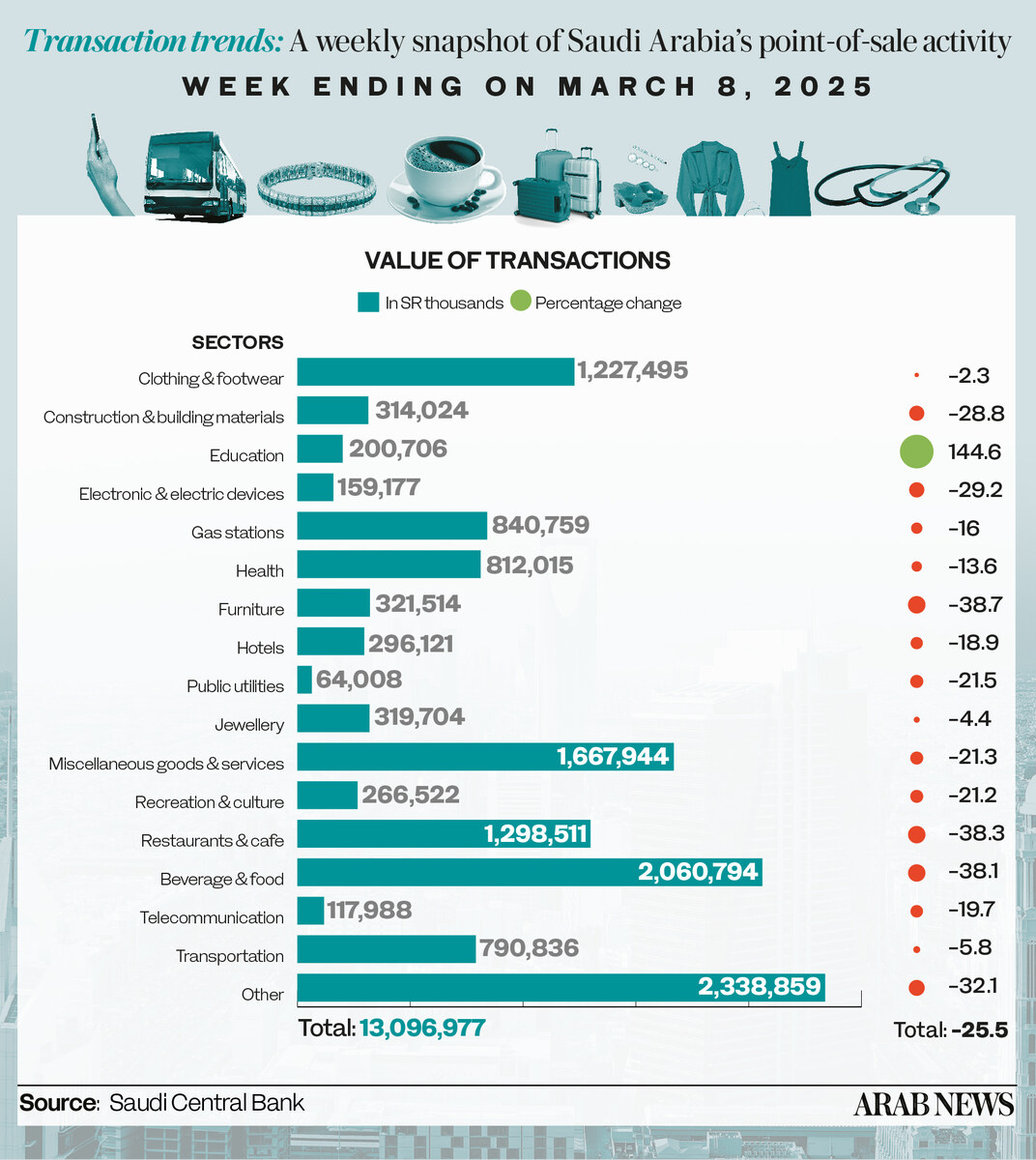

RIYADH: Saudi Arabia’s education sector saw a notable rise in spending in the week ending March 8, climbing 144.6 percent to SR200.7 million ($53.5 million) as students returned from a break.

Transaction volumes rose 7.6 percent to 116,000 across the category, after registering a 33.6 percent slump in the previous week.

The latest point-of-sale data from the Kingdom’s central bank showed this was the only sector posting growth over the seven-day period, as consumer spending across the Kingdom contracted sharply.

Total POS transactions fell 25.5 percent to SR13.09 billion, dowm from SR17.57 billion a week earlier.

Furniture sales led the decliners, falling 38.7 percent to SR321.5 million. Electronics spending slid 29.2 percent to SR159.1 million, while recreation and culture dropped 21.2 percent to SR266.5 million.

Spending on food and beverages recorded a decrease of 38.1 percent to SR2.06 billion, claiming the biggest share of the total POS value.

Expenditure in restaurants and cafes followed closely, recording a 38.3 percent decrease to SR1.29 billion. Miscellaneous goods and services ranked third, down 21.3 percent to SR1.66 billion. Together, these three categories accounted for 38.3 percent — or SR5 billion — of total weekly POS spending.

At 2.3 percent, the smallest decrease occurred in spending on clothing and footwear, leading total payments to reach SR1.22 billion. Expenditures on jewelry followed dipping by 4.4 percent to SR319.7 million, while transportation recorded a 5.8 percent fall to SR790.8 million.

Geographically, Riyadh dominated POS transactions, representing around 34.9 percent of the total, with expenses in the capital reaching SR4.58 billion — a 21.9 percent decrease from the previous week.

Jeddah followed with a 24.4 percent dip to SR1.85 billion, and Dammam came in third at SR666.6 million, down 21.4 percent.

Hail experienced the most significant decrease in spending, dipping by 36 percent to SR188.4 million.

Abha and Tabuk followed, recording decreases of 30.4 percent and 28.57 percent, reaching SR139.7 million and SR239.4 million, respectively.

Hail and Buraidah saw the largest decreases in terms of the number of transactions, slipping 27.2 percent and 23.4 percent, respectively, to 2.9 million and 4 million transactions.