) and May (down 96 percent).

UNWTO Secretary-General Zurab Pololikashvili said: “Even as the news of a vaccine boosts traveler confidence, there is still a long road to recovery. We need to step up our efforts to safely open borders while supporting tourism jobs and businesses. It is ever clearer that tourism is one of the most affected sectors by this unprecedented crisis.”

Despite the dire international picture, the Saudi Ministry of Tourism announced in September that domestic tourism saw a significant rise in traveler numbers, surpassing official projections.

In an April interview with Reuters, Saudi Minister of Tourism Ahmed Al-Khateeb said that Saudi tourism could shrink as much as 45 percent in 2020. However, in September, Al-Khateeb told Bloomberg that a sudden surge in domestic travel — 50 percent more than officials projected — helped save businesses and jobs, as well as boost the economy.

Bloomberg reported that 10 sites where the government promoted summer travel generated SR8.6 billion ($2.3 billion) from June 25 to Aug. 31, a 31 percent increase from last year. Hotel occupancy at those sites rose to about 80 percent over the summer, compared to just 5 percent earlier in the pandemic.

Other initiatives to boost internal tourism, such as the Red Sea Spirit luxury cruises, Oasis Riyadh and the Saudi Summer campaign also saw a modicum of success, helping to offset revenue losses.

Data on international tourism expenditure continues to reflect very weak demand for outbound travel. However, some large markets such as the US, Germany and France have shown some signs of recovery in recent months. Furthermore, like in Saudi Arabia, demand for domestic tourism continues to grow in some markets, including China and Russia.

The announcement of various COVID-19 vaccines is expected to gradually increase consumer confidence, the UNWTO said, while the growing number of destinations that are easing or lifting restrictions on travel will help, too.

The UNWTO said the proportion of destinations classed as closed had dropped from 82 percent in late April this year to 18 percent by early November.

The international body also drafted extended scenarios for 2021-2024, which suggested a rebound in the global market by the second half of 2021. However, the UNWTO also expects that a return to 2019 levels of international arrivals could take between two-and-a-half to four years.