WASHINGTON: Senate leaders and moderate Democratic Sen. Joe Manchin struck a deal over emergency jobless benefits, breaking a logjam that had stalled the party’s showpiece $1.9 trillion COVID-19 relief bill.

The compromise, announced by the West Virginia lawmaker and a Democratic aide late Friday, seemed to clear the way for the Senate to begin a climactic, marathon series of votes and, eventually, approval of the sweeping legislation.

The overall bill, President Joe Biden’s foremost legislative priority, is aimed at battling the killer pandemic and nursing the staggered economy back to health. It would provide direct payments of up to $1,400 to most Americans and money for COVID-19 vaccines and testing, aid to state and local governments, help for schools and the airline industry and subsidies for health insurance.

Shortly before midnight, the Senate began to take up a variety of amendments in rapid-fire fashion. The votes were mostly on Republican proposals virtually certain to fail but designed to force Democrats to cast politically awkward votes. It was unclear how long into the weekend the “vote-a-rama” would last.

More significantly, the jobless benefits agreement suggested it was just a matter of time until the Senate passes the bill. That would ship it back to the House, which was expected to give it final congressional approval and whisk it to Biden for his signature.

White House press secretary Jen Psaki said Biden supports the compromise on jobless payments.

Friday’s lengthy standoff underscored the headaches confronting party leaders over the next two years — and the tensions between progressives and centrists — as they try moving their agenda through the Congress with their slender majorities.

Manchin is probably the chamber’s most conservative Democrat, and a kingmaker in the 50-50 Senate. But the party can’t tilt too far center to win Manchin’s vote without endangering progressive support in the House, where they have a mere 10-vote edge.

Aiding unemployed Americans is a top Democratic priority. But it’s also an issue that drives a wedge between progressives seeking to help jobless constituents cope with the bleak economy and Manchin and other moderates who have wanted to trim some of the bill’s costs.

Biden noted Friday’s jobs report showing that employers added 379,000 workers — an unexpectedly strong showing. That’s still small compared to the 10 million fewer jobs since the pandemic struck a year ago.

“Without a rescue plan, these gains are going to slow,” Biden said. “We can’t afford one step forward and two steps backwards. We need to beat the virus, provide essential relief, and build an inclusive recovery.”

The overall bill faces a solid wall of GOP opposition, and Republicans used the unemployment impasse to accuse Biden of refusing to seek compromise with them.

“You could pick up the phone and end this right now,” Sen. Lindsey Graham, R-S.C., said of Biden.

But in an encouraging sign for Biden, a poll by The Associated Press-NORC Center for Public Affairs Research found that 70% of Americans support his handling of the pandemic, including a noteworthy 44% of Republicans.

The House approved a relief bill last weekend that included $400 weekly jobless benefits — on top of regular state payments — through August. Manchin was hoping to reduce those costs, asserting that level of payment would discourage people from returning to work, a rationale most Democrats and many economists reject.

As the day began, Democrats asserted they’d reached a compromise between party moderates and progressives extending emergency jobless benefits at $300 weekly into early October.

That plan, sponsored by Sen. Tom Carper, D-Delaware, also included tax reductions on some unemployment benefits. Without that, many Americans abruptly tossed out of jobs would face unexpected tax bills.

But by midday, lawmakers said Manchin was ready to support a less generous Republican version. That led to hours of talks involving White House aides, top Senate Democrats and Manchin as the party tried finding a way to salvage its unemployment aid package.

The compromise announced Friday night would provide $300 weekly, with the final check paid on Sept. 6, and includes the tax break on benefits.

During the “vote-a-rama,” the Senate narrowly passed an amendment from Sen. Rob Portman, R-Ohio, that would have extended the $300 unemployment insurance benefit to July 18. But Portman’s victory was short-lived and the proposal was canceled out when the chamber subsequently passed the unemployment insurance proposal worked out by the Democrats.

Before the unemployment benefits drama began, senators voted 58-42 to kill a top progressive priority, a gradual increase in the current $7.25 hourly minimum wage to $15 over five years.

Eight Democrats voted against that proposal, suggesting that Sen. Bernie Sanders, I-Vermont, and other progressives vowing to continue the effort in coming months will face a difficult fight.

That vote began shortly after 11 a.m. EST and was not formally gaveled to a close until nearly 12 hours later as Senate work ground to a halt amid the unemployment benefit negotiations.

Senate Minority Leader Mitch McConnell chided Democrats, calling their daylong effort to work out the unemployment amendment a “spectacle.”

“What this proves is there are benefits to bipartisanship when you’re dealing with an issue of this magnitude,” McConnell said.

Republicans criticized the overall relief bill as a liberal spend-fest that ignores that growing numbers of vaccinations and signs of a stirring economy suggest that the twin crises are easing.

“Democrats inherited a tide that was already turning.” McConnell said.

Democrats reject that, citing the job losses and numerous people still struggling to buy food and pay rent.

“If you just look at a big number you say, ‘Oh, everything’s getting a little better,’” said Senate Majority Leader Chuck Schumer, D-N.Y. “It’s not for the lower half of America. It’s not.”

Friday’s gridlock over unemployment benefits gridlock wasn’t the first delay on the relief package. On Thursday Sen. Ron Johnson, R-Wisconsin, forced the chamber’s clerks to read aloud the entire 628-page relief bill, an exhausting task that took staffers 10 hours and 44 minutes and ended shortly after 2 a.m. EST.

Democrats made a host of other late changes to the bill, designed to nail down support. They ranged from extra money for food programs and federal subsidies for health care for workers who lose jobs to funds for rural health care and language assuring minimum amounts of money for smaller states.

In another late bargain that satisfied moderates, Biden and Senate Democrats agreed Wednesday to make some higher earners ineligible for the direct checks to individuals.

Senate Dems strike jobless aid deal, relief bill OK in sight

https://arab.news/gx5dz

Senate Dems strike jobless aid deal, relief bill OK in sight

- The overall bill, President Joe Biden’s foremost legislative priority, is aimed at battling the killer pandemic and nursing the staggered economy back to health

IsDB Group annual meetings conclude with 85 agreements worth over $8bn

RIYADH: As many as 85 agreements worth over $8 billion were signed across diverse sectors during the recently concluded annual meetings of the Islamic Development Bank Group.

This stands in contrast to the last year’s meetings, which recorded only 77 financing agreements, totaling $5.4 billion.

Speaking at the concluding press briefing, IsDB Chairman Mohammed bin Sulaiman Al-Jasser disclosed the signing of financing agreements between the group's institutions, 38 member countries, and 22 international financial institutions, covering diverse projects.

He lauded the continuous backing of the group by Saudi leadership, citing it as a testament to the Kingdom’s commitment to global cooperation and advancement.

Highlighting the significance of this year’s gatherings, the chairman mentioned that they included meetings of the IsDB Group’s councils and over 27 consequential side events.

These sessions brought together distinguished intellectuals, experts, and researchers from various developmental domains, with a total of more than 3,750 participants.

Notably, representatives from approximately 55 international and regional partner organizations, including 23 institutional heads, were present.

Detailing the Private Sector Forum’s activities, Al-Jasser noted the participation of over 1,500 delegates from more than 60 nations. The forum, comprising 17 events, facilitated the signing of over 60 agreements amounting to approximately $6.5 billion.

Over the past 50 years, the IsDB has played a significant role in progress by funding developmental projects exceeding a total value of $182 billion, according to the chairman.

These projects have encompassed diverse vital areas, ranging from basic infrastructure and agriculture to various strategic sectors such as health, education and energy, as well as trade, and Islamic finance.

He emphasized that the discussions and exchanges during the meetings provided valuable insights and success stories crucial for fostering sustainable social and economic development. He affirmed that the outcomes would transform the IsDB’s future initiatives and strategic partnerships.

The issuance of the “Golden Jubilee Declaration” by the IsDB Board of Governors, acknowledging the bank’s pivotal role and achievements, was also highlighted by Al-Jasser.

The declaration outlined key future priorities, including enhancing governance, expanding concessional financing, and advancing Islamic finance and cooperation in Southern countries.

In conclusion, Al-Jasser reiterated the theme of the annual meetings – “Cherishing our Past, charting our Future: Originality, Solidarity and Prosperity” – underscoring its significance as a guiding principle for the IsDB’s trajectory.

He emphasized the organization’s commitment to drawing inspiration from past achievements, learning from historical lessons, and leveraging current challenges and opportunities to forge a brighter future.

Last year, the IsDB Group announced several projects with 24 member countries aimed at addressing pressing challenges hindering growth in the Global South, with a focus on health, agriculture, and food security, as well as initiatives targeting small and medium enterprises, education, and humanitarian assistance, among others.

Saudi’s Ma’aden completes 10% acquisition of Brazil’s Vale Base Metals

RIYADH: Saudi Arabian Mining Co., also known as Ma’aden, has announced that it has completed the 10 percent acquisition of Brazil’s Vale Base Metals.

Ma’aden, which is majority-owned by the Public Investment Fund, said that its joint venture, Manara Minerals Investment Co., finalized the purchase, according to a Tadawul statement.

This move will boost the growth of the Kingdom’s mining sector in line with the objectives of the Vision 2030 initiative to diversify the Saudi economy away from oil.

It follows Ma’aden’s announcement in July 2023 that its joint venture had signed a binding agreement to acquire the stake for $26 billion as part of a strategy to invest in global mining assets.

“This investment is an important milestone for Manara Minerals. Through our investment in VBM, we are increasing the supply of strategic minerals and enabling Saudi Arabia to play a growing role in the global energy transition supply chains,” Robert Wilt, executive director of Manara Minerals and CEO of Ma’aden, said at the time in a statement.

“Our proactive approach is a step further towards Saudi Vision 2030. It will support local industrial development, create jobs across the Kingdom, and strengthen the position of the mining sector as the third pillar of the economy,” Wilt added at the time.

Egypt’s net foreign assets deficit shrinks $17.8bn in March

CAIRO: Egypt’s net foreign assets deficit shrank $17.8 billion in March, its second month of decline, central bank data showed, after remittances, foreign portfolio investment and a $5 billion payment from the UAE poured into the country, according to Reuters.

Egypt received a second $5 billion payment from the UAE in early March for a land development on the Mediterranean coast after an initial payment in February.

On March 6, it devalued its currency and announced an $8 billion agreement with the International Monetary Fund, triggering a flood of portfolio investments and remittances from workers abroad.

The March NFA deficit shrank to 200 billion Egyptian pounds ($4.18 billion) from 679 billion pounds in February.

The March NFA figures does not reflect an $820 million first instalment in early April under the expanded IMF financial support program.

Commercial banks’ foreign assets jumped by $7.4 billion in March while their liabilities slid by $3 billion, according to Reuters calculations based on central bank data and taking account of the March 6 devaluation.

Egypt has allowed its currency to weaken to 47.8 pounds to the dollar since it signed the IMF agreement after having left it fixed at 30.85 to the dollar for a year.

Central bank foreign assets rose by $3.5 billion while its foreign liabilities decreased by $3.9 billion.

NFAs represent both central bank and commercial bank assets held by non-residents, minus their liabilities.

The $17.4 billion reduction in the deficit followed a $7.04 billion reduction in February.

Before that, the central bank had been drawing on the NFAs over the past two and a half years to help support the country’s currency. In September 2021, NFAs stood at a positive $3.9 billion.

Oil Updates – prices fall for a 3rd day as Middle East ceasefire hopes rise

NEW YORK/SINGAPORE: Oil prices fell for a third day on Wednesday amid increasing hopes of a ceasefire agreement in the Middle East and rising crude inventories and production in the US, the world’s biggest oil consumer

Brent crude futures for July fell 70 cents, or 0.8 percent, to $85.63 a barrel by 7:56 a.m. Saudi time. US West Texas Intermediate crude for June declined 75 cents, or 0.9 percent, to $81.18 per barrel.

Expectations that a ceasefire agreement between Israel and Hamas could be in sight, following a renewed push led by Egypt to revive stalled negotiations between the two, pushed oil prices lower.

“The potential for a ceasefire agreement between Israel and Hamas has eased concerns of an escalation of the conflict and any possible disruptions to supply,” ANZ analysts said in a note on Wednesday.

However, Israeli Prime Minister Benjamin Netanyahu vowed on Tuesday to go ahead with a long-promised assault on the southern Gaza city of Rafah, whatever the response by Hamas to the latest proposals for a halt to the fighting and a return of Israeli hostages.

Also pressuring prices were swelling US crude oil inventories and rising crude supply.

US production rose to 13.15 million barrels per day in February from 12.58 million bpd in January, its biggest monthly increase in about 3-1/2 years, the Energy Information Administration said on Tuesday.

“Continued signs of inflation also raised concerns about demand for crude oil. This comes ahead of the US driving season, where demand for gasoline rises strongly,” analysts at ANZ said.

Keeping oil from slipping further, output by the Organization of the Petroleum Exporting Countries was seen falling by 100,000 bpd in April to 26.49 million bpd, a Reuters survey found on Tuesday.

The survey reflected lower exports from Iran, Iraq and Nigeria against a backdrop of ongoing voluntary supply cuts by some members agreed with the wider OPEC+ alliance.

Saudi Arabia’s real GDP rises by 1.3% in first quarter: GASTAT

RIYADH: Saudi Arabia’s real gross domestic product saw a 1.3 percent rise in the first three months of this year compared to the previous quarter, official data showed.

According to the General Authority for Statistics, this rise in real GDP was propelled by oil and non-oil activities which increased by 2.4 percent and 0.5 percent during the period, respectively.

On the other hand, government activities in the Kingdom witnessed a decline of 1 percent in the first quarter of this year, compared to the last quarter of 2023.

However, GASTAT revealed that Saudi Arabia’s real GDP decreased by 1.8 percent in the first quarter of 2024 compared to the same period of the preceding year.

The authority attributed this decline to a drop in oil activities, which decreased by 10.8 percent year-on-year in the first quarter. The fall in oil exports stemmed from the Kingdom’s decision to curtail crude output, in line with an agreement by the Organization of the Petroleum Exporting Countries and its allies, collectively known as OPEC+.

In a bid to maintain market stability, Saudi Arabia decreased its oil output by 500,000 barrels per day in April 2023, a measure that has now been extended until December 2024.

Meanwhile, non-oil activities in the Kingdom witnessed a 2.8 percent year-on-year increase in the first quarter, with government activities experiencing a growth of 2 percent during the same period.

Strengthening the non-oil private sector is crucial for Saudi Arabia, as the Kingdom is steadily reducing its dependence on oil, aligned with the economic diversification efforts outlined in Vision 2030.

In March, another report released by GASTAT revealed that Saudi Arabia’s GDP decreased by 0.8 percent in 2023, compared to 2022.

On the other hand, the Kingdom’s non-oil activities demonstrated significant growth of 4.4 percent in 2023 compared to the previous year.

In 2023, the Kingdom’s government activities also witnessed a rise of 2.1 percent compared to 2022.

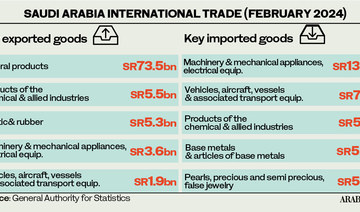

GASTAT releases International Trade report

On April 30, GASTAT also released its international trade report, which indicated that Saudi Arabia’s non-oil exports, including re-exports, declined 13.7 percent to SR272.37 billion ($72.62 billion) in 2023 compared to 2022.

The analysis revealed that the Kingdom’s overall merchandise exports also fell by 22.2 percent year-on-year in 2023 to SR1.2 trillion, driven by a 24.3 percent decrease in oil exports during the period.

Consequently, the percentage of oil exports out of total exports decreased to 77.3 percent in 2023 from 79.5 percent in 2022.

On the other hand, Saudi Arabia’s imports rose by 9 percent in 2023 to SR776 billion compared to the year-ago period.

The report also revealed that Saudi Arabia’s trade balance surplus stood at SR424 billion in 2023.

China was Saudi Arabia’s most important trading partner in 2023, with exports to the Asian nation amounting to SR199.3 billion or 16.6 percent of the total exports.

Japan and India closely followed China with $121.83 billion and 113.35 billion, respectively.

According to GASTAT, South Korea, the US, and the UAE, as well as Bahrain, Taiwan and Malaysia were the other countries that ranked in the top 10 destinations for Saudi Arabia’s exports.

On the other hand, imports from China to Saudi Arabia amounted to SR162.55 billion in 2023, followed by the US and the UAE with SR70.50 billion and SR50.05 billion, respectively.

India, Germany, and Japan, along with Switzerland, South Korea, and Italy, were the other countries that ranked in the top 10 countries for imports.

The report revealed that the Jeddah Islamic Port topped the list of terminals through which goods reached the Kingdom in 2023 at a value of SR227.38 billion, corresponding to 29.3 percent of the total imports.