RIYADH: Saudi Arabia’s total point-of-sale transactions remained above the $3 billion mark in the week ending Nov. 15, reaching SR13.07 billion ($3.48 billion) despite declines in most sectors.

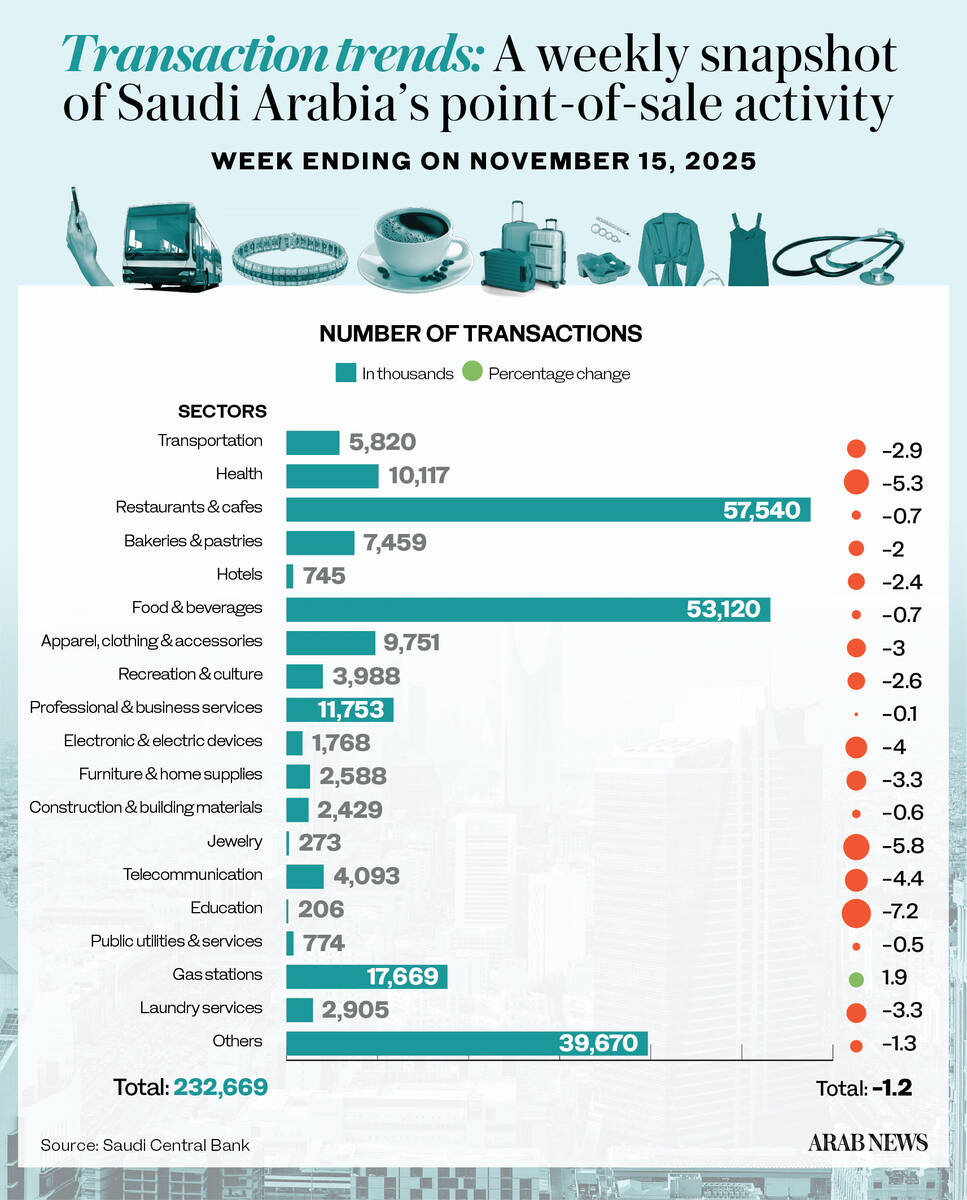

According to the latest data from the Saudi Central Bank, also known as SAMA, the overall POS amount represented a 4.6 percent week-on-week dip, with the number of transactions also seeing a decrease of 1.2 percent to reach 232.67 million compared to the previous seven days.

Some categories posted slight gains, including vehicles and spare parts, which rose 0.6 percent to SR513.75 million. Spending on hotels increased 1.9 percent to SR318.79 million, while gas station expenditure edged up 0.1 percent to SR981.36 million.

Data revealed decreases across the rest of the categories, led by education, which saw the largest dip of 29.5 percent to reach SR126.76 million. Spending on furniture and home supplies followed, with a 12.9 percent decrease to reach SR478.25 million.

Expenditure on food and beverages saw a 5.3 percent decrease to SR1.97 billion, claiming the largest share of the POS. Spending on restaurants and cafes followed despite a dip of 1.6 percent to SR1.62 billion.

Apparel and clothing decreased by 4.1 percent to SR1.18 billion, although the sector was still responsible for the third largest share of POS spending during the monitored week.

The Kingdom’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 4.5 percent dip to SR4.68 billion, down from SR4.91 billion the previous week. The number of transactions in the capital reached 76.83 million, down 1.6 percent week-on-week.

In Jeddah, transaction values decreased 5.5 percent to SR1.75 billion, while Dammam reported a 5.9 percent dip to SR647.71 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with Saudi Arabia’s Vision 2030 objectives, promoting electronic transactions and contributing to the Kingdom’s broader digital economy.