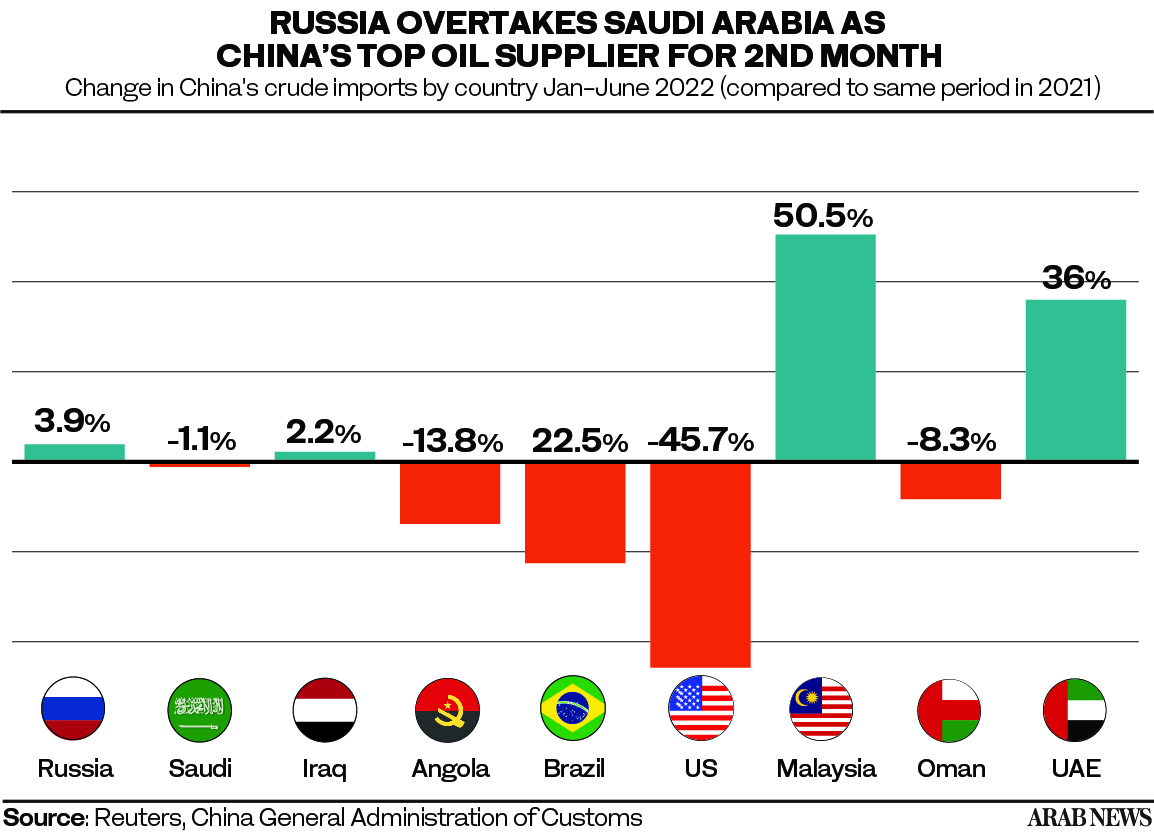

SINGAPORE: Russia held its spot as China’s top oil supplier for a second month in June as Chinese buyers cashed in on lower-priced supplies, slashing more costly shipments from Saudi Arabia, data showed on Wednesday.

Imports of Russian oil, including supplies pumped via the East Siberia Pacific Ocean pipeline and seaborne shipments from Russia’s European and Far Eastern ports, totalled 7.29 million tons, up nearly 10 percent from a year ago, according to data from the Chinese General Administration of Customs.

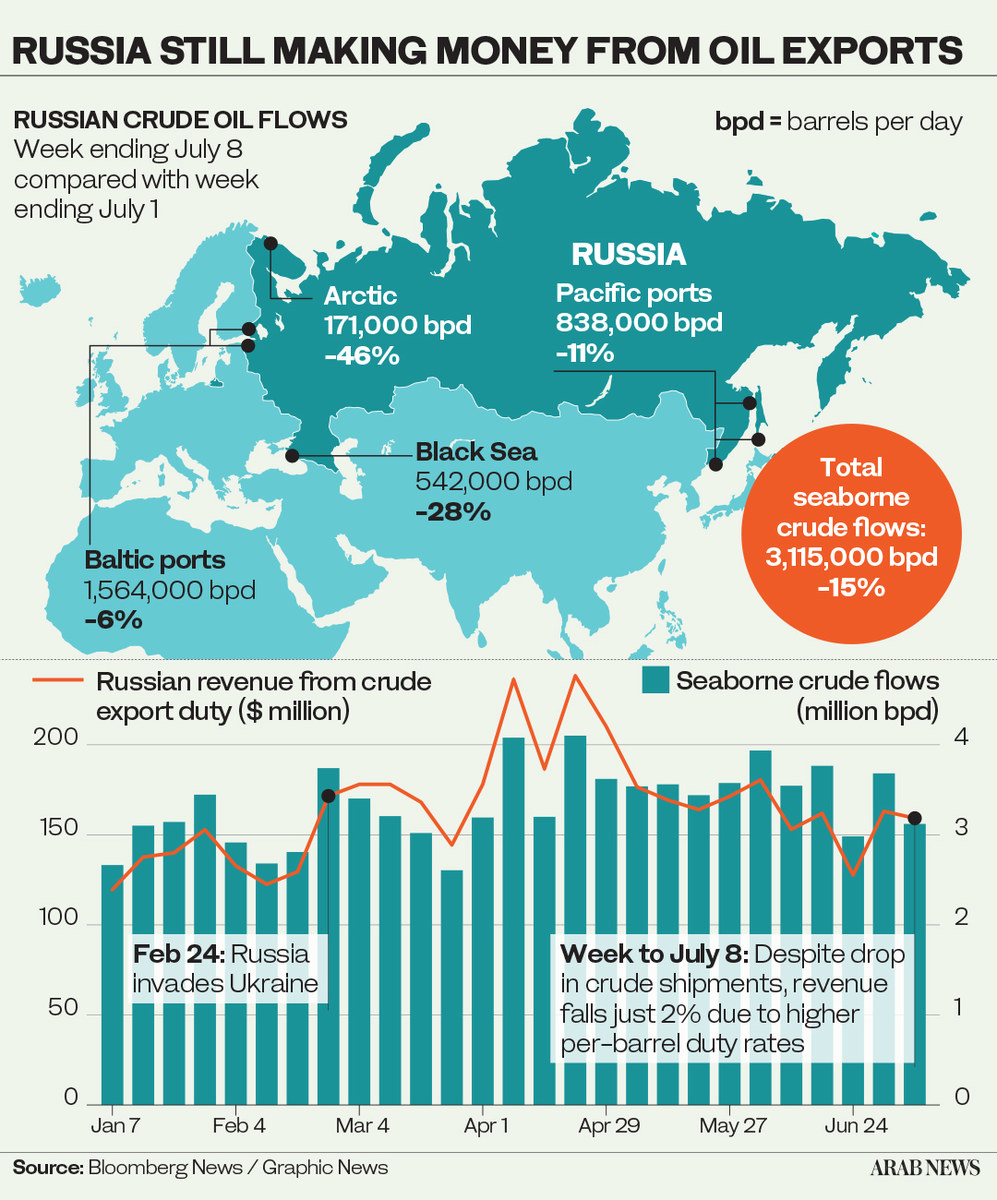

Still, Russian supplies in June, equivalent to about 1.77 million barrels per day (bpd), were below May’s record of close to 2 million bpd, a level analysts had expected to be maintained.

China imported 5.06 million tons from Saudi Arabia, or 1.23 million bpd, down from 1.84 million bpd in May and 30 percent below the level in June last year.

Year-to-date imports from Russia totalled 41.3 million tons, up 4 percent on the year but still trailing behind Saudi Arabia, which supplied 43.3 million tons.

China’s total crude oil imports sank in June to near a four-year low as rigid lockdowns to contain the spread of coronavirus reduced fuel demand.

The rise in imports from Russia also displaced supplies from Angola and Brazil.

The Customs data showed China imported 260,000 tons of Iranian crude oil last month, its fourth shipment of Iran oil since last December, confirming an earlier Reuters report.

Despite US sanctions on Iran, China has kept taking Iranian oil, usually passed off as supplies from other countries. These supplies, roughly 7 percent of China’s total crude oil imports, are facing competition from the growing Russian flows.

Customs reported zero imports from Venezuela. State oil firms have shunned purchases since late 2019 for fear of falling foul of secondary US sanctions.

Imports from Malaysia, often used as a transfer point in the past two years for oil originating from Iran and Venezuela, soared 126 percent year-on-year to 2.65 million tons. Below is the detailed breakdown of oil imports, with volumes in metric tons