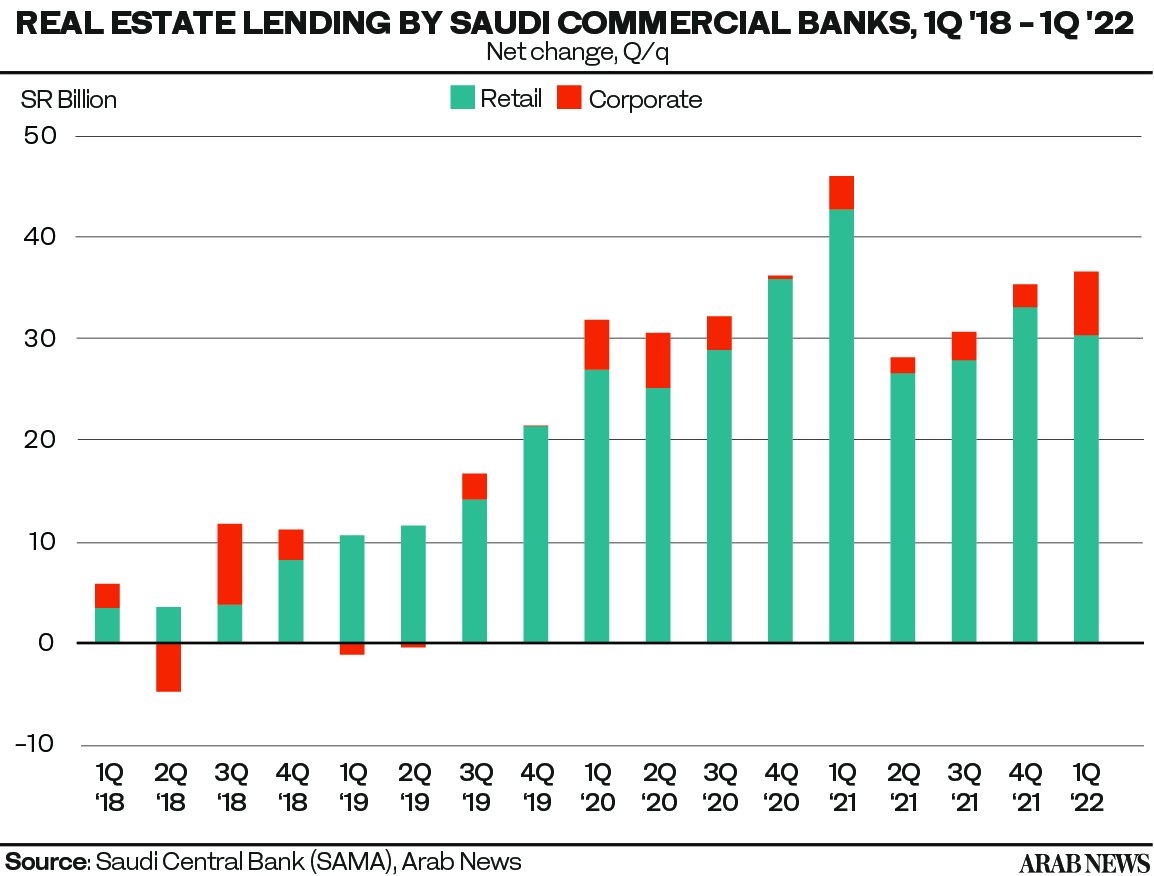

RIYADH: Saudi banks’ real estate lending witnessed a year-on-year increase of SR131 billion ($34.9 billion) to SR605.5 billion in the first quarter of 2022, from SR474.5 during the same period last year, according to latest figures released by the Saudi Central Bank, also known as SAMA.

Data compiled by Arab News shows a 27.6 percent year-on-year growth in total real estate lending, but the growth rate has slowed in comparison to 44.1 percent in the same period last year.

On a quarterly basis, the total loan credit increased by SR36.7 billion, or 6.4 percent in the first quarter of 2022 from SR568.9 billion in the fourth quarter of 2021. The loan credit has grown for the 15th consecutive month.

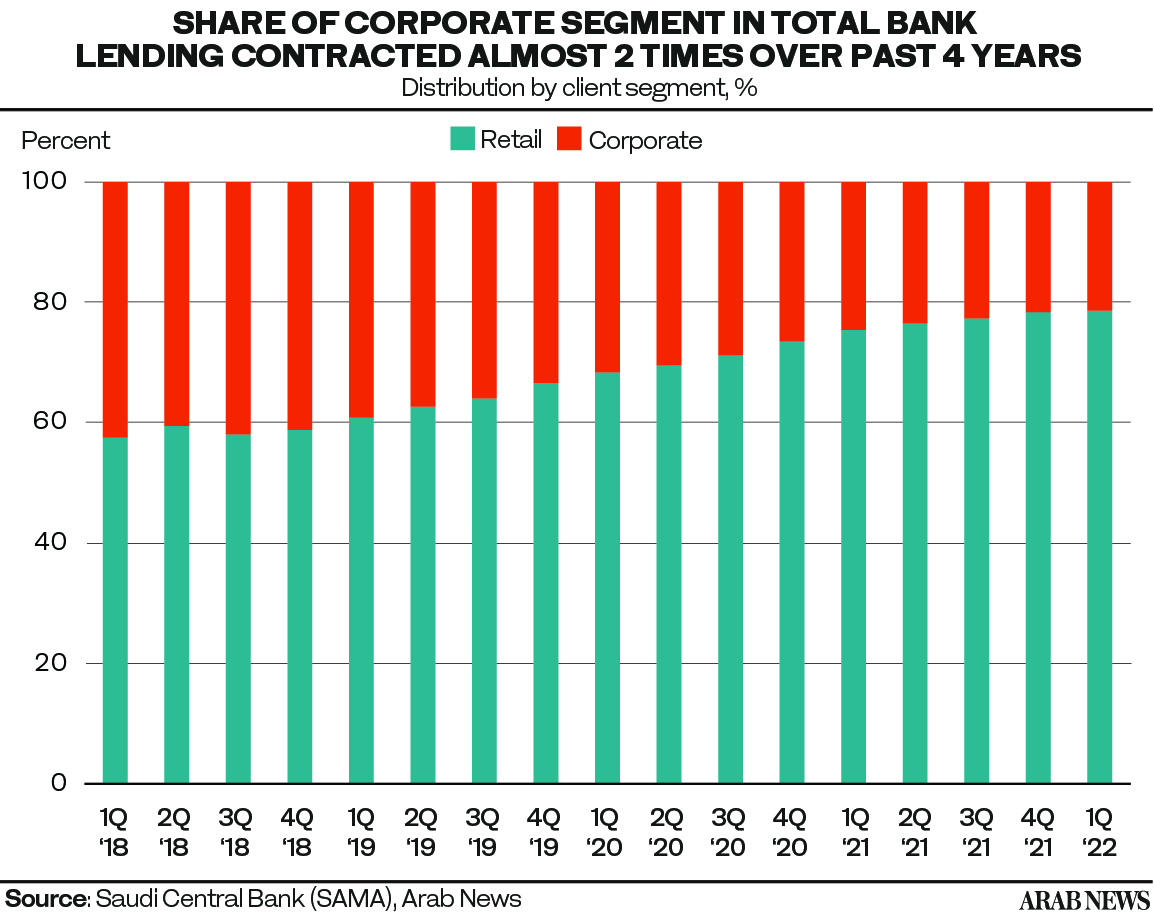

In the breakdown of real estate loans — 79 percent of the loans were issued to individuals, and the remaining 21 percent constituted corporate loans.

On an annual basis, the retail segment showed a 33 percent year-on-year increase while corporate loans grew 11 percent.

Additionally, the total value of real estate loans given to individuals witnessed a quarterly growth of 6.8 percent to SR476.2 billion, while corporate loans increased by 5.1 percent over the same period.

Over the past two years, the corporate loans experienced a decline of 10 percentage points in terms of their share in the total real estate lending by Saudi banks. It would be pertinent to mention here that any percentage lost in the corporate sector means a percentage gained in the retail segment.

Regardless, corporate loans seem to be on the rise — as they have grown 3.2 percentage points in this quarter. This is a 5.1 percent growth in the first quarter of 2022 against 1.9 percent growth recorded in the fourth quarter of 2021.

On the other hand, retail loans experienced a slight decline in growth rates, from 8 percent in the last quarter to 6.8 percent growth in the first quarter of 2022.

The outstanding balance of real estate loans provided by Saudi banks rose 6 percent quarter-on-quarter, SAMA data revealed.