CAIRO: Consumer loans of Saudi commercial banks increased 13 percent to SR445.8 billion ($118.9 billion) on June 30, 2022, compared to SR394.2 billion on the same day last year, the Saudi Central Bank, also known as SAMA, revealed.

This growth, however, pales in comparison to the 17.4 percent growth between June 30, 2021, and June 30, 2020, the data pointed out.

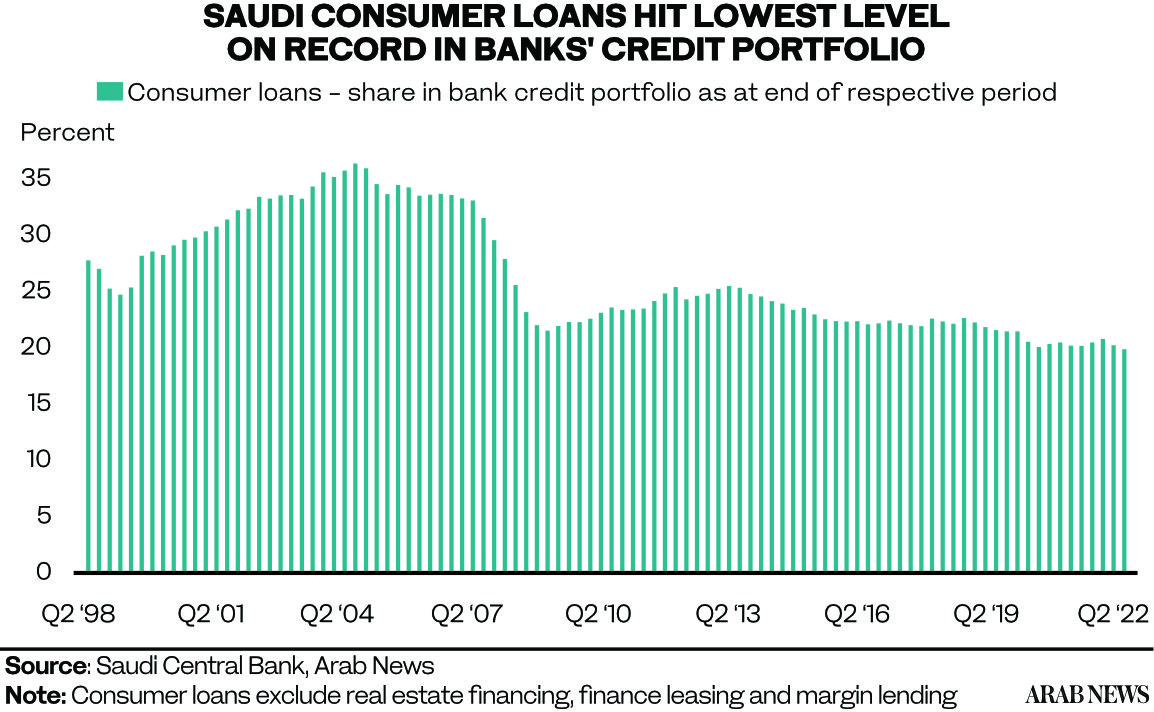

Moreover, the share of consumer loans in total bank credit has fallen to 19.9 percent on June 30, 2022, the lowest share percentage on record, data compiled by Arab News revealed.

It is worth mentioning that consumer loans do not include real estate financing, finance leasing and margin lending, according to SAMA.

From June 2017-2022, consumer loans have had a positive trend. The value grew 0.5, 0.6, 5.3, 17.4, and 13.1 percent year on year, respectively. The consumer loans stood at SR315.1 billion on June 30, 2017.

According to SAMA, 90 percent of consumer loans fall under the “other” products category.

“The ‘other’ major loan component is related to general consumer bank overdraft short- and medium-term funding as credit card loans are captured separately,” said Mohamed Ramady, a London-based consultant and former professor.

The balance of consumer loans to finance “other” products increased 19 percent to SR402.3 billion on June 30 this year from SR338.2 billion the same day last year.

The remaining 10 percent is distributed among renovation and home improvement, vehicles and private transport, furniture and durable goods, education, healthcare, tourism and travel.

Renovation and home improvement, which makes up 3.4 percent of the 10 percent, saw a 31.4 percent decline to SR15.2 billion on June 30, 2022, from SR22.2 billion a year ago.

Moreover, car loans experienced a 20.6 percent year-on-year decrease from SR15.5 billion to SR12.3 billion during the period under study.

“Consumer loans have decreased in some items, especially in capital home goods and home improvements as well as vehicles as consumers await to take stock of increased input price hikes,” he added.

Furniture and durable goods underwent a 31.1 percent decrease from SR12.6 billion to SR8.7 billion over the same period. In contrast, education loans grew by 33 percent to SR5.9 billion.

Looking at consumer spending during the first half of 2022, the total value of point of sale transactions grew 12.9 percent year on year, reaching SR271.2 billion in June year-to-date compared to SR240.3 billion over the same period in 2021, SAMA data stated.

“POS transactions have gone up over H1 2022 in the items that were expected to increase with the gradual easing of lockdown restrictions such as food and beverages, restaurants and cafes and goods and services,” revealed Ramady while pointing out that this trend was also apparent in other countries coming out of the lockdown.

The most significant change in POS value between the first half of 2021 and 2022 was in “miscellaneous goods and services,” which grew 42.6 percent from SR19.7 billion to SR28.2 billion during this period.

The “others” category in POS, which makes up 21.2 percent of the total value of transactions in the first half of 2022, surged 33.6 percent from SR42.7 billion in the first half of 2021 to SR57.1 billion in the first half of 2022.

“The “others” in POS capture general personal services sales, including home delivery and uber services not captured in the broader items,” specified Ramady.

Food and beverages, another component that exhibits a prominent share of 14.7 percent in POS sales, showed an increase of 14.8 percent from SR35.8 in June year-to-date last year to SR41.0 billion in June this year.

On the other hand, restaurants and cafes increased 31.4 percent from SR28.3 billion in the first half of 2021 to SR37.2 billion in the first half of 2022.