RIYADH: Saudi Arabia’s total point-of-sale transactions surged by 20.4 percent in the week ending Nov. 29, to reach SR15.1 billion ($4 billion).

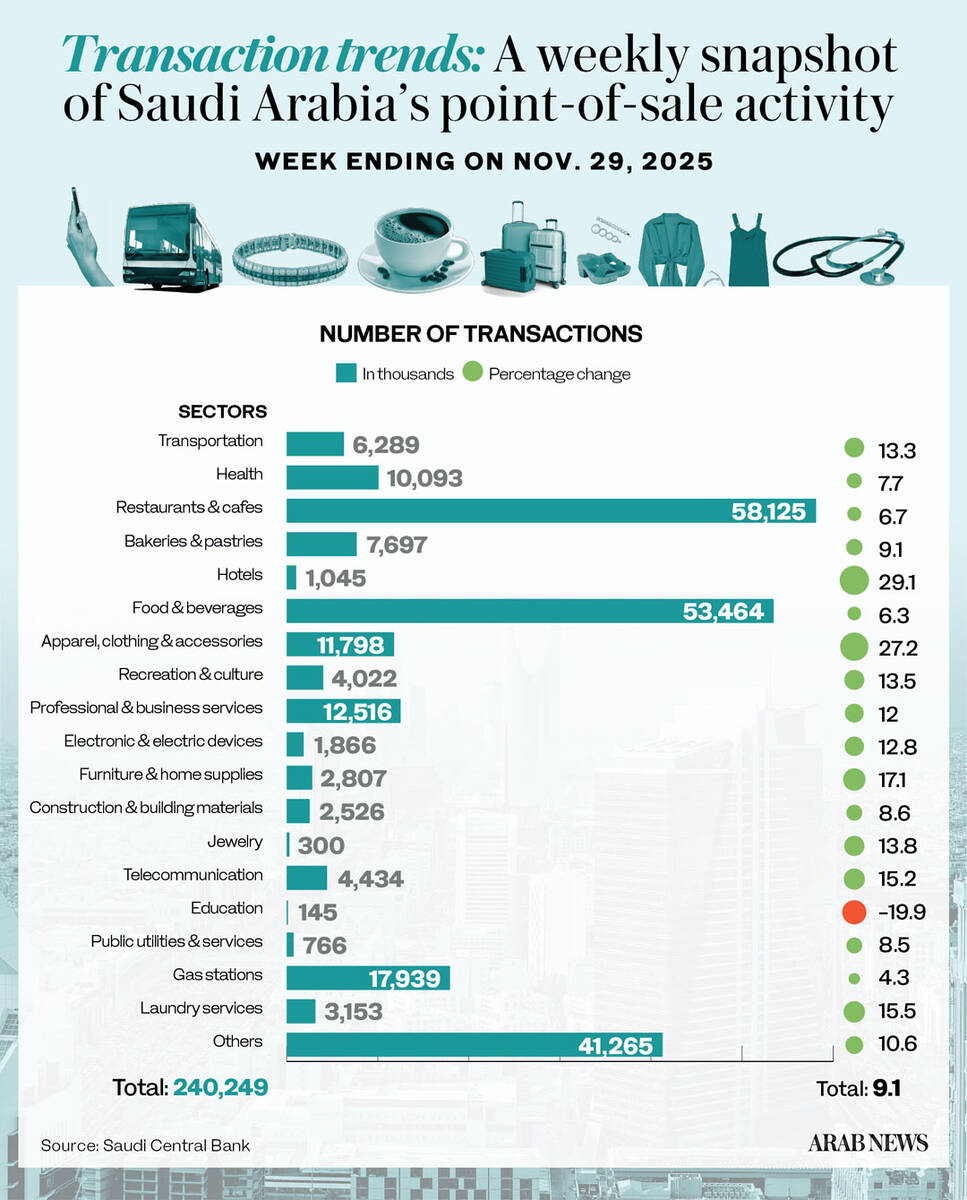

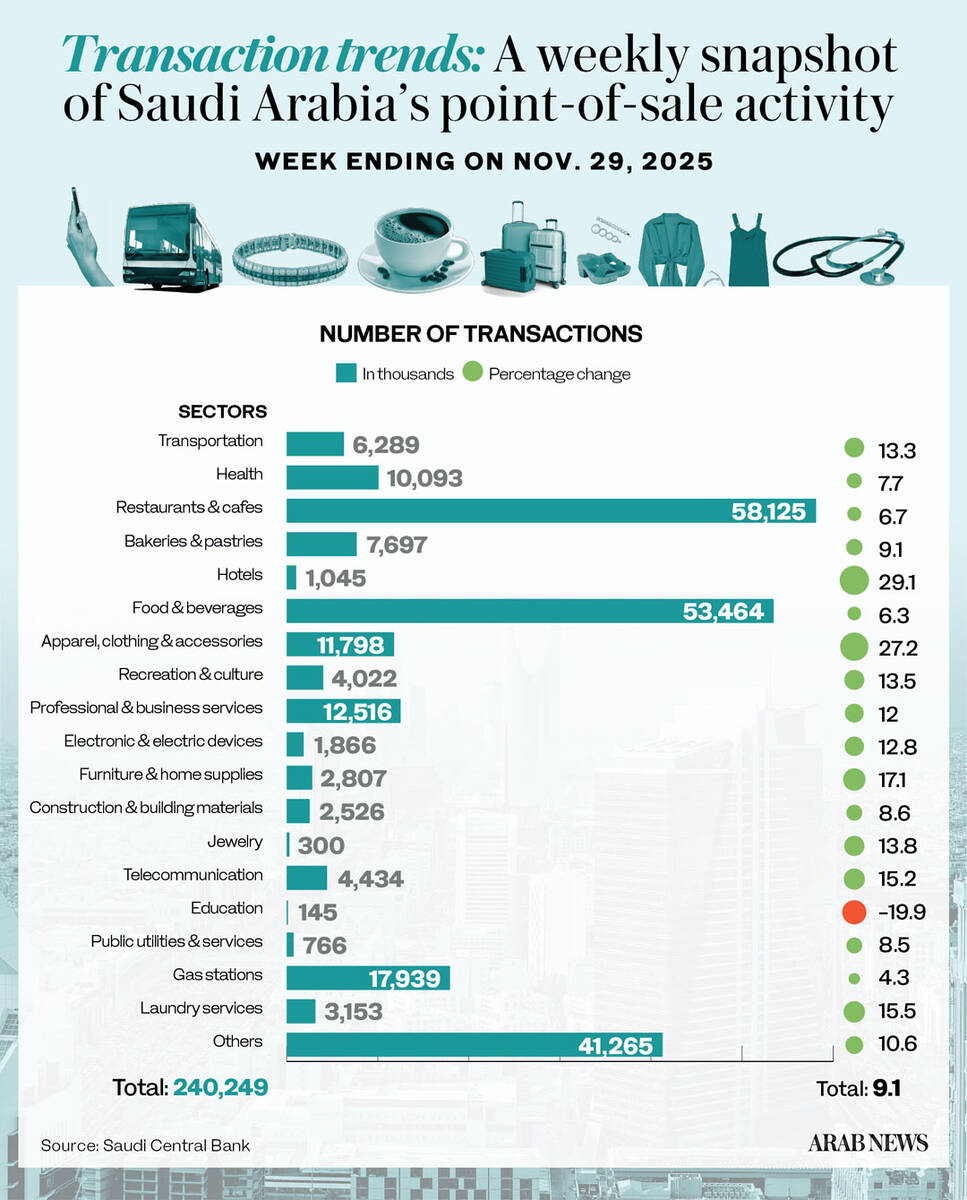

According to the latest data from the Saudi Central Bank, the number of POS transactions represented a 9.1 percent week-on-week increase to 240.25 million compared to 220.15 million the week before.

Most categories saw positive change across the period, with spending on laundry services registering the biggest uptick at 36 percent to SR65.1 million. Recreation followed, with a 35.3 percent increase to SR255.99 million.

Expenditure on apparel and clothing saw an increase of 34.6 percent, followed by a 27.8 percent increase in spending on telecommunication. Jewelry outlays rose 5.6 percent to SR354.45 million.

Data revealed decreases across only three sectors, led by education, which saw the largest dip at 40.4 percent to reach SR62.26 million.

Spending on airlines in Saudi Arabia fell by 25.2 percent, coinciding with major global flight disruptions. This followed an urgent Airbus recall of 6,000 A320-family aircraft after solar radiation was linked to potential flight-control data corruption. Saudi carriers moved swiftly to implement the mandatory fixes.

Flyadeal completed all updates and rebooked affected passengers, while flynas updated 20 aircraft with no schedule impact. Their rapid response contained the disruption, allowing operations to return to normal quickly.

Expenditure on food and beverages saw a 28.4 percent increase to SR2.31 billion, claiming the largest share of the POS. Spending on restaurants and cafes followed with an uptick of 22.3 percent to SR1.90 billion.

The Kingdom’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 14.1 percent surge to SR5.08 billion, up from SR4.46 billion the previous week. The number of transactions in the capital reached 75.2 million, up 4.4 percent week-on-week.

In Jeddah, transaction values increased by 18.1 percent to SR2.03 billion, while Dammam reported a 14 percent surge to SR708.08 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with the Kingdom’s Vision 2030 objectives, promoting electronic transactions and contributing to the nation’s broader digital economy.