What happened this week:

US first-time jobless claims for the week ending May 30 came in at 1.9 million. While the growth rate has been on a downward trajectory, the figure is still an extraordinary number. Unemployment claims have reached 43 million since the beginning of the COVID-19 lockdown. Non-farm payroll for May increased by 2.5 million bringing the unemployment rate to 13.3 percent, which is markedly lower than expected, because the private-sector services recovered 2.4 million jobs.

The US trade deficit in goods and services for April widened to $49.4 billion.

US-China tensions increased when American President Donald Trump’s administration threatened to suspend Chinese passenger flights to the US in response to Beijing barring American carriers from re-entering China. In response China has widened eligible countries and airlines when it eases it ban on foreign carriers. That may give access to some US carriers.

However, it is unclear if the current concessions will be sufficient from the US perspective not to jeopardize the US-China Civil Air Transport Agreement of 1980.

London-listed HSBC and Standard Chartered banks supported China’s controversial security law for Hong Kong alongside other big names such as Jardines and airline Cathay Pacific. While the move will land the two UK banks in disagreement with their government, HSBC gets a vast proportion of its revenues from the greater China area.

German airline Lufthansa’s supervisory board finally agreed to the government’s 9 billion-euro stimulus package. The company yielded to EU pressure and withdrew four planes each from Frankfurt and Munich airports. Lufthansa has undertaken a major restructuring program that will involve a headcount cut of between 10,000 and 20,000 people.

Lufthansa shares have dipped in value by more than 30 percent since the beginning of the year, bringing the company’s market cap down to $5.2 billion. The carrier is now 60th in terms of market capitalization and will leave the DAX after 32 years, because the index is reserved for the 30 largest German companies. Its replacement is property firm Deutsche Wohnen.

Background:

The European Central Bank (ECB) decided to leave interest rates unchanged and announced an additional 600 billion euros of bond purchases, bringing the total pandemic emergency purchase program (PEPP) to 13.5 billion euros.

ECB President Christine Lagarde never tires in highlighting the need for monetary policies to be supported by fiscal policy.

The European Commission plans to issue 750 billion euros-worth of bonds through the EU budget. This constitutes a de facto mutualization of that portion of pandemic relief to the economy. While some northern countries have reservations, it is expected that the package will pass in the end, especially as Germany starts the rotating six-month EU leadership on July 1. German Chancellor Angela Merkel and French President Emmanuel Macron are the architects of the plan’s precursor.

Merkel also made good on fiscal support in her own country: On Thursday, the German government surprised with a greater-than-expected 130 billion-euro stimulus equaling one-third of last year’s budget. It contains a 3 percent cut in value-added tax for 2020 and substantial sums allocated to bridge financing for small- and medium-sized enterprises, digital, security and defense spending, tax credits, support for municipalities, as well as a 300-euro credit per child.

A decade of expansionary fiscal policies and accommodating monetary policies to be financed by long tenors could be in store, which will have implications on the yield curve. These large packages are not just necessary to cushion the economic blow from the COVID-19 pandemic, they are also justified in light of the inflation forecasts from the ECB and other economists.

The ECB and proposed EU packages narrowed the yield differential between southern rim and northern European bonds.

The S&P 500 index is close to pre-pandemic levels despite high unemployment and amid violent protests in the aftermath of the death at the hands of US police of African American George Floyd. Yields reached their highest levels since 2000.

The big rally seen since the March lows are in part due to technology stocks outperforming the pack. Industrials, which are a good benchmark for economic performance, fared less well.

This is no surprise considering the COVID-19 outbreak is expected to wipe out a cumulative $15.7 trillion this decade, according to the US Congressional Budget Office.

The high unemployment numbers make a further stimulus package likely. Trump is said to favor spending on infrastructure as well as various unemployment and tax provisions. Its number is expected to be lower than the $3.5 billion the democratic-majority Congress passed last month. That package had included $1 trillion earmarked to support state and local budgets.

Where we go from here:

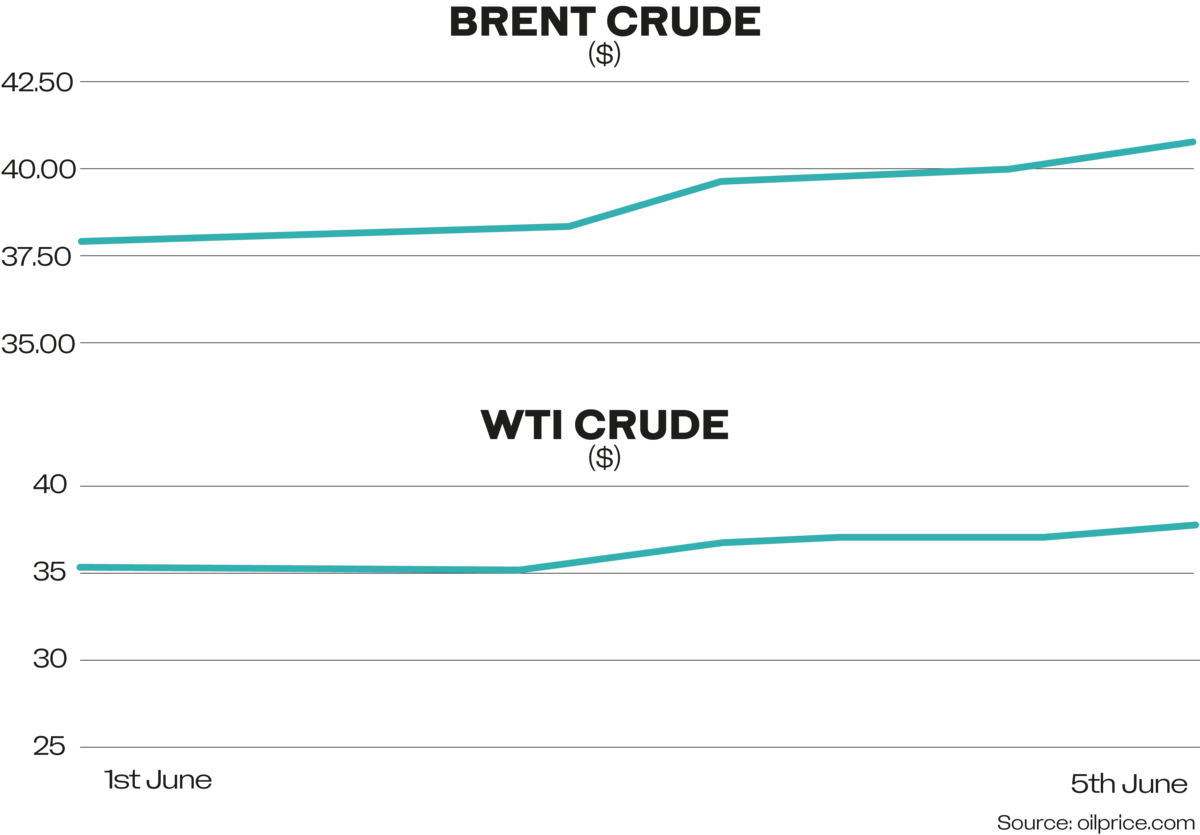

A meeting of OPEC+ failed to transpire on June 4 but a get-together is widely expected on Saturday. While Saudi Arabia and Russia have reportedly finally agreed on extending the current 9.7 million barrels per day of oil cuts for at least another month, the sticking point was non-compliance by several countries, especially Iraq and Nigeria.

Saudi Arabia, in particular, seems no longer willing to be burdened with a disproportionate share of the cuts in order to make up for the under-compliance of laggards. The various parties are rumored to get closer to an agreement.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources