JEDDAH: The total value of construction contracts awarded in Saudi Arabia during the third quarter (Q3) of this year collapsed by 84 percent on figures for the same period in 2019 as the economic impact of the coronavirus disease (COVID-19) pandemic continued to bite.

Despite the large drop, industry experts remained upbeat, pointing out that the Q3 figure was a statistical anomaly, as 2019 was a record year, and predicting that once the short-term impact of the global health crisis had passed the construction sector would bounce back.

According to the latest Contract Awards Index (CAI) produced by the US-Saudi Business Council (USSBC), the total value of construction contracts awarded in the Kingdom during July, August, and September declined by SR40.4 billion ($10.8 billion) to SR7.4 billion.

Within the quarter itself, the figure also gradually declined, going from SR2.958 billion in July to SR2.613 billion in August, and SR1,842 billion in September. One of the main reasons for the slump was budgetary constraints, as the Ministry of Finance looked to absorb the economic impact of the pandemic and reined in capital expenditure.

Looking back on the year as a whole, the data compiled by the USSBC found that during the first three quarters of 2019 construction contracts worth a total of SR161.8 billion were handed out. By comparison, during the same period this year the figure fell to SR63.6 billion, a drop of 60.69 percent.

Albara’a Alwazir, economist and author of the USSBC report, told Arab News that he was confident the sector would rebound, just as it had done after the downturn between 2016 and 2018.

“The Kingdom was pursuing a market share leadership strategy as an oil producer in 2016 whereby oil prices decreased as a result of high global oil inventories.

The slowdown in global demand for oil led to the reduction in the Kingdom’s budgetary spending, with a particular slowdown in capital expenditures,” he said.

He pointed out that the current downturn was somewhat similar in that lower oil revenues necessitated a revaluation of the Kingdom’s expenditures in the face of reduced global oil demand, but the long-term impact would be minimal, as the sector returned to normal after the COVID-19 slowdown.

“The Saudi economic outlook appears promising as the number of COVID-19 cases have sharply decreased coupled with the recent news that vaccines are showing promising results and are reported to be available by the middle of 2021.

“Furthermore, while numerous projects have been delayed because of the pandemic, the government has stated that there will be a continued focus on megaprojects especially those that relate to Vision 2030,” he added.

Alwazir was also optimistic that decisive government actions would also mean the long-term impact had been reduced. “The recent announcement that the Public Investment Fund (PIF) will inject SR150 billion annually into the economy in 2021 and 2022 is a positive development.

“The PIF’s role in keeping the economy buoyant in the face of a global downturn will be pivotal in progressing through Vision 2030’s mandates,” he said.

Taimur Khan, an associate partner at real estate consultancy Knight Frank, noted that the dramatic year-on-year drop in Q3 was mainly down to statistics and the fact that the figures were being compared to a record-breaking 2019.

The PIF’s role in keeping the economy buoyant in the face of a global downturn will be pivotal in progressing through Vision 2030’s mandates.

Albara’a Alwazir, Economist

“It is important to note that the total value of contracts awarded in 2019 was the highest level since 2015 and 95.4 percent higher than total awards in 2018, so we are comparing against a high base,” he said.

“Whilst the total value of new contracts has decreased, the level of activity underway in Saudi Arabia still remains high compared to previous years and considering new financing agreements signed during the course of 2020, particularly those relating to urban and real estate development, we expect new contracts activity levels to begin to return to pre-pandemic highs in 2021,” he added.

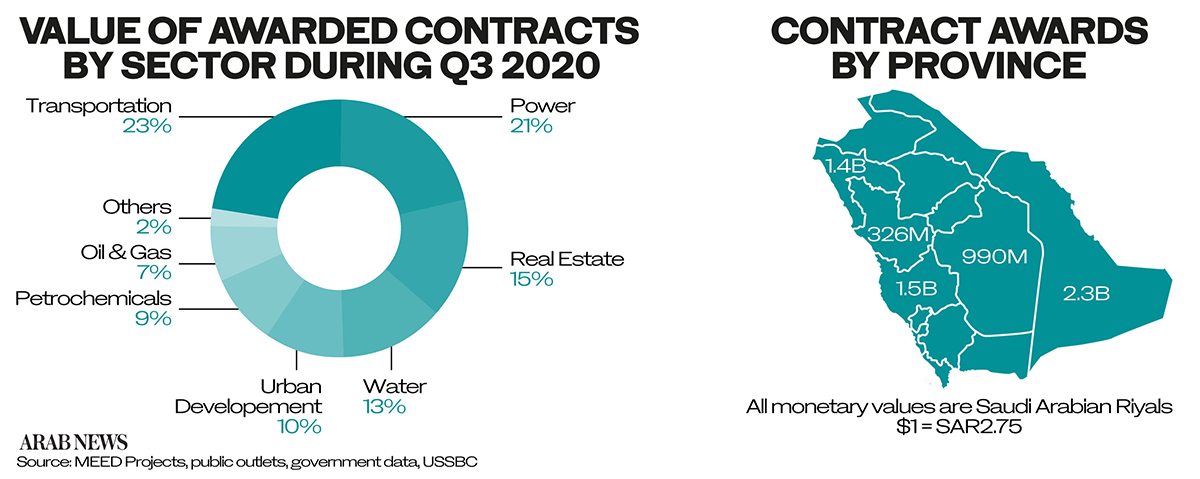

Figures in the USSBC report revealed that the majority of the awarded contracts during Q3 were in the transportation, power, and real estate sectors, which jointly accounted for 59 percent of the total. The transportation sector registered the highest value of contract awards with SR1.7 billion to three major road development projects linked to the Red Sea Development, Qiddiya, and Amaala megaprojects.

The largest Q3 contract was for SR938 million, awarded by the Red Sea Development Co. to Almabani, and Nesma and Partners for the construction of a 3.7-km runway and taxiways at the Red Sea International Airport. In terms of geography, the Eastern Province continued to be the focus for activity, accounting for SR2.3 billion worth of deals, or 32 percent of all contracts awarded, including a new chlorine derivatives plant and an industrial wastewater processing plant in Jubail.

Makkah Province accounted for 20 percent of contracts, primarily in the power and real estate sectors, followed by Tabuk province with 19 percent.

According to Alwazir, the Saudi Contractors Authority has maintained that the government’s megaprojects related to Vision 2030 would continue to be its focal point in the near-term, with investments continuing into these strategically important areas.