BEIJING/SHANGHAI: China will strengthen rules to defuse risks for domestic companies investing abroad and curb “irrational” overseas investment on its Belt and Road initiative, the state planner said on Friday.

The National Development and Reform Commission (NDRC) said in an online statement lauding the Belt and Road initiative that it would provide better guidance on risks to companies investing overseas in order to prevent “vicious” competition and corruption.

The state planner also cited unspecified security risks for Chinese companies investing abroad.

The NDRC did not give more details about how it planned to strengthen current rules or why it was concerned about corruption and unhealthy competition between companies.

Mergers and acquisitions by Chinese companies in countries linked to the Belt and Road initiative have been growing at a rapid rate, even as Beijing takes aim at China’s acquisitive conglomerates to restrict capital outflows.

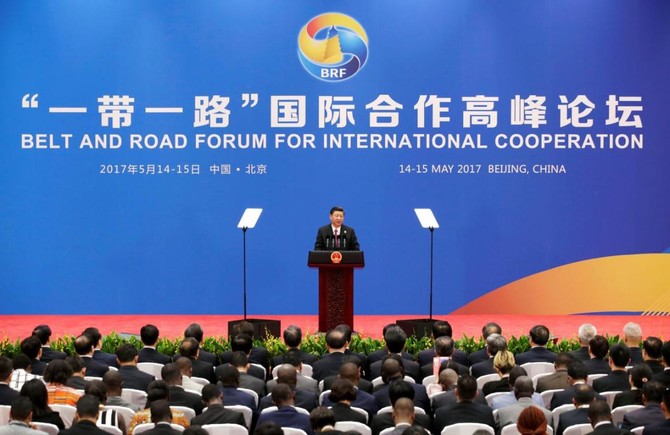

Unveiled in 2013, the Belt and Road project aims to boost trade and investment along two routes — one along the ancient “Silk Road”, connecting China by land and sea through Central Asia and the Middle East to Europe, and the second linking it to Southeast Asia and Africa.

However, the initiative has also come with some security concerns for China. This year, militants in Pakistan, a key Belt and Road partner, killed 10 workers and two teachers from China.

The largest deal in a Belt and Road country so far this year was a Chinese consortium’s $11.6 billion buyout of the Singapore-based Global Logistics Properties.

Chinese acquisitions in the 68 countries officially associated with President Xi Jinping’s signature foreign policy totaled $33 billion as of August 14, surpassing the $31 billion for all of 2016, according to Thomson Reuters data.

Lawyers and dealmakers had told Reuters that companies were enjoying a relatively smooth approval process for Belt and Road-related deals as regulators tended to classify them differently when reviewing outbound investments.

China has tightened outbound capital controls and cracked down on overseas deals it sees as risky, putting pressure on acquisitive conglomerates like Anbang Insurance Group, HNA Group, Dalian Wanda Group and Fosun International Ltd.

In the statement Friday, the NDRC cited projects such as a high-speed railway in Indonesia and a crude oil pipeline between southwest China and Myanmar as examples of how the initiative was advancing.

Up to the end of 2016, Chinese companies had invested more than $18.5 billion to build economic and trade cooperation zones in 20 countries along the Belt and Route routes, it said.

China to curb ‘irrational’ overseas Belt and Road investment

China to curb ‘irrational’ overseas Belt and Road investment

Saudi POS spending jumps 28% in final week of Jan: SAMA

RIYADH: Saudi Arabia’s point-of-sale spending climbed sharply in the final week of January, rising nearly 28 percent from the previous week as consumer outlays increased across almost all sectors.

POS transactions reached SR16 billion ($4.27 billion) in the week ending Jan. 31, up 27.8 percent week on week, according to the Saudi Central Bank. Transaction volumes rose 16.5 percent to 248.8 million, reflecting stronger retail and service activity.

Spending on jewelry saw the biggest uptick at 55.5 percent to SR613.69 million, followed by laundry services which saw a 44.4 percent increase to SR62.83 million.

Expenditure on personal care rose 29.1 percent, while outlays on books and stationery increased 5.1 percent. Hotel spending climbed 7.4 percent to SR377.1 million.

Further gains were recorded across other categories. Spending in pharmacies and medical supplies rose 33.4 percent to SR259.19 million, while medical services increased 13.7 percent to SR515.44 million.

Food and beverage spending surged 38.6 percent to SR2.6 billion, accounting for the largest share of total POS value. Restaurants and cafes followed with a 20.4 percent increase to SR1.81 billion. Apparel and clothing spending rose 35.4 percent to SR1.33 billion, representing the third-largest share during the week.

The Kingdom’s key urban centers mirrored the national surge. Riyadh, which accounted for the largest share of total POS spending, saw a 22 percent rise to SR5.44 billion from SR4.46 billion the previous week. The number of transactions in the capital reached 78.6 million, up 13.8 percent week on week.

In Jeddah, transaction values increased 23.7 percent to SR2.16 billion, while Dammam reported a 22.2 percent rise to SR783.06 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with Saudi Arabia’s Vision 2030 objectives, promoting electronic transactions and contributing to the Kingdom’s broader digital economy.