SEATTLE: Executives from Amazon Web Services, the world’s largest data center provider and a key player in the global AI race, are eyeing opportunities nearly 10,000 km away in Saudi Arabia.

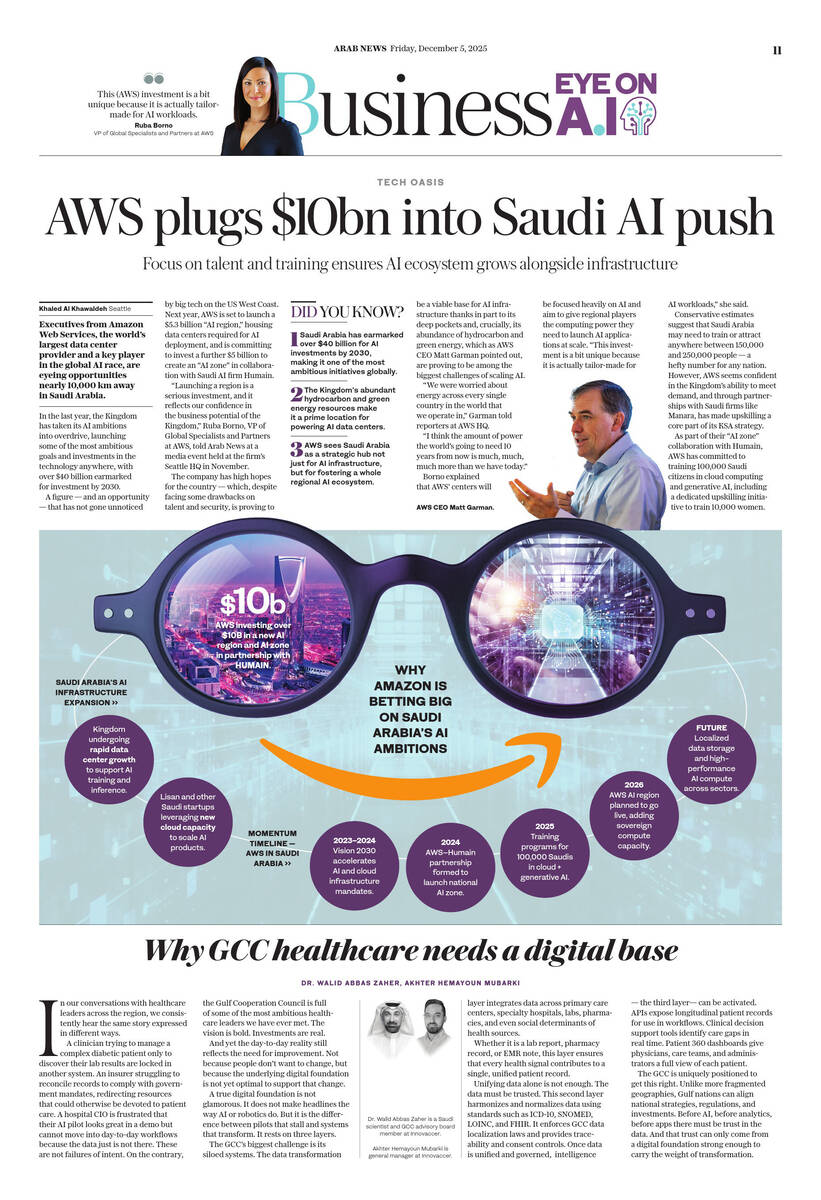

In the last year, the Kingdom has taken its AI ambitions into overdrive, launching some of the most ambitious goals and investments in the technology anywhere, with over $40 billion earmarked for investment by 2030.

A figure — and an opportunity — that has not gone unnoticed by big tech on the US West Coast. Next year, AWS is set to launch a $5.3 billion “AI region,” housing data centers required for AI deployment, and is committing to invest a further $5 billion to create an “AI zone” in collaboration with Saudi AI firm Humain.

A look at the global hyperscale cloud providers competing for market share in Saudi Arabia, including AWS, Microsoft, Google, Oracle, and stc. (creativecommons.org)

“Launching a region is a serious investment, and it reflects our confidence in the business potential of the Kingdom,” Ruba Borno, VP of Global Specialists and Partners at AWS, told Arab News at a media event held at the firm’s Seattle HQ in November.

The company has high hopes for the country — which, despite facing some drawbacks on talent and security, is proving to be a viable base for AI infrastructure thanks in part to its deep pockets and, crucially, its abundance of hydrocarbon and green energy, which as AWS CEO Matt Garman pointed out, are proving to be among the biggest challenges of scaling AI.

“We were worried about energy across every single country in the world that we operate in,” Garman told reporters at AWS HQ.

“I think the amount of power the world’s going to need 10 years from now is much, much, much more than we have today.”

Matt Garman, CEO of AWS, speaking at the company’s Seattle headquarters, where he discussed the rising global demand for energy to support AI growth. (Supplied)

With Saudi Arabia keen to capitalize on its comparative advantages, the Kingdom is undergoing a massive infrastructure boom, racing to transform the desert into sprawling data centers.

Borno explained that AWS’ centers will be focused heavily on AI and aim to give regional players the computing power they need to launch AI applications at scale. “This investment is a bit unique because it is actually tailor-made for AI workloads,” she said.

“It is the infrastructure that is specific for AI training and inference — to help train models that are developed in that region or trained in that region on data to support customers and partners in that region.”

Opinion

This section contains relevant reference points, placed in (Opinion field)

Borno said AWS’ goal in Saudi Arabia is to “lay down the roads” to allow a viable AI ecosystem to take shape. She pointed out that this required not only infrastructure like data centers but also training to ensure the talent to utilize the hardware is available.

“To start to extract the value from the oil, you’ve got to build physical roads and lay the tar, get the pumps, and I think we’re seeing much of that happening right now with AI,” she said.

Bridging the skills gap

Conservative estimates suggest that Saudi Arabia may need to train or attract anywhere between 150,000 and 250,000 people — a hefty number for any nation. However, AWS seems confident in the Kingdom’s ability to meet demand, and through partnerships with Saudi firms like Manara, has made upskilling a core part of its KSA strategy.

“We believe that there’s a tremendous opportunity to support the customers there to totally transform, but it has to be coupled with training,” Borno said.

“It’s not just about getting the certifications, it’s actually about getting them jobs. So it’s not just training them, getting them AWS certified, but actually placing them.”

As part of their “AI zone” collaboration with Humain, AWS has committed to training 100,000 Saudi citizens in cloud computing and generative AI, including a dedicated upskilling initiative to train 10,000 women.

This is being done while simultaneously signing partnerships that will see AWS become the infrastructure partner of choice in the Kingdom — aiming to make AWS foundational to all AI development. These partnerships include big players like Humain, but smaller startups as well.

“I think when we launch these new regions, we’re going to see a lot more startups actually innovate, because they now have this innovation at their fingertips to be able to build businesses,” Borno said.

“There’s a KSA startup in this year’s cohort called Lisan, and they’re focused on language translation with the right dialect, using AI to actually support that language translation.”

AWS recently made global headlines when it laid off 30,000 staff, prompting fears of a mass exodus of jobs as AI tools emerge. Confronted on the topic by reporters in Seattle, CEO Matt Garman admitted that he had little idea what AI’s impact may be on workforce size; however, he seemed confident that the upheaval would result in new opportunities.

“I am not going to pretend I have any idea what the right size of the workforce is 10 years from now,” Garman said.

“What I will say is the thing that I feel confident about is the shape of the workforce will look different.”

DID YOU KNOW?

• Saudi Arabia has earmarked over $40 billion for AI investments by 2030, making it one of the most ambitious initiatives globally.

• The Kingdom’s abundant hydrocarbon and green energy resources make it a prime location for powering AI data centers.

• AWS sees Saudi Arabia as a strategic hub not just for AI infrastructure, but for fostering a whole regional AI ecosystem.

Managing risks

In September this year, multiple undersea cables were cut in the Red Sea, causing internet disruptions. The act of vandalism — purported to be part of active campaigns of economic coercion in a politically volatile region — has sparked fears that the region’s AI ambitions could be hindered by geopolitical risk.

However, speaking to Arab News, Sara Duffer, director of AWS Security Assurance, said the company was confident in its ability to mitigate these risks and stay ahead of disruptions, which she said impact many regions for varying reasons.

“We think about that level of connectivity and ensure that we have multiple paths from a connectivity perspective so that you’re able to continue to engage within a specific region,” Duffer said.

Attendees walk through an expo hall during AWS re:Invent 2025, a conference hosted by Amazon Web Services, at The Venetian Convention & Expo Center on December 2, 2025 in Las Vegas, Nevada. (AFP)

She said part of the advantage of having “cloud regions” and AI zones in different parts of the world was the ability to build to the exact requirements of each. Duffer stated that this would be no different in Saudi Arabia, where they hope that by having the infrastructure to store data locally, much of the risk could be mitigated.

“We really design from the ground up our regions with the concept of data sovereignty,” she said.

“The availability and resiliency controls that we have enable our customers to choose which regions they want their content to reside in — down to even which data center they want it in.”