RIYADH: Saudi Arabia’s oil giant Aramco has announced the start of its development of its Jafurah unconventional gas field in a press event on Monday.

The company’s chief executive officer, Amin Nasser, said the field, which it claims to be the largest in the world, could replace 500,000 barrels per day of oil production “at its peak.”

The project comes amid global pressure to transition to cleaner sources of energy, following major climate change-focused events in recent months.

“This breakthrough in unconventional gas could not come at a better time for the energy transition,” Aramco’s Nasser said, describing gas a “proven, reliable, and affordable energy source.”

He explained gas “emits around half of coal emissions in power generation.”

This project, Nasser added, contributes to the Kingdom’s broader environmental agenda, where the government said it wants to reach net-zero emissions by 2060.

Once completed, the unconventional gas field is expected to provide approximately 2 billion standard cubit feet per day of sales gas, Nasser said.

“We managed to reduce drilling cost by 70 percent and stimulation cost by 90 percent since the 2014 cost benchmark, while increasing well productivity six-fold compared with the start of the program,” he explained.

Nasser highlighted the Kingdom’s aim to generate electricity 50 percent from renewables, and 50 percent from gas.

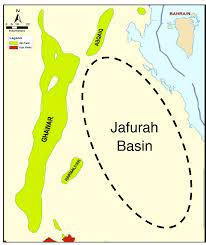

Jafurah basin

The Jafurah basin is the largest natural gas field in the Kingdom, stretching 170 kilometers by 100 kilometers, and is estimated to have 200 trillion standard cubic feet of gas.

The Jafurah project will not only aid the Kingdom’s environmental ambitions but will also support its petrochemicals industry.

“Its Ethan and LNG are highly valuable feedstocks for the Kingdom’s petrochemical’s industry,” the Aramco chief said

The field will also be able to produce about 425 million cubic feet of ethane per day, and about 550 thousand barrels per day of gas liquids and condensates.

Saudi Energy Minister Prince Abdulaziz bin Salman earlier said the Jafurah gas field will place the Kingdom third in the world in natural gas production by 2030.