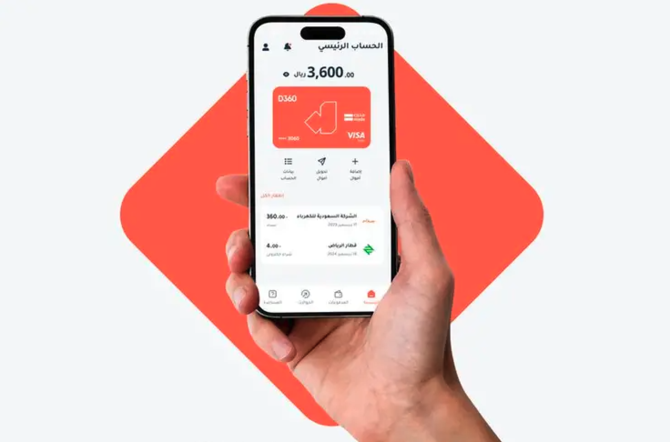

RIYADH: Saudi Arabia’s Public Investment Fund-backed digital bank D360 is in early talks with potential global investors as it prepares for a Series A funding round planned for the second half of 2025.

The Shariah-compliant lender, which began operations in December, is targeting the first quarter of 2026 to complete the raise, CEO Eze Szafir said in an interview with Bloomberg.

This development follows the bank’s successful securing of around $500 million from existing shareholders, including PIF and Derayah Financial Co.

While Szafir did not disclose the size of the upcoming round, he told Bloomberg the funding will support the bank’s efforts to expand services to small and medium enterprises, aligning with the Kingdom’s broader economic diversification strategy under Vision 2030.

“We’re looking for new investors in the international landscape, most probably from Europe or the US, with the same quality we have here with the PIF and Derayah,” Szafir was quoted as saying.

D360 also plans to roll out full lending services for individuals and SMEs later this year.

In preparation for the raise, the company has appointed former JPMorgan Chase & Co. banker Mohammed Nazer as chief financial officer to lead the process. Nazer said the bank expects to appoint advisers to manage the Series A round by the end of July.

One of the first institutions to be granted a digital banking license in Saudi Arabia, D360 currently serves over 1 million users. It is targeting 4 million account holders ahead of a potential public listing within the next four years.

By adopting data-driven strategies and modern technologies, D360 aims to contribute to the development of the Kingdom’s digital financial infrastructure and align with the goals of Vision 2030.

The move comes as the Saudi Central Bank continues to advance regulatory frameworks that support digital transformation in the financial sector. The institution, also known as SAMA, has prioritized fostering innovation and financial inclusion through digital banking, granting licenses to new digital players in a bid to modernize the Kingdom’s banking landscape and strengthen financial resilience.

This push has helped Saudi electronic payments account for 79 percent of all retail transactions in the Kingdom in 2024, up from 70 percent the previous year, according to SAMA.

The central bank also reported that the total number of non-cash retail transactions reached 12.6 billion in 2024, compared to 10.8 billion in 2023, reflecting the continued growth and widespread adoption of digital payment systems nationwide.