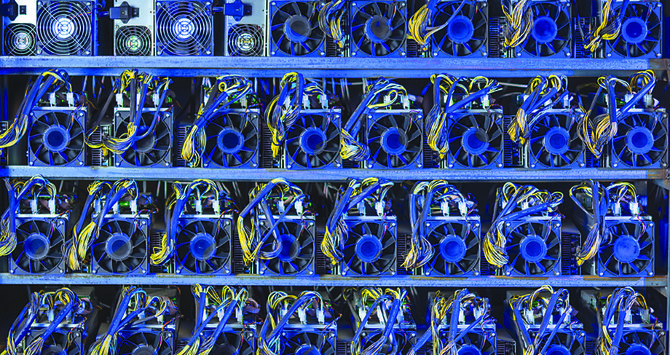

LONDON: Banks must set aside enough capital to cover losses on any bitcoin holdings in full, global banking regulators proposed on Thursday, in a “conservative” step that could prevent widescale use of the cryptocurrency by major lenders.

The Basel Committee on Banking Supervision, made up of regulators from the world’s leading financial centers, proposed a twin approach to capital requirements for crypto assets held by banks in its first bespoke rule for the nascent sector.

El Salvador has become the world’s first country to adopt bitcoin as legal tender even though central banks globally have repeatedly warned that investors in the cryptocurrency must be ready to lose all their money.

Major economies including China and the US have signalled in recent weeks a tougher approach, while developing plans to develop their own central bank digital currencies.

The Swiss-based Basel committee said in a public consultation paper that while bank exposures to crypto assets are limited, their continued growth could increase risks to global financial stability if capital requirements are not introduced.

Bitcoin and other cryptocurrencies are currently worth around $1.6 trillion globally, which is still tiny compared with bank holdings of loans, derivatives and other major assets.

Basel’s rules require banks to assign “risk weightings” to different types of assets on their books, with these totted up to determine overall capital requirements.

For crypto assets, Basel is proposing two broad groups.

The first includes certain tokenized traditional assets and stablecoins which would come under existing rules and treated in the same way as bonds, loans, deposits, equities or commodities.

This means the weighting could range between 0 percent for a tokenized sovereign bond to 1,250 percent or full value of asset covered by capital.

The value of stablecoins and other group 1 crypto-assets are tied to a traditional asset, such as the dollar in the case of Facebook’s proposed Diem stablecoin.

Nevertheless, given crypto assets are based on new and rapidly evolving technology like blockchain, this poses a potentially increased likelihood of operational risks which need an “add-on” capital charge for all types, Basel said.

The second group includes cryptocurrencies like Bitcoin that would be subject to a new “conservative prudential treatment” with a risk-weighting of 1,250 percent because of their “unique risks.”

Bitcoin and other cryptocurrencies are not linked to any underlying asset.

Under Basel rules, a 1,250 percent risk weight translates into banks having to hold capital at least equal in value to their exposures to Bitcoin or other group 2 crypto assets.

“The capital will be sufficient to absorb a full write-off of the crypto asset exposures without exposing depositors and other senior creditors of the banks to a loss,” it added.

Few other assets that have such conservative treatment under Basel’s existing rules, and include investments in funds or securitizations where banks do not have sufficient information about their underlying exposures.

The value of Bitcoin has swung wildly, hitting a record high of around $64,895 in mid-April, before slumping to around $36,834 on Thursday.

Banks’ appetite for cryptocurrencies varies, with HSBC saying it has no plans for a cryptocurrency trading desk because the digital coins are too volatile. Goldman Sachs restarted its crypto trading desk in March.

Basel said that given the rapidly evolving nature of crypto assets, a further public consultation on capital requirements is likely before final rules are published.

Central bank digital currencies are not included in its proposals.

Bank regulators plan capital rule for bitcoin

https://arab.news/y8pyq

Bank regulators plan capital rule for bitcoin

- Crypto assets could increase risk to global financial stability if capital requirements are not met

Real Estate Registry signs 10 agreements at forum in Riyadh

RIYADH: The Real Estate Registry concluded its participation in the Real Estate Future 2026, as a partner of the forum, with a distinguished presence that included the launch of its business portal, the signing of 10 agreements and memoranda of understanding with entities from the public and private sectors, the organization of specialized workshops, and the awarding of the Gold Award at the Real Estate Excellence Awards.

During his participation in the forum, the CEO of the firm, Mohammed Al-Sulaiman, reviewed the latest developments in real estate registration in the Kingdom in a keynote speech, highlighting the pivotal role of the Real Estate Registry in building a unified and reliable system for data. He also announced the launch of the national blockchain infrastructure, which aims to enable the microcoding of real estate assets, enhance transparency, expand investment opportunities, and support innovative ownership models within a reliable regulatory framework.

On the sidelines of the forum, Al-Sulaiman met with Nigeria’s Minister of Housing and Urban Development, Ahmed Dangiwa. During the meeting, they discussed areas of joint cooperation, exchanged experiences and advice on shaping the future of the real estate sector, and reviewed best practices in implementing real estate registration systems that enhance reliability and improve the efficiency of property registration.

efficiency of property registration systems.

The Real Estate Registry’s participation included organizing three specialized workshops that focused on the role of geospatial technologies in identifying ownership, enhancing transparency, and improving the quality of real estate data.

The workshop “Empowering the Real Estate Registry for the Business Sector” reviewed digital solutions that enable the business sector to manage its real estate assets more efficiently and enhance governance and technical integration. The workshop “From Off-Plan Sales to Title Deed” focused on the journey of documenting real estate ownership and the role of the registry in linking the stages of development and documentation within an integrated digital system.

On the sidelines of the forum, the Real Estate Registry signed 10 agreements and memorandums of understanding, including a deal with Yasmina Information Technology Co. to utilize real estate data in developing smarter insurance solutions that support the real estate sector and enhance service reliability.

Partnerships were also signed with Haseel, NewTech, and Sahl, as well as HissaTech and Droub, to develop innovative digital solutions in property ownership, fractional ownership, and asset tokenization, as well as real estate finance and investment within a trusted regulatory framework.

Further collaborations included an MoU with ROSHN Group, an agreement with the Saudi Water Authority to enable data integration and quality enhancement, an agreement with the Saudi National Bank, and a partnership with Saudi Post to link the national address with the property registry as a unified geospatial identifier supporting data accuracy and integration.

The registry’s participation was crowned with the Golden Award at the Real Estate Excellence Awards in the category of Excellence in Property Documentation, in recognition of its role in building a model based on transparency, accuracy, and speed, as well as advanced digital technologies and specialized legal expertise, contributing to rights protection and increasing the sector’s attractiveness.

The Real Estate Registry emphasized that its participation reflects its continued role as a key enabler of the real estate sector, a trusted data source, and an active partner in driving digital transformation, enhancing market efficiency, and building investor and financier confidence, in line with Saudi Arabia’s Vision 2030 objectives for a fully integrated and sustainable digital real estate ecosystem.