RIYADH: Emerging market economies are facing escalating challenges, including geopolitical tensions, sluggish global growth, financial volatility, and increasing public debt, according to the governor of the People’s Bank of China.

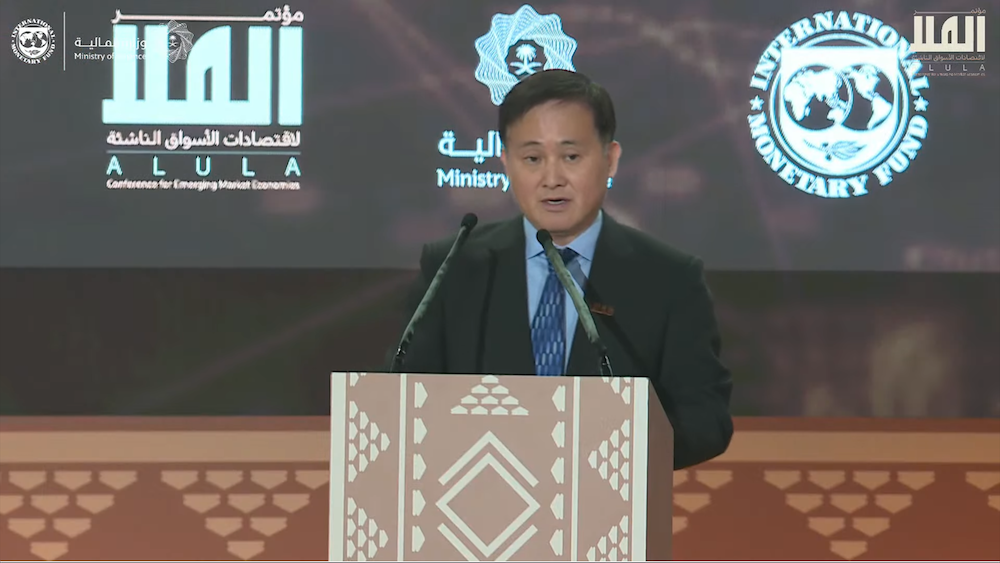

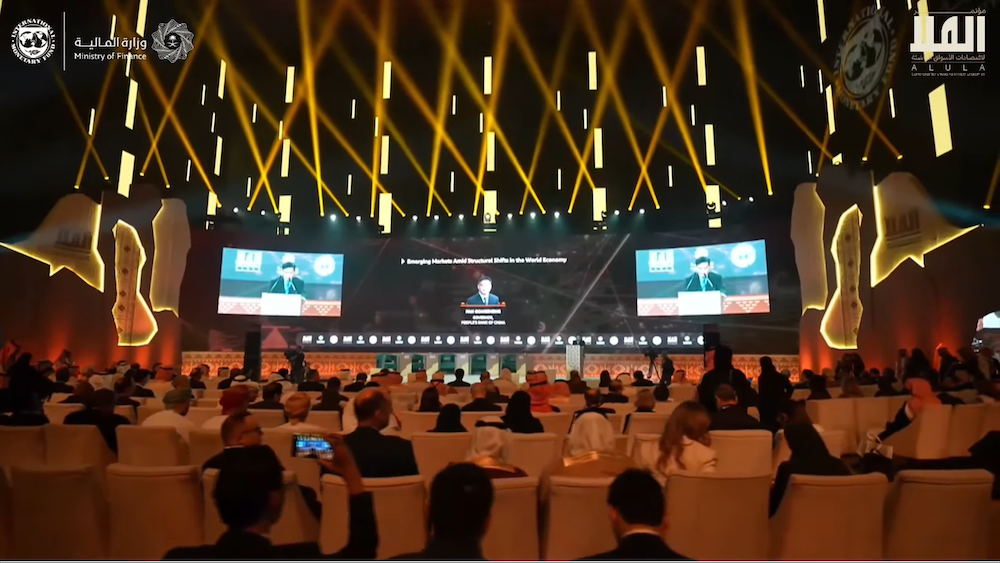

Speaking at the two-day AlUla Conference for Emerging Market Economies, organized by the Saudi Ministry of Finance and the International Monetary Fund, Pan Gongsheng emphasized the need for proactive policy measures and strengthened multilateral cooperation to enhance economic resilience.

“In my view, emerging markets face four key challenges,” Gongsheng said. “The first challenge is geopolitical tension.” He highlighted how increasing geopolitical conflicts and protectionism disrupt international value chains and restrict the flow of capital, technology, and labor.

“There has been a drop in global growth and productivity gains and the rising divergences in key industries across countries, mainly due to uneven development and resource misallocation,” he said.

Pan Gongsheng, the governor of the People’s Bank of China, speaks during the AlUla Conference for Emerging Market Economies. AN Photo

Gongsheng’s remarks align with the IMF’s recent report, which warns that friendshoring — the practice of countries trading primarily with geopolitical allies — could reduce global economic output by up to 1.8 percent.

Emerging markets, particularly in Asia, may experience up to 6 percent declines due to this shift.

Despite these warnings, a Financial Times report said China has intensified its control over technology and resources, including restricting key battery technology exports, disrupting global value chains, and escalating geopolitical tensions.

Gongsheng identified the second challenge as the slower medium-term growth of the international economy.

“We are now facing policy uncertainties in some economies. If protectionism escalates, rising trade fluctuations will drive up inflation expectations and undermine medium-term growth,” he added.

Pan Gongsheng, the governor of the People’s Bank of China, warned that growing investor concerns over fiscal sustainability could trigger government bond market volatility. AN Photo

Citing IMF forecasts, he said global economic growth is projected to hover at just 3 percent in the medium term, the lowest level since 2000.

Financial market volatility and capital outflows represent the third major challenge.

“The trajectory of the interest rate in major advanced economies remains highly uncertain,” Gongsheng said.

“Markets have become particularly sensitive to unexpected economic data. If rates differ and rise significantly from market expectations, market repricing may increase asset price volatility in emerging markets.”

This aligns with a recent Reuters report, which said emerging markets are facing significant challenges due to a strong US dollar and high treasury yields.

These factors have led to weaker local currencies, increased costs for servicing dollar-denominated debt, reduced capital inflows, and dampened economic growth.

Policymakers in these regions find it difficult to counteract these pressures effectively, which are further heightened by new US tariff and trade policies.

The fourth issue Gongsheng discussed was the burden of high public debt and its implications for financial stability.

“The IMF points out that global public debt risk has risen significantly due to political and other factors. Those risks not only exist in developing countries — the level of public debt in some advanced economies also merits close attention,” he said.

He warned that growing investor concerns over fiscal sustainability could trigger government bond market volatility, with potential spillover effects on other asset classes, liquidity risks, and financial stability.

According to a report by the Institute of International Finance, the global debt stock increased by over $12 trillion in the first three quarters of last year, reaching nearly $323 trillion.

Pan Gongsheng, the governor of the People’s Bank of China, stressed the importance of multilateralism and global financial governance reform. AN Photo

The IIF attributes the rise to declining borrowing costs and a heightened risk appetite among investors, underscoring concerns similar to those expressed by the governor.

To address these challenges, Gongsheng outlined key policy responses for emerging markets.

“First, we should continue improving monetary policy frameworks, enhancing the efficiency of monetary policy transmission, increasing policy transparency, and improving policy communication,” he said.

He also advocated for increased exchange rate flexibility, stronger public debt management, improved macroprudential regulations, and the development of local currency markets to mitigate capital flow risks.

Gongsheng stressed the importance of multilateralism and global financial governance reform.

“The IMF has made great progress in surveillance and governance reform. At the same time, there is still more work to be done for us to advance global financial governance reform,” he said.

He called on the IMF to enhance support for developing countries, promote trade and investment liberalization, and establish comprehensive policy tools to help emerging markets address capital flow risks and external shocks.

“The current quota shares can no longer reflect the actual position of emerging markets in the global economy,” Gongsheng said, urging the IMF to establish a “concrete and binding timetable” for future quota realignments, with discussions on fiscal realignment plans set by June.