ISLAMABAD: Federal Minister for Finance and Revenue Muhammad Aurangzeb held talks with the Asian Development Bank and an international aviation services company, a government statement said on Wednesday, to discuss energy sector reforms and private investment in airport operations.

The meetings took place on the sidelines of the World Economic Forum in Davos, where Aurangzeb outlined Pakistan’s recent economic stabilization efforts and its plans to expand private sector participation and international partnerships.

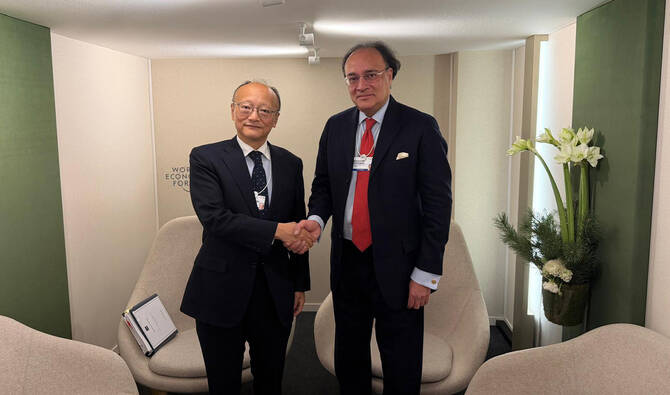

“The past year has marked a decisive shift toward macroeconomic stability,” he said in conversation with ADB President Masato Kanda, according to a statement circulated by the Finance Division.

“Discussions also covered efforts to modernize Pakistan’s energy sector and advance sustainable and clean energy solutions,” the statement added. “The Finance Minister highlighted ongoing reforms aimed at improving efficiency, strengthening systems, and supporting long-term economic sustainability.”

Aurangzeb emphasized the importance of continued collaboration with development partners, including ADB, to support these reforms and unlock Pakistan’s growth potential.

The ADB president reaffirmed the Bank’s commitment to Pakistan, highlighting ADB’s focus on ensuring timely and effective delivery of development outcomes.

The finance minister separately met with Hassan El Houry, chairperson of Menzies Aviation, to explore opportunities for improving airport services, operational efficiency, and private investment.

During the meeting, he briefed El Houry on plans to outsource operations at Islamabad, Karachi, and Lahore airports, saying the improving economic environment was creating space for international partnerships, according to the statement.

Menzies Aviation expressed interest in expanding its engagement in Pakistan and discussed ways to enhance service quality and the overall passenger experience.