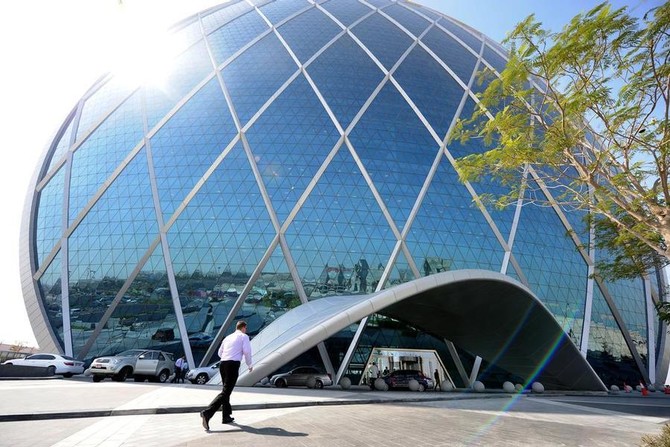

ABU DHABI: Aldar Properties, the builder of Abu Dhabi’s Formula One circuit, reported a 5.6 percent drop in second-quarter profit on Thursday amid a double-digit drop in revenue.

The results come against a backdrop of a slowing economy and property market in the UAE.

Aldar made a net profit attributable to owners of Dh620 million (SR633 million) in the three months to June 30 compared to Dh657.4 million in the same period a year ago, its full financial statement showed.

Earlier in a statement on the company website, Aldar said it made a net profit of Dh620 million in the three months to June 30 compared to Dh654 million in the prior-year period.

SICO Bahrain and EFG Hermes had forecast Aldar would make a quarterly a profit of Dh631.72 million and Dh600 million, respectively.

Aldar’s second-quarter revenues totaled Dh1.35 billion versus Dh1.7 billion in second quarter 2016, down roughly 20 percent.

Four new investments were committed during the first six months of 2017, completing Aldar’s Dh3 billion investment program. Aldar continues to assess opportunities for high-quality assets to grow recurring revenues, it said in a statement.

The company booked lower impairments of Dh6.84 million in second quarter compared to Dh26 million a year ago.

Aldar said it appointed a developer for the Dh1 billion media and entertainment free zone project on Abu Dhabi’s Yas island.

UAE developer Aldar Properties reports lower second-quarter net profit as revenue falls

UAE developer Aldar Properties reports lower second-quarter net profit as revenue falls

Armah Sports net profit up 62% on strong personal training demand

RIYADH: Strong demand for personal training services and continued expansion in its membership base drove Armah Sports Co.’s net proft to shareholders up 62 percent to SR62 million ($16.53 million) in 2025.

Revenue increased rising 27 percent annually to SR224.9 million in the year ending Dec. 31, while while operating revenue climbed 48 percent to SR81.1 million, reflecting operating leverage as revenue growth outpaced cost increases.

Personal training profit increased 51 percent during the year, supported by sustained demand for high-quality training services.

Subscription and membership revenue grew 24 percent, driven by expansion in the average member base and the increasing maturity of existing clubs. The company also recorded growth in ancillary revenue streams from its fitness centers.

Industry data suggests the company’s performance reflects broader structural growth in the Kingdom’s fitness sector.

Ahmed Attallah, manager at the organizers of health and fitness exhibition FIBO Arabia, told Arab News: “Saudi Arabia’s fitness industry is undergoing structural expansion rather than cyclical growth.”

He added: “The market has grown from approximately SR3.4 billion in 2017 to SR7.7 billion in 2024 and is projected to reach SR15.5 billion by 2030. This growth is supported by regulatory reform, rising female participation, and sustained private-sector investment aligned with Vision 2030.”

FIBO Arabia is one of the largest annual health, fitness and wellness industry exhibitions in Riyadh that brings together operators, suppliers, investors and other sector stakeholders to showcase innovations and business opportunities.

Attallah added that revenue growth across operators is increasingly driven by premium services.

“Personal training and premium services remain underdeveloped compared to mature markets, creating room for further revenue growth. At the same time, boutique formats and digitally integrated models are attracting younger, experience-driven consumers,” he said.

Attallah stated that strong financial results from leading operators reflect underlying market fundamentals, and said: “Capital inflows, international brand expansion, and fitness infrastructure embedded within gigaprojects and mixed-use developments point to long-term confidence in the sector.”

He added: “Saudi Arabia is moving from rapid expansion to institutional maturity, positioning it as the Middle East’s leading growth market for fitness and wellness investment.”

Deferred revenue at Armah rose to SR62.6 million across the year, reflecting strong membership renewals and enhancing revenue visibility for future periods.

Cost of revenue increased 22 percent in line with higher activity levels, while operating expenses rose 46 percent, reflecting investments in automation and key senior hires to support future expansion. Interest expenses were linked to financing and lease liabilities associated with the company’s growth strategy.

During the year, Armah recorded non-recurring items including a SR9.5 million gain from a sublease transaction, a SR0.8 million gain from a rent waiver on a lease, and SR1.5 million in expenses related to preparations for transitioning to the Kingdom’s Main Market from Nomu.

Excluding non-recurring items, adjusted net income attributable to shareholders reached SR53.2 million, while adjusted earnings before interest, taxes, depreciation and amortization totaled SR115 million, in line with the reconciliation disclosed in the audited financial statements.

Armah has advanced its expansion and market positioning over the past year, announcing plans in January for a new men’s B_FIT club in Riyadh’s Irqah district. In 2025, it signed agreements for additional clubs in Al Maseef and a SR224 million development deal with Qimam Noshoz.