RIYADH/LONDON: The Future Investment Initiative (FII), an international platform for debate between global leaders, investors and innovators, kicked off in Saudi Arabia on Wednesday with a host of high-profile speakers brought together under the theme “The Neo-Renaissance.”

Opening remarks at the King Abdul Aziz International Conference Center (KAICC) came from Yasir Al-Rumayyan, Governor of Saudi Arabia's Public Investment Fund (PIF) and FII Institute Chairman.

Other speakers include Jamaican eight-time Olympic gold medalist Usain Bolt, Matteo Renzi, former prime minister of Italy and Kevin Rudd, former Australian prime minister.

Follow the coverage below (all times GMT):

18:40 - FII CEO Richard Attias brings day one to a close, and that ends our first day coverage here at Arab News. Remember to come back to www.arabnews.com/fii2021 for coverage of the second day's discussions.

18:30 - ICYMI: Saudi Arabia has revamped over half of the 400 foreign direct investment (FDI) regulations, as foreign investment rose in 2020 compared to 2019, said Minister of Investment Khalid bin Abdulaziz Al-Falih.

“We have performed better than most, and ultimately, investors trust a government that provides security to them and the population. Saudi Arabia handled it better than most, as investors want to trust governments that look after them. Saudi Arabia, through our leadership, has shown that,” he stated. READ MORE HERE.

18:20 - The value of mergers and acquisitions declined globally by 5% year-on-year to $3.6 trillion in 2020, the lowest level since 2017, according to studies. But two sectors where there was still significant activity were technology and pharma.

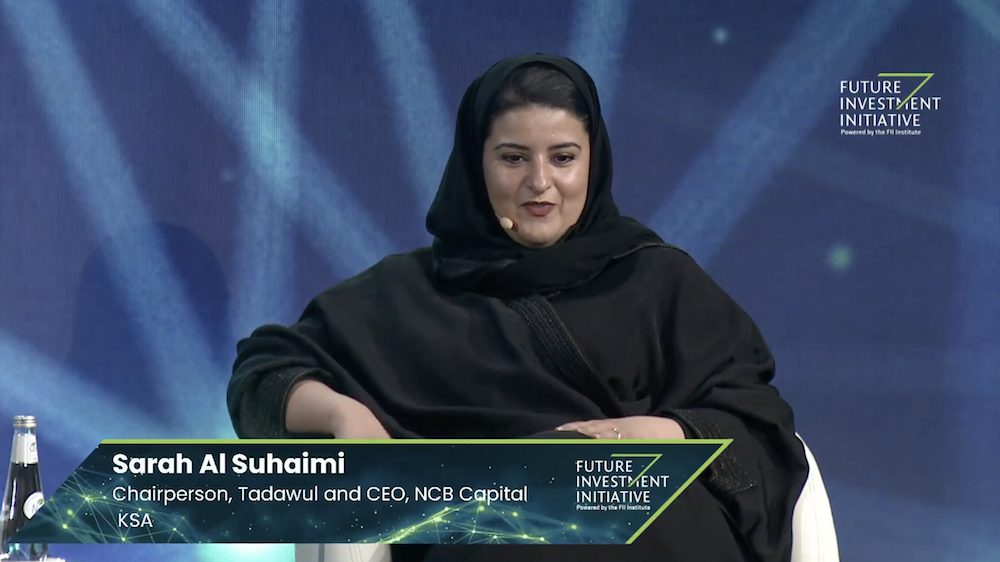

Sarah Al-Suhaimi, chairwoman at Tadawul and CEO of NCB Capital in Saudi Arabia joins the panel to discuss a blueprint for financial leaders assessing future market opportunities and public-private partnerships needed to ensure sustainable growth.

18:15 - ICYMI: The COVID-19 pandemic has led to the restructuring of the global health care system, with an accelerated shift in focus away from hospitals to providing more facilities to homes, speakers told delegates at the Future Investment Initiative (FII) conference place in Riyadh.

Dr. Harsh Vardhan, India’s Minister of Health and Family Welfare, said another health care trend was a closer collaboration between the government and citizens, where all elements of society must work together to ensure the safety and wellness of the whole country. READ MORE HERE.

18:05 - We've reached the penultimate panel of day one of the FII, which looks at the "new pathways" to global growth, after the pandemic resulted in a steep rise in unemployment and sharp contraction in specific segments of the economy, with input from CEO of Bahrain's Mumtalakat Holding Company Khalid Al-Rumaihi and Senegal's economy minister Amadou Hott.

17:55 - Prince Abdulaziz bin Salman, Saudi Arabia’s Minister of Energy, said that Saudi Arabia is working with so many countries on green hydrogen and blue hydrogen.

“Easily and simply, I could say, that we will be pioneering more of that blue hydrogen and green hydrogen,” Prince Abdulaziz said. READ MORE HERE.

17:40 - Saudi Arabian finance minister Mohammed bin Abdullah Al-Jadaan joins his Bahraini counterpart Shaikh Salman bin Khalifa Al-Khalifa to discuss how the Gulf nations are adapting to the challenges of economic diversification posed by the COVID-19 pandemic.

17:35 - ICYMI: Saudi Arabia is cultivating the trust of global investing institutions as it seeks to attract foreign funds into the Kingdom’s ambitious development plans, Khalid Al-Falih, the Minister of Investment, told the Future Investment Initiative (FII) summit. READ MORE HERE.

17:20 - Amin Nasser, President and CEO of Saudi Aramco and Abdullah Amer Al-Swaha, Saudi Arabia's Minister of Communications and IT join Dr. Thomas A. Kennedy, Executive Chairman, Board of Directors, Raytheon Technologies to discuss the future of global technology policy.

17:05 - As we look ahead into 2021 and beyond, where will the greatest opportunities be to invest in assets with high conformity to environmental, social and governance (ESG) principles? Our next panel, which include a NEOM investor and the CEOs of Nasdaq and London Stock Exchange, are discussing their predictions.

16:45 - Our next panel is Playing to Win: How will global investment drive the future of the sports industry? And the panelists are discussing how Saudi Arabia was able to mitigate the effects of the COVID-19 pandemic to continue hosting world-class sporting events — such as the Dakar Rally, FIA Formula E and golf's Saudi International.

Alejandro Agag, CEO of ExtremeE (Pictured, R), said the reason this can happen in the Kingdom is because “everything works in Saudi Arabia... nothing is impossible here.”

Moderator: Richard Attias, CEO, FII Institute

• Bader Alkadi, Advisor to the Minister of Sport, Saudi Arabia

• Dr. Amina Mohamed, Cabinet Secretary for Sports, Culture and Heritage of the Republic of Kenya

• Alejandro Agag, Founder and CEO, Extreme E, UK

• Usain Bolt, Eight-Time Olympic Gold Medalist, Jamaica

• Jean Todt, President, Fédération Internationale de l’Automobile, France

The panel also included a brief appearance from eight-time Olympic gold medalist Usain Bolt who spoke about athletes having to compete in the COVID-19 era without spectators.

------

------

16:00 - Prince Abdulaziz bin Salman, Saudi Arabia's Minister of Energy, first has a discussion with Palki Sharma Upadhyay, the executive editor at WION, which precedes a panel discussion on how the energy sector can be part of and power the post-COVID-19 crisis recovery.

15:50 - ICYMI: Yasir Al-Rumayyan, governor of Saudi Arabia’s Public Investment Fund (PIF), is concerned about the different valuation of financial and other assets that has been a feature of markets affected by the coronavirus (COVID-19) pandemic. READ MORE HERE.

15:40 - Next up, Peggy Johnson, CEO of Magic Leap, is in discussion with Turqi Al-Nowaiser of Saudi Arabia's Public Investment Fund about the expected investment ($72.8 billion by 2024) in AR/VR and how it will revolutionize the sector.

15:30 - ICYMI: Yasir Al-Rumayyan, governor of the Public Investment Fund (PIF), said that the sovereign wealth fund is looking to invest not only in large companies but in the entire spectrum of technology. READ MORE HERE.

15:15 - Next up, our panelists will discuss how work will change in the post-COVID era, and how the pandemic and its aftermath will influence the way CEOs reshape their companies to provide stability and hope to a workforce living in a new social, political, and economic reality.

Moderator: Edie Lush, Executive Editor, Hub Culture, UK

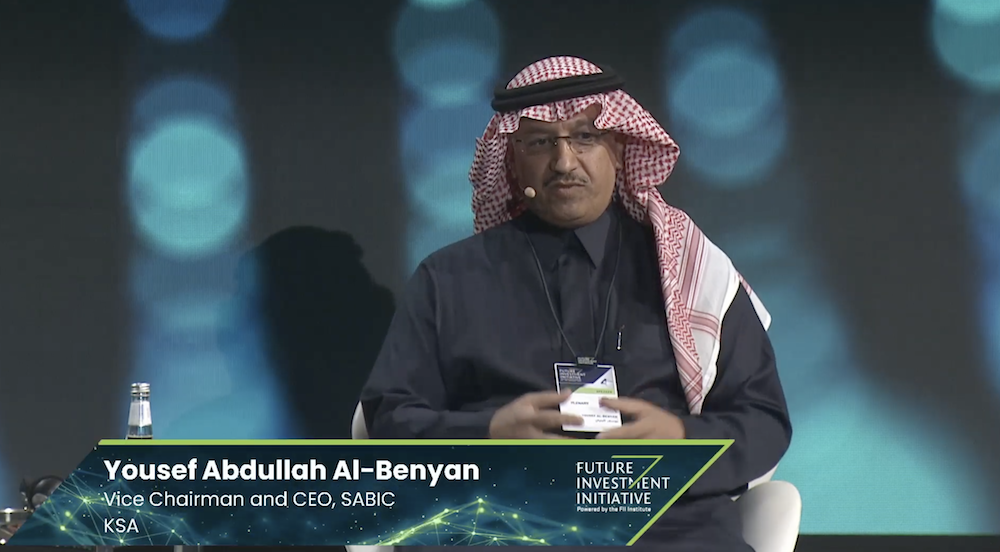

• Yousef Abdullah Al-Benyan, Vice Chairman and CEO, SABIC, Saudi Arabia (pictured)

• Patrice Caine, Chairman & CEO, Thales Group, France

• Todd Gibbons, CEO, BNY Mellon, USA

• Daniel S. Loeb, Founder and CEO, Third Point LLC, USA

• Andrew N. Liveris, Special Advisor, Public Investment Fund, Saudi Arabia

15:05 - Next is a brief discussion between Lameen Abdul-Malik, Nobel Peace Prize 2005 and Head of THINK and Anand Mahindra, chairman of the Mahindra Group in India.

-----

-----

14:45 - The health of nations: A CEO’s guide to investing in the next decade of global health is our third panel.

Some context for you: The global healthcare market is expected to surpass $11 trillion by 2022, while Deloitte data shows funding for health technology innovators surpassed $7.4 billion in 2019 and continues to rise.

So how can business and government expand access to healthcare, train healthcare workers, remove regulatory barriers, and encourage investment in advanced health technologies?

Moderator: Dr. Peter H. Diamandis, Founder and Executive Chairman, XPRIZE Foundation, Board of Trustees Member, FII Institute, USA

• Dr. Harsh Vardhan, Minister of Health and Family Welfare, Science and Technology, Earth Sciences, India

• Dr. Bernd Montag, CEO, Siemens Healthineers, Germany

• Dr. Ali Parsadoust, Founder and CEO, Babylon Health, UK

14:30 - Kirill Dmitriev of the Russian Direct Investment Fund speaks briefly about the fund's achievements last year - including the Sputnik V vaccine - and how looking ahead to 2021, it wants to work closer with Saudi Arabia on transforming the Kingdom into a leading investment destination and continue to work on oil price regulation.

14:00 - Our second panel discussion looks at how, with lower oil prices and costs of the pandemic taking their toll, global business leaders and policymakers will strengthen investment and trade partnerships in the midst of new geopolitical realities and economic possibilities.

Moderator: Fatima Daoui, Anchor Business News, Al Arabiya

H.E. Khalid bin Abdulaziz Al-Falih, Minister of Investment, Saudi Arabia

• H.E. Dr. Rania Al-Mashat, Minister of International Cooperation, Egypt

• H.E. Sultan Ahmed bin Sulayem, Group Chairman and CEO, DP World, UAE

• Lord Grimstone of Boscobel, Kt, Minister for Investment, Department for International Trade and the Department for Business, Energy & Industrial Strategy, UK

• Eric I. Cantor, Vice Chairman and Managing Director, Moelis & Company, USA

13:45 - PHOTOS: 200 seats have been allocated for FII guests in the plenary hall, as well as for the media in the event's media center.

13:20 - ICYMI: The fifth edition of the Future Investment Initiative (FII) will take place from Oct. 25th to 28th, Richard Attias, CEO of organizing body the FII Institute, confirmed on Wednesday. READ MORE HERE.

13:10 - The first panel discussion of the day asks how the global investment community can leverage the economic downturn brought about by the COVID-19 pandemic, in order to build a stronger, more sustainable future for all. Panelists for this talk are:

Moderator: David Rubenstein, Co-Founder and Co-Executive Chairman, The Carlyle Group, USA

• H.E. Yasir Al Rumayyan, Chairman, FII Institute and Governor and Board Member, Public Investment Fund, Saudi Arabia

• Ray Dalio, Co-Chairman and CIO, Bridgewater Associates, USA

• Laurence D. Fink, Chairman and CEO, BlackRock, USA

• Dr. Thomas P. Gottstein, CEO, Credit Suisse Group, Switzerland

• David M. Solomon, Chairman and CEO, The Goldman Sachs Group, USA

13:00 - The opening remarks from Yasir Al Rumayyan, Chairman of the FII Institute and governor and board member of Saudi Arabia's Public Investment Fund, will get us started on day one.

12:45 - Follow Arab News' special coverage of this year’s FII, at our dedicated online section.

12:30 - Jamaican eight-time Olympic gold medalist Usain Bolt is one of the star speakers lined up to take part in the event, you can hear him at 7 p.m. KSA (4 p.m. GMT)...

12:15 - Hello, and welcome to the first day of coverage of the Future Investment Initiative (FII) - guests and media participants attending the two-day event have limited access due to the exceptional circumstances of the coronavirus disease (COVID-19) pandemic.