What happened:

Global stock markets were torn between two forces: Firstly, the reopening of the economies in Europe as well as more gradually in certain US states; and secondly the fear of a flaring up of US-China tensions over the National People’s Congress (NPC) waiving through a controversial new security law for Hong Kong against subversion, separatism and treason.

Markets were up through Thursday with reopening optimism prevailing. On Friday futures turned negative in Europe and the US as the anti-China sentiment in Washington turned up a notch.

US first-time jobless claims came in at 2.1 million for the week ending May 22, pushing the overall claims number for the last 10 weeks up to more than 40 million. Consensus estimates for May’s unemployment rate (to be published next week) are around 20 percent, which is the highest since the Great Depression when it was 25.6 percent.

Employment news was grim around the globe. On Thursday, US low-cost airline JetBlue announced it could let go of 30 percent of its workforce and the British budget carrier easyJet earlier made a similar announcement. French motor manufacturer Peugeot announced a cut 14,600 jobs.

In its Beige book, an assessment of economic conditions, the US Federal Reserve pointed out that economic activity continued to fall sharply into May in most of America. Declines were particularly steep in the leisure and hospitality industries amid the coronavirus disease (COVID-19) lockdown. Manufacturing activity was down too with auto, aerospace, and energy-related plants particularly hard hit.

On Thursday, credit rating agency Standard and Poor’s withdrew its investment grade rating from aero engine maker Rolls-Royce after 20 years. Last week the company had announced it would cut 9,000 jobs. Fitch and Moody’s still have Rolls-Royce at BBB+ (two notches above junk) and Baa3 (one notch above junk), respectively.

US President Donald Trump was irritated by Twitter attaching a fact-checking link to two of his tweets, one of them relating to the accuracy of mail-in ballots. He issued an executive order instructing federal regulators to remove the liability shield social media companies enjoy from users’ posts, if said companies engage in censoring or any political conduct. Twitter shares fell 4.4 percent during the regular session on Thursday but recovered some after.

The Lufthansa board has not accepted the 9 billion-euro rescue package it was offered by the German government. The sticking points were the 20 percent equity stake and board representation by the government and the EU directive that the airline give up slots in Frankfurt. The EU’s decision has to be seen in the context of ensuring competition in the sector in light of government intervention.

Focus

EU Package:

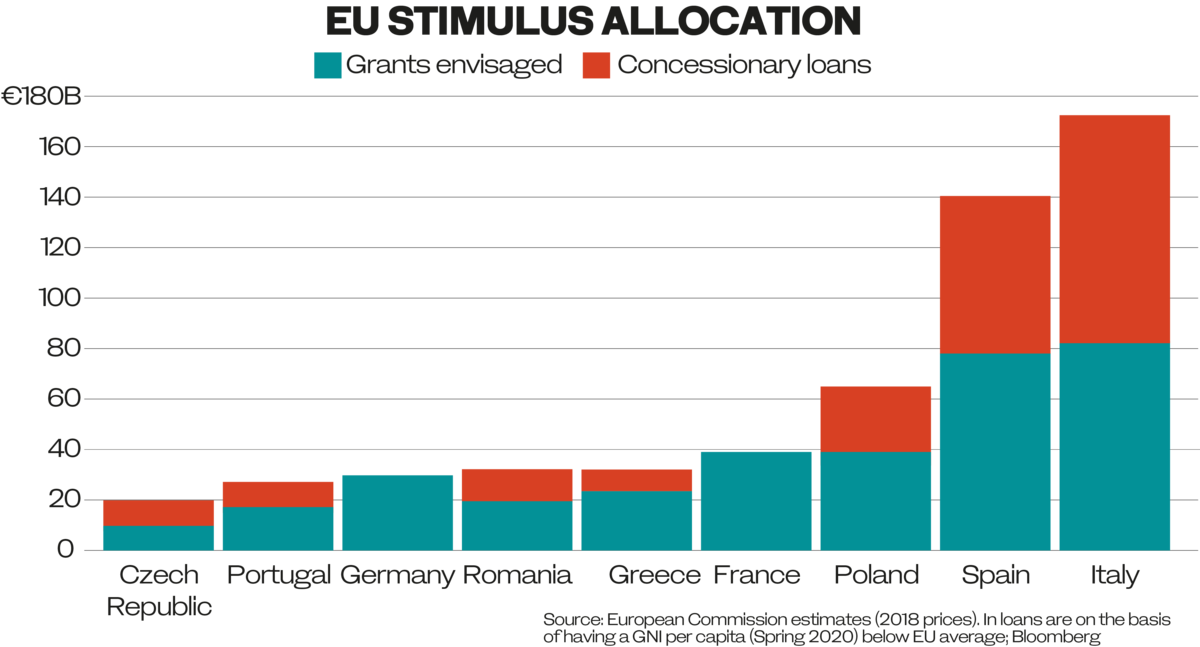

President of the European Commission Ursula von der Leyen announced a 750 billion euros package to be processed through the EU’s seven-year budget, the multiannual financial framework (MFF).

It envisages for the commission to issue bonds taking advantage of its AAA rating and all 27 member states to stand behind the bonds, as they do behind the budget. The bonds would have durations of up to 38 years.

The proposal is significant not only in size, but also in structure: Germany and northern states had so far also been opposed to the mutualization of debt while France and southern states had demanded it, especially since the pandemic spread through the continent. It was a controversy which threatened the cohesion of the union.

French President Emmanuel Macron and German Chancellor Angela Merkel had proposed a similar package worth 500 billion euros last week. The European Commission proposal will consist of 250 billion euros in loans and the rest in grants.

Discussions about the MFF (2021-2028) will be heated, with the “frugal four” (Netherlands, Austria, Demark and Sweden) opposing mutualization of debt and demanding that the funds be tied to COVID-19-related expenditure.

Meanwhile von der Leyen has asked for a carbon tax, digital tax, and a border adjustment mechanism for carbon.

US Investment Grade Bonds:

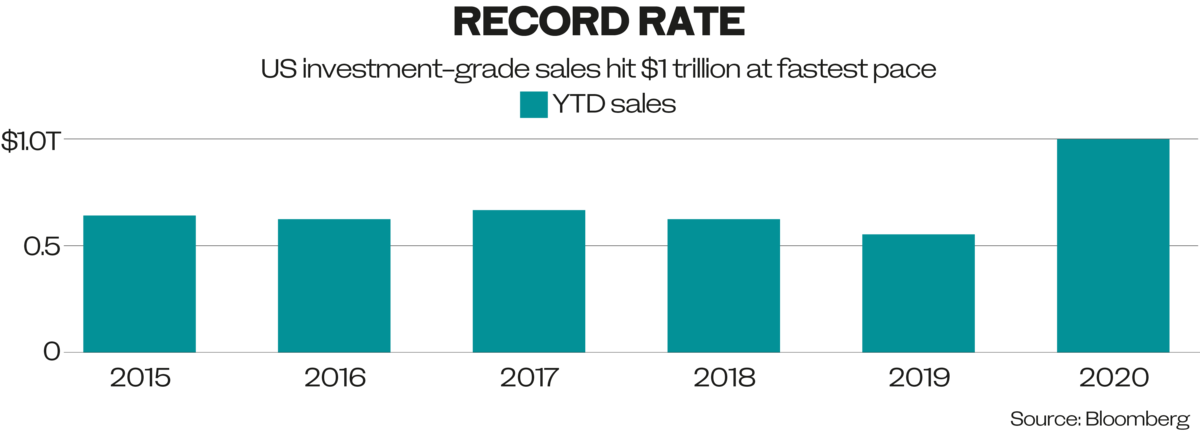

In the US, the investment grade bonds hit a significant milestone surpassing the $1 trillion mark much earlier than in previous years.

This showed two things: On the supply side, even well-capitalized companies wanted to shore up their cash reserves to weather the COVID-19 crisis. On the demand side, there were the Fed’s corona-related bond buying packages and investors who felt safe following the Fed’s policies.

The importance of maintaining liquidity and access to debt markets is important to avoid falling into the insolvency trap. There were more corporate bankruptcies in the US during May than in any other month since the Great Depression.

Where we go from here:

Merkel has proposed another 100 billion-euro package to support the economy coming out of lockdown. The package faces opposition by her own Christian Democratic Union party which does not want to incur more debt.

Later Friday, Trump will announce how he wants to respond to the NPC’s Hong Kong security law.

The US has the legislative framework to do so: The Hong Kong Human Rights and Democracy Act allows it to put Hong Kong’s special trading status under tighter scrutiny over Hong Kong’s autonomy from Beijing. This potentially endangers billions of dollars-worth of trade.

Other sanctions could consist of visa restrictions for targeted individuals or freezing their US assets, and restrictions of visas for Chinese students.

Meanwhile, the UK is considering extending the visa rights of 300,000 British national (overseas) passport holders to fast-track them for UK citizenship.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources