KARACHI: Pakistan’s health ministry on Friday confirmed the country’s eighth case of the mpox virus this year in a patient who had recently returned from travels abroad.

People who contract mpox get flu-like symptoms and pus-filled lesions. Children, pregnant women and people with weakened immune systems are at higher risk of complications from the infection.

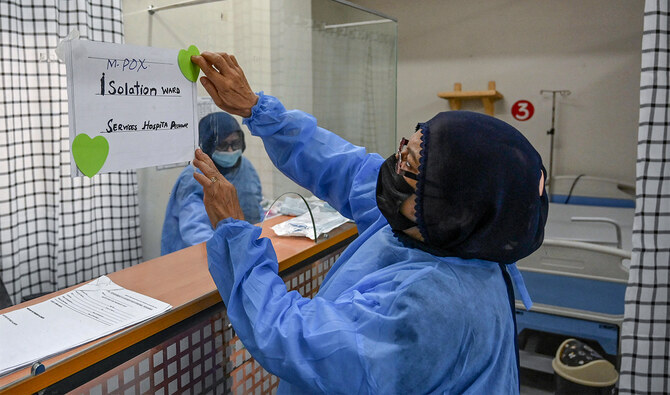

Pakistan confirmed its first mpox case in August and has since implemented screening protocols at all airports and border entry points.

“The 32-year-old patient has been isolated and treated,” Health Ministry spokesperson Sajid Shah told Arab News. “He is experiencing mild symptoms and is expected to recover soon.”

The spokesman added that the patient had recently returned from traveling in a Gulf country.

The World Health Organization in August declared a global health emergency over the spread of a new mutated strain of mpox named clade I, which first emerged in the Democratic Republic of Congo and has since spread to several countries, leading to increased monitoring and preventive measures worldwide.

Pakistan has so far not reported any cases of the new mutation.