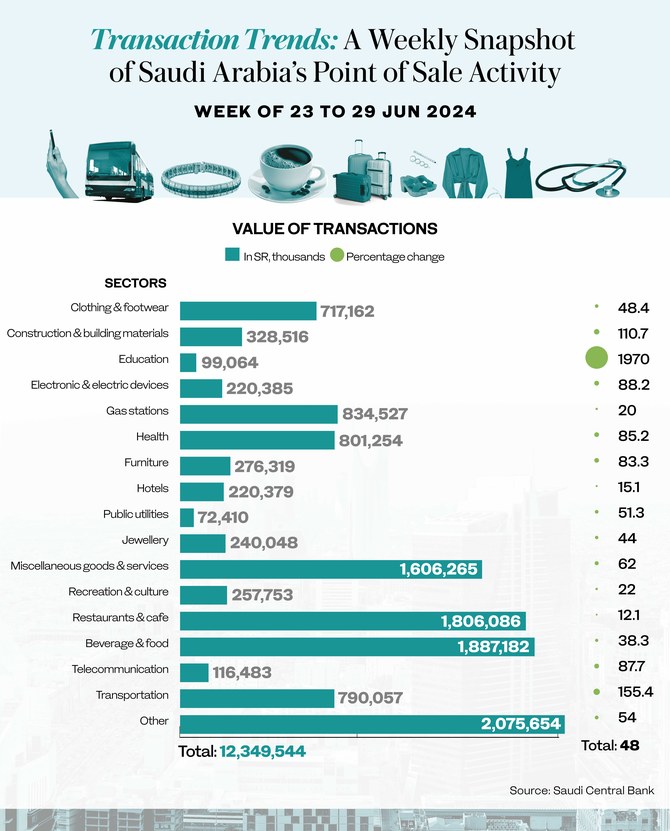

RIYADH: Saudi Arabia’s point-of-sale spending increased by 48 percent to reach SR12.34 billion ($3.29 billion) from June 23 to 29, with the education sector registering the largest surge.

The latest data from the Saudi Central Bank, also known as SAMA, revealed that the transaction value in the sector, which accounts for only 0.05 percent of the total number of transactions, saw a 1,970 percent increase, reaching SR99.06 million during the week.

From May 16 to June 22, POS spending in the Kingdom dipped to its lowest in months, reaching SR8.34 billion, coinciding with the Eid al-Adha vacation period.

Saudi-based economist Talat Hafiz explained in an interview with Arab News that “spending is usually less during such vacations,” as citizens perform Hajj compared to regular days when they visit shopping malls and restaurants for entertainment.

Data from SAMA for the last week of June showed that spending on transportation surged by 155.4 percent to reach SR790 million, the second-highest increase compared to the previous week.

Spending on construction and building materials came in third place, recording a 110.7 percent rise, reaching SR328.5 million.

Outlays on food and beverages constituted the highest share of the POS and witnessed a 38.3 percent surge, reaching SR1.88 billion. This came alongside spending in restaurants and cafés, reaching SR1.8 billion and constituting the second-largest share with the smallest increase of 12.1 percent compared to the previous week.

POS spending on miscellaneous goods and services, including personal care items, supplies, maintenance, and cleaning, constituted the third-highest share and witnessed a 62 percent rise that week, reaching SR1.6 billion.

The hotel sector experienced the second-smallest increase in POS transaction value, increasing by 15.1 percent to SR220.3 million. On the other hand, gas stations witnessed the third-smallest surge, with a 20 percent increase, reaching SR834.5 million.

According to data from SAMA, 32.15 percent of POS spending occurred in Riyadh, with the total transaction value reaching SR3.96 billion, representing a 61.2 percent increase from the previous week.

Riyadh has undergone considerable expansion, evolving into a pivotal center for growth and progress.

The city’s La Strada Yard recently witnessed the debut of the Dubai-based supermarket chain Spinneys in Saudi Arabia.

The 43,520 square foot flagship outlet in Riyadh’s emerging mixed-use development marks the beginning of Spinneys’ expansion strategy in the capital city and Jeddah, aiming to cater to the increasing preference for high-quality grocery choices across the Kingdom.

Spending in Jeddah followed, accounting for 13.8 percent of the total and reaching SR1.71 billion, marking a 45.3 percent weekly positive change.

Moreover, spending in Dammam surged by 58.1 percent, taking the second-largest increase to reach SR580.4 million, the third-largest share of this week’s POS.

The most significant positive change was spotted in Tabuk, with a 71.6 percent surge, reaching SR230.8 million.

The only negative change was registered in Makkah, where spending decreased by 1.1 percent to reach SR444 million.