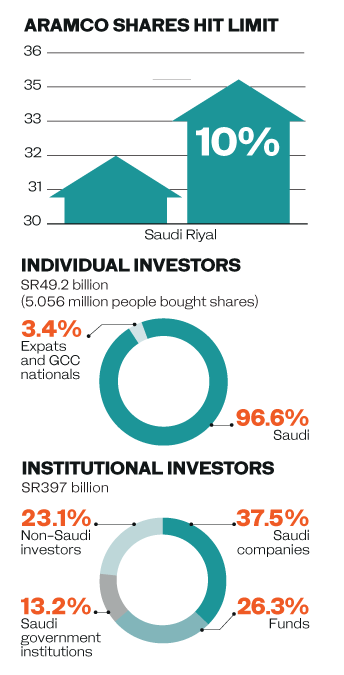

RIYADH: Saudi Aramco shares surged to the maximum allowed 10 percent above their listing price on their debut in Riyadh on Wednesday.

The stock jumped to SR35.2 ($9.39), up from the initial public offering (IPO) price of SR32 ($8.53), hitting the daily limit permitted by the Tadawul stock exchange and giving the company a valuation of about $1.88 trillion.

At that price, Aramco is world’s most valuable listed company. That’s more than the top five oil companies – Exxon Mobil, Total, Royal Dutch Shell, Chevron and BP – combined.

The Aramco IPO also surpassed the $25 billion raised by Chinese retail giant Alibaba in its 2014 Wall Street debut.

HIGHLIGHTS

- Shares up by the maximum daily limit

- Valuation approaches $2 trillion goal

- Tadawul propelled into global top ten

The listing debut was marked by a symbolic ringing of the Tadawul bell by Aramco Chairman Yasir Al-Rumayyan and Chief Executive Amin Nasser.

“This is a proud and historic mo- ment for Saudi Aramco and our majority shareholder, the Kingdom,” Al-Rumayyan said. The focus of company chiefs was “to work in the interests of all shareholders, guiding Saudi Aramco as it continues to fulfill its vital role in global energy supply, while striving to create long-term value to benefit all shareholders,” he said.

“Today’s milestone underlines the Kingdom’s commitment to nur- turing a strong capital market and demonstrates further significant progress in delivering Vision 2030 — the Kingdom’s transformation, economic growth and diversifica- tion program that continues with pace and determination.”

“Today Aramco will become the largest listed company in the world and (Tadawul) among the top ten global financial markets,” Sarah Al-Suhaimi, chairwoman of the Saudi Arabian stock exchange, said during a ceremony marking the oil giant’s first day of trading.

Amin Nasser, the president and CEO of Saudi Aramco, meanwhile thanked the new shareholders for their confidence and trust of the oil company.

The sale of 1.5 percent of the firm, or three billion shares, is the bedrock of Crown Prince Mohammed bin Salman’s ambitious strategy to overhaul the oil-reliant economy.

Prince Abdulaziz bin Salman, the Kingdom's energy minister, said last week that investors who didn’t buy into the offering would be “chewing their thumbs” after missing out.

But for the 5 million people who did buy shares in the world’s biggest IPO, it was the best possible start for their investments.

With the ring of a bell, the Tadawul was catapulted into the top ten exchanges in the world by market value, marking another key milestone for a bourse that is rapidly gaining in global financial visibility following its inclusion in the MSCI Emerging Markets and FTSE Russell indexes last year.

“The level of demand for Saudi Aramco was high at almost 5 times oversubscribed, highlighting the local appeal for a quality asset and its attractive dividend policy, even if foreign participation was more muted,” said Bassel Khatoun, a managing director, at Franklin Templeton Emerging Markets Equity. “We believe Aramco’s Tadawul listing will provide further impetus for Saudi’s privatization drive.”

The share sale took place at a turbulent time for the global oil industry, increasingly under the spotlight because of its greenhouse gas emissions. At the same time, a global supply glut caused in part by the growth of the US shale oil sector has dampened investor sentiment towards the sector. Plans for the share sale faced a further shock in September when Saudi Aramco’s main oil processing facility in Abqaiq was hit in a drone attack.

Despite the unfavorable global market mood, the Saudi government pressed ahead with the sale that has long been a cornerstone of the Kingdom’s efforts to modernize its economy and develop its financial sector.

Despite the unfavorable global market mood, the Saudi government pressed ahead with the sale that has long been a cornerstone of the Kingdom’s efforts to modernize its economy and develop its financial sector.

It is expected to be followed by more privatizations as Saudi Arabia seeks to curb its budget deficit.

Announcing the Saudi budget earlier in the week, Finance Minister Mohammed Al-Jadaan said that the proceeds from the Aramco IPO would be reinvested, helping to create more revenue channels for the government.

Within just one hour of Aramco chairman Yasir Al-Rumayyan ringing the trading bell, some 766.8 million shares had changed hands.

“Today’s milestone underlines the Kingdom’s commitment to nurturing a strong capital market and demonstrates further significant progress in delivering Vision 2030,” he said.

Millions of Saudis bought into the IPO and yesterday cheered the performance of their shares.

“Buying Aramco shares was a trustworthy opportunity for a small investor like me,” said Alanoud Issa, a 27-year-old housewife from Riyadh. “It is a small beginning which I am hopeful will result in a good dividend for me in the future.”

Such citizen investors formed a major chunk of the subscribers to the IPO, buying some SR49.2 billion worth of shares, many of them making their purchases from ATM machines across the Kingdom.

Institutional investors, mainly from the region, bought SR397 billion of the stock.

Watch the video marking Aramco’s opening trading: