ISLAMABAD: Leading Egyptian fintech MNT-Halan plans to invest $10 million in Pakistan and open 100 new branches of its microfinance bank across the South Asian country by the end of this year, the company’s founder said this week, hoping to tap Pakistan’s large “unbanked” population.

Founded in 2017 by Mounir Nakhla and Ahmed Mohsen, MNT-Halan began as a ride-hailing platform before evolving into a comprehensive fintech organization after a share swap between Halan and MNT in 2018.

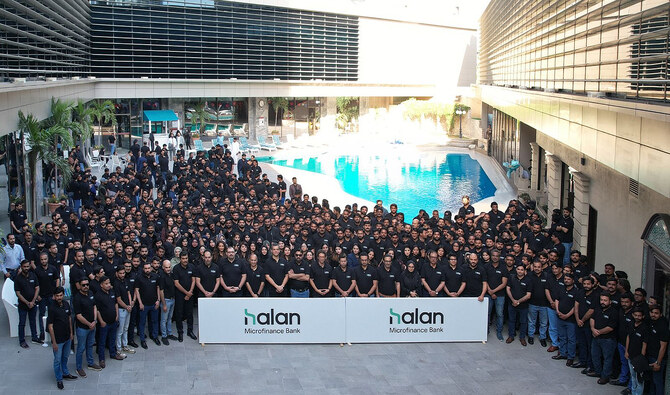

Following its acquisition of Advans Pakistan Microfinance Bank Ltd. in March 2024, MNT-Halan, Egypt’s largest and fastest-growing lender to the unbanked and underbanked, is providing financial services to micro, small and medium-sized enterprises through Halan Microfinance Bank’s 19 branches in Pakistan’s southern Sindh province.

“We are rapidly scaling operations in Pakistan to address the country’s large unbanked population and cash-driven economy,” Mounir Nakhla, the founder and CEO of MNT-Halan, told Arab News on Wednesday.

“And by the end of 2025, we aim to increase our investments to $10 million to support our local expansion, digital transformation and product innovation.”

MNT-Halan offers cutting-edge digital financial solutions such as mobile wallets, debit and credit cards, and a BNPL (Buy Now, Pay Later) e-commerce platform. These services enhance accessibility and efficiency in Pakistan’s microfinance sector.

“We also plan to open 100 new branches and business units and serve 200,000 customers and we also intend to grow our loan book to $500 million within five years,” Nakhla said.

FORMAL TRANSACTIONS, INFORMAL ECONOMY

Pakistan’s economy lacks digital inclusion and is mainly dominated by cash-based commercial transactions. Micro and small retailers make very little use of electronic payments.

Nakhla said Pakistan represented a significant growth opportunity, adding that the Egyptian fintech was well-positioned to expand its operations here.

He said MNT-Halan was focused on small-and-medium enterprises (SME) lending to support businesses and entrepreneurs, along with providing customers salary-based and earned wage access (EWA) loans to address liquidity needs.

“Additionally, we are committed to offering Shariah-compliant financial services for women entrepreneurs and agricultural lending, ensuring alignment with market demand,” Nakhla said.

He said Pakistan’s household debt-to-GDP ratio is among the lowest in the world at just 3-4 percent, signaling a massive unmet demand for credit.

“Key drivers of our expansion included large, cash-driven economy as Pakistan has $33 billion in circulation, with daily cash transactions exceeding $175,000,” Nakhla said.

He pointed out that Pakistan had a large underserved micro and SME sector where millions of businesses rely on informal lending at high costs.

Nakhla said MNT-Halan provided scalable, tech-driven lending solutions to bring informal transactions into the formal economy. He said the fintech follows a hybrid model that combines physical expansion with digital innovation to enhance efficiency and accessibility in Pakistan.

“By digitizing lending and optimizing credit decision-making, we will expand access while maintaining low-risk, high-efficiency operations,” he said.

Nakhla said a key component of this strategy was the Neuron Core Banking System, an AI-powered platform designed to support risk assessment models, enable instant credit decisions, facilitate real-time processing and enhance fraud detection.

“The company also plans to launch Halan super app, our mobile-first lending platform which will allow customers to apply, track and manage their loans seamlessly, reducing reliance on physical banking,” he added.

He said MNT-Halan is also developing alternative data and AI credit solutions that will leverage behavioral and transactional data to assess unbanked customers who have no traditional credit history.

“Risk management is at the core of our lending strategy as we ensure high portfolio quality through diversified portfolio strategy, a balanced mix of microfinance, SME lending, and consumer credit mitigates exposure,” he added.