LONDON: Energy companies must move from fossil fuels to lower carbon sources but should be allowed to manage their own transitions, a Saudi Aramco director said in Davos on Tuesday

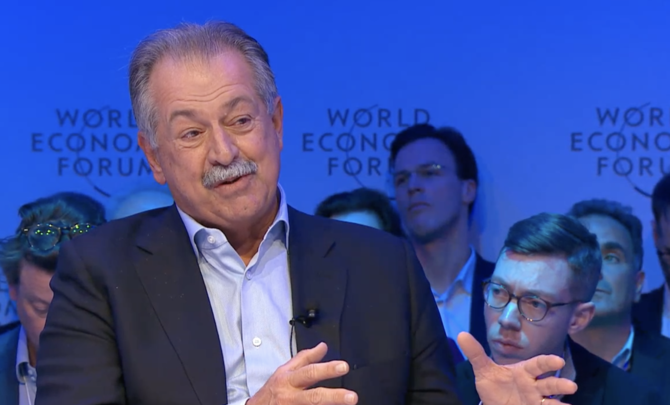

Speaking at the World Economic Forum during a panel on the growth of green energy, Aramco board member Andrew Liveris said the world “could do without” fossil fuels but that energy firms would need help in transitioning to cleaner fuels.

“The ecosystem that we’re living in — this planet — is strained to the limit. We have only one planet, the last time we checked, that we can live on. So, we have to do something about the humanity we have inhabited the planet with,” he said.

“Fossil fuels, the fuels of the 20th century, its days are numbered. They are not over, but they are transitioning to be over.”

Liveris said there were many ways to help that transition come about, including extensive financing, correct global regulation and legislation, as well as harnessing innovation. He also said climate accords, such as the Paris Agreement, had to be given more power.

------

READ MORE: Saudi Arabia joins club of Middle East’s ‘green energy’ leaders

------

“The swathe of available technologies to humanity today are building to put policies in place, from efficiency to alternatives to carbon, the hydrogen economy, all of these are things we can do to transition away from coal and oil, to natural gas and ultimately to electrification.

“What lacks (at the moment) is an alignment, a will and a purpose for all the various groups to get together and make that happen, in my new life (and role) I’m putting a lot of time into that,” he said.

The former chairman and CEO of Dow Chemical Company also highlighted the need for so-called “Big Oil” companies to think of themselves as energy companies.

“The term ‘Big Oil’ is almost a neanderthal term, I think we have to realise these companies are energy companies and these companies, like Saudi Aramco, have realised this is a time and a place that humanity is speaking,” he said.

“Communities are speaking and audiences around the world — including hopefully more shareholders — are basically voting with their feet and we are going to have to respond to that.”

“Let’s help ‘Big Oil’ truly become energy companies and manage their own transitions. They can afford it and they should be able to afford it.

“We can’t get there overnight, but there are ways to get there and we can.”

His views were echoed by another panelist Jennifer Morgan, executive director of Greenpeace, who said: “The private banks should stop investing in fossil fuels, they have been investing trillions into them, and move into investments in a low carbon, or zero carbon, infrastructure and renewable energies — you would have to put laws in place that do that.

“You would be powering the world with 100 percent renewable energy and you would put in place incentives and infrastructure to do that,” she said.

Outgoing Bank of England governor Mark Carney said he believed large-scale investment would be able to help the transition thanks to a shift in mindset about the need for greener energy in the financial sector.

“I think they are (listening), they’re listening to the realities, so these issues have moved very swiftly from being corporate responsibility issues or more niche issues within finance to become fundamental value drivers. I think we’re seeing a fundamental reshaping of the financial system,” he said.