FRANKFURT: BMW is following other German carmakers in pumping up its financial liquidity to ride out the coronavirus crisis, its chief executive said Friday, as car sales in the auto-mad nation booked their steepest plunge in almost 30 years in March.

“Circumstances as serious as this can threaten the existence of even a large company,” BMW boss Oliver Zipse said in an interview circulated to staff.

“We have already introduced large-scale measures, in particular to secure our liquidity,” Zipse added, calling the steps an “absolute priority” but without going into details.

High-end competitor Daimler, which builds Mercedes-Benz cars, said Thursday it had agreed a new 12-billion-euro ($13 billion) credit line with banks, “increasing its financial flexibility.”

A hint at the pressure on carmakers came from Volkswagen boss Herbert Diess last week, when he said virus-imposed shutdowns were costing the sprawling 12-brand giant up to two billion euros per week.

Official data showed new registrations of cars on German roads plunging in March to their lowest in almost three decades.

Sales tumbled 38 percent year-on-year to just over 215,100, according to the KBA vehicle licensing authority.

“Necessary health policy measures, like the massive limits on public life, closure of car dealerships and limited ability to work in the licensing offices” had braked the car trade, the VDA carmakers’ federation said.

Domestic demand fell 30 percent, while foreign orders were down 37 percent.

In a quarterly comparison, sales in January-March were down 20 percent year-on-year.

“April is likely to be even more catastrophic,” analysts from consultancy EY predicted.

In European virus epicenter Italy, where lockdown restrictions are even harsher, transport ministry figures released Thursday showed sales collapsing by more than 85 percent year-on-year in March.

At just over 28,300 cars registered, Italian sales were “at a level comparable with the early 1960s, when mass car ownership in our country was just getting started,” experts at car industry research center Promotor commented.

“Forecasts for the coming months call for similar or even worse falls until the crisis is over,” they added.

In Germany, “even if the acute crisis were overcome in summer, the economic and social consequences — massive increase in unemployment, plunges in income, bankruptcies — will continue to squeeze demand strongly,” EY predicted.

Ratings agency Moody’s expects the global auto market to contract 14 percent in 2020.

Up to 100,000 of the roughly 800,000 jobs in Germany’s massive auto sector could be at risk, according to recent estimate from University of St. Gallen expert Ferdinand Dudenhoeffer.

To weather the impact of the coronavirus restrictions, major manufacturers like Volkswagen, Mercedes-Benz parent Daimler and BMW have closed factories and placed tens of thousands of workers on government-funded shorter hours schemes.

Chancellor Angela Merkel said this week that restrictions on public life would be extended to at least April 19, including a ban on gatherings of more than two people and the closure of many businesses such as restaurants.

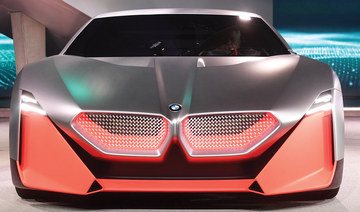

BMW in dash for cash as German car sales plummet amid coronavirus chaos

https://arab.news/ra8fj

BMW in dash for cash as German car sales plummet amid coronavirus chaos

- Chancellor Angela Merkel said this week that restrictions on public life would be extended to at least April 19

Stellantis eyes expanding product range in Saudi Arabia, CEO says

- Dutch-based automobile manufacturer to introduce smart cars and light commercial vehicles into Saudi market

RIYADH: Dutch-based automobile manufacturing corporation Stellantis is planning to expand its product range in Saudi Arabia by introducing smart cars and light commercial vehicles into the market, an official has revealed.

In an interview with Arab News, Samir Cherfan, chief operating officer of Stellantis in the Middle East and Africa, said that the company’s Dare Forward 2030 plan aims to turn the automaker into a mobility tech company.

“Our approach in the Kingdom is multifaceted – and includes driving increased market share by expanding across brands and segments. This will be driven by introducing and expanding models including smart cars and light commercial vehicles under our Fiat, Citroen and Peugeot brands,” said Cherfan.

He added: “Moreover, Jeep is set to grow by reaching customers in new market segments while Ram will strengthen its position in the full-size pickup segment.”

Cherfan noted that Stellantis’ strategy in the Kingdom is aligned with Saudi Arabia’s Vision 2030 objectives.

He added that the company is committed to support Saudi Arabia’s economic diversification efforts and ongoing technological progress.

“By expanding our product range while improving efficiency and adopting new sustainable technologies, we aim not just for market dominance but also to support economic diversification and technological progress in Saudi Arabia,” he said.

Sustainability in focus

During the talk, the COO said that Stellantis’ move to reintroduce the Citroen brand in 2022 was to meet the rising demand for electric vehicles in the Saudi market, as the younger population in the Kingdom are giving priority to sustainability.

“In the Kingdom, Citroën offers a diverse range of vehicles that cater to young buyers – particularly in urban centers like Riyadh and Jeddah – including the growing number of women drivers,” said Cherfan.

He continued: “These younger demographics are typically looking for more sustainable, smaller, smarter models. As EVs produce zero emissions and zero noise, this in turn aligns with Vision 2030 objectives to enhance quality of life and reduce the Kingdom’s carbon footprint.”

According to Cherfan, Saudi Arabia’s economic diversification efforts aimed at reducing the Kingdom’s dependency on oil is also reshaping the automotive market in the country.

He added that Saudi Arabia’s sovereign wealth fund’s strategic investments in various sectors are also helping companies like Stellantis invest in the Kingdom.

“As the Kingdom is looking toward its post-oil economy and becoming more competitive internationally, this change is affecting the automotive market too. With the Public Investment Fund supporting the growth of the Kingdom’s economy by investing in different sectors, this opens doors for companies like Stellantis to invest and grow our business,” said Cherfan.

He added: “At Stellantis, we have a goal to increase our sales in Saudi Arabia and we believe that the Kingdom is a key to our plan to supply 90 percent of the cars and parts needed in the Middle East and Africa from within the region.”

The COO went on to say the company is planning to introduce new EV models in Saudi Arabia soon, as it eyes to grab 30 percent of this market by the end of this decade.

“When it comes to electrification, we are engaged with our Saudi Arabian partners with the objective of incorporating EV models or establishing dedicated EV brands within our product portfolios. Our aim is to have a 30 percent EV share by 2030 as set out in our Dare Forward Strategy,” he continued.

Encouraging local talents in the automotive industry

According to Cherfan, the automotive industry is an employment generator and is expected to grow at a double-digit rate till 2030 in Saudi Arabia as the Kingdom is embarking to ensure clean and autonomous mobility.

The official noted that the company currently has 12,000 employees in the Middle East and Africa region and among them only 20 are expats.

“In the Kingdom, through Stellantis and our distributor partners, we have over thousands of people working across different departments and under multiple brands, and we expect to continue to grow that number as our brands increase their market share,” said Cherfan.

He added that Stellantis aims to position itself as the most localized player in the region.

“We position ourselves as the partner in the country to maximize value creation. We have programs with universities, we have created dedicated training programs to upskill local talent. And with 1.2 billion people in our region, there is a lot of brilliant talent to be further developed,” continued Cherfan.

The company is aiming to achieve 70 percent regional production autonomy by 2030, representing a significant leap from its current level of 25 percent.

The COO said Stellantis aims to sell one million vehicles in the region by 2030, out of which 35 percent will be electric.

Strategic partnership with private and government entities

Cherfan further said that Stellantis’ strategy involves collaborating closely with local businesses, government entities and other stakeholders.

He pointed out that leveraging partnerships with local businesses is necessary to understand the market in Saudi Arabia, while collaborations with government entities is essential to navigate through regulatory frameworks.

“By working hand in hand with local companies, we can tailor our products and services to better meet the needs and expectations of Saudi consumers. Additionally, partnering with local businesses provides opportunities for technology transfer, skill development, and job creation, thereby contributing to the growth of the Saudi economy,” he noted.

Cherfan added: “By partnering with government agencies, we can ensure that our activities are in line with Saudi Arabia’s vision for economic diversification, sustainability, and innovation.”

He noted that government partnerships will also facilitate access to infrastructure and support programs, enabling the company to accelerate its growth and expansion efforts in the Kingdom.

Cherfan also underscored the vitality of collaborating with stakeholders like academic institutions, research centers and industry associations.

“Collaborating with these entities allows us to use cutting-edge research, innovation, and talent pools. By promoting partnerships with academia and research institutions, we can drive technological advancements, develop new products and solutions, and enhance our competitive edge in the Saudi market,” he concluded.

Egyptian startups secure funding to boost expansion to Saudi Arabia following a period of stagnation

Egyptian startups secure funding to boost expansion to Saudi Arabia following a period of stagnation

CAIRO: Startups in Egypt have started to gain momentum with several ventures securing funding to boost expansion efforts to the Kingdom.

Following a period of startup funding stagnation, Egyptian founders have made their way back to the regional venture capital space with a flurry of investment deals and expansion strategies already in place.

Egyptian fintech startup Waffarha has secured a seven-figure seed round from Value Makers Studio to expand its footprint.

Founded in 2012 by Tarek Magdy, the platform offers significant discounts, with daily deals ranging from 50 percent to 90 percent.

The new capital will enable Waffarha to enhance its technology, recruit talent, and expand into Saudi Arabia and additional markets.

Moreover, in 2018, Fawry for Banking Technology and Electronic Payments, one of Egypt’s largest financial institutions, acquired a share of 30 percent of the company.

The company claims to boast a network of over 1,000 merchants and over 3,000 stores that cater to more than 5 million customers, without any subscription fees.

Over the last 12 years, Waffarha claims to have emerged as a top-tier lifestyle website and mobile app.

Egyptian HRtech startup Bluworks secures $1m in pre-seed funding

Bluworks, an HR and Software-as-a-Service solutions provider based in Egypt, has raised $1 million in pre-seed funding led by Khawarizmi Ventures and included Camel Ventures, Acasia Ventures, and angel investors.

Founded in 2022 by Farah Osman, Hussein Wahdan, and Nour Ahmadein, Bluworks aims to optimize costs for businesses through data-driven decision-making.

“With so many HR softwares on the market, not one is built to manage blue-collar workers,” Wahdan said.

“Since the process of managing this type of workforce is so manual, errors frequently occur, leading to penalties and deducted salaries with no oversight from the workers, causing them to leave and ultimately contributing to high turnover rates,” he added.

“Currently, companies can spend about 7-10 days just closing their payroll accounts, but with Bluworks, this time can be cut down to one day - all while leveraging data and insights on their workforce,” he stated.

The company aims to utilize the funding to support its product development goals, expand its presence, and grow its team.

Egypt-based fintech Bokra closes $4.6m pre-seed funding round

Bokra, an emerging fintech startup from Egypt, has secured $4.6 million in pre-seed funding, led by DisrupTech Ventures and SS Capital.

Founded in 2023 by Ayman El-Sawy, Bokra offers diversified investment solutions for retail and SME investors.

The funds will support the launch of the Bokra app, expansion of its investment products, and scaling operations across the Middle East and North Africa region.

“We are dedicated to accelerating financial inclusion and elevating investment awareness across MENA,” El-Sawy said.

“In a region where financial needs and aspirations are ever-changing, Bokra is poised to become the preferred investment platform for both individuals and small and medium-sized enterprises looking to diversify their fractional ownership portfolio in a simple, trackable and informed way,” he added.

Egyptian startups win big in Saudi-Egyptian program

Ten Egyptian startups have received awards from the VMS Bridge program, aimed at enhancing connections between Egypt and Saudi Arabia’s entrepreneurial ecosystems.

Winners included Amanleek, Farhy, Sprints, Career180, and Jamaykaa, which will explore investment opportunities during a 4-day visit to the Kingdom.

Other winners, Notchnco and Neqabty, received free company licenses in Saudi Arabia, and AgriCash, ReNile, and ICareer won access to Arweqah’s training programs.

Jordan-based healthtech startup Arab Therapy secures $1m seed funding

Arab Therapy, a Jordan-based mental health platform, has raised $1 million in seed funding, led by Flat6Labs and Vision Health Pioneers, with participation from international angel investors.

Founded in 2021 by Tareq Dalbah, Omar Koudsi, and Hekmat Al-Hasi, Arab Therapy connects users with licensed mental health professionals.

The investment will facilitate the company’s market expansion and the initiation of business to business sales operations.

TVM Capital Healthcare invests $17m in Neurocare Group AG

TVM Capital Healthcare, based in the UAE, has invested $17 million into Neurocare Group AG, a Munich-headquartered healthtech specializing in personalized mental healthcare.

The investment will support Neurocare’s expansion plans in the US and Saudi Arabia and fund the development of new hardware and software innovations, enhancing their clinical solutions.

UAE-based logistics startup Shorages secures $1m for expansion

Shorages, a UAE-based logistics startup, has raised $1 million in a pre-series A funding round led by Joa Capital’s S3 Ventures Fund.

Founded in 2019 by Rayan Osseiran, the company provides fulfillment solutions in the UAE and Saudi Arabia for e-commerce platforms.

The company aims to utilize the funding to help expand its warehouse operations across the Gulf region.

UAE e-commerce startup WEE secures $12m in funding

UAE-based e-commerce startup WEE has concluded a $12 million pre-series A funding round, facilitated by SIG Investment.

Founded in 2021 by Anastasia Kim, Oleg Dashkevich, and Sergey Kolikov, WEE is an online marketplace that offers below 15-minutes delivery services.

The investment will be used to spearhead WEE’s logistics capabilities, accelerate growth, and expand its team.

Turkish fintech app Midas closes $45m funding round to boost MENA expansion

Turkish fintech app Midas closed a $45 million funding round by Portage, a global investment platform, supported by International Finance Corporation, Spark Capital and Earlybird Digital East Fund.

Founded by Egem Eraslan, the company allows users in Turkiye to invest in Turkish and US equities.

The startup is aimed at Turkiye’s retail investor market and claims to have more than 2 million users. The company claims to charge significantly lower transaction and commission fees for Turkish customers who want to invest in US or Turkish stocks.

Midas has plans to expand beyond Turkiye, and aims to target countries in the MENA region, according to a report by TechCrunch.

Midas also plans to use the new funding to roll out three new products in cryptocurrency trading, mutual funds and savings accounts.

UAE’s Maalexi signs agreement with Etihad Credit Insurance

Maalexi, a UAE-based risk management platform focused on SME agri-businesses, has entered into a strategic credit insurance agreement with Etihad Credit Insurance, the UAE’s federal export credit company.

This collaboration will enable Maalexi to utilize ECI’s extensive trade credit solutions and services, enhancing the competitiveness of regional SMEs in the food and agriculture trade sectors, both locally and internationally.

The partnership aims to reduce market entry barriers, support Maalexi’s goal of increasing SME participation in the cross-border trade of agricultural produce, and contribute to food security in the UAE.

Open Forum Riyadh to discuss digital currency, AI, and mental health

- The event will run in parallel to the WEF’s Special Meeting on Global Collaboration

LONDON: The Open Forum Riyadh — a series of public sessions taking place in the Saudi capital on Sunday and Monday — will “spotlight global challenges and opportunities,” according to the organizers.

The event, a collaboration between the World Economic Forum and the Saudi Ministry of Economy and Planning, will run in parallel to the WEF’s Special Meeting on Global Collaboration, Growth and Energy for Development, taking place in Riyadh on April 28 and 29.

“Under Saudi Vision 2030, Riyadh has become a global capital for thought leadership, action and solutions, fostering the exchange of knowledge and innovative ideas,” Faisal F. Alibrahim, Saudi minister of economy and planning, said in a press release, adding that this year’s Open Forum being hosted in Riyadh “is a testament to the city’s growing influence and role on the international stage.”

The forum is open to the public and “aims to facilitate dialogue between thought leaders and the broader public on a range of topics, including environmental challenges, mental health, digital currencies, artificial intelligence, the role of the arts in society, modern-day entrepreneurship, and smart cities,” according to a statement.

The agenda includes sessions addressing the impact of digital currencies in the Middle East, the role of culture in public diplomacy, urban development for smart cities, and actions to enhance mental wellbeing worldwide.

The annual Open Forum was established in 2003 with the goal of enabling a broader audience to participate in the activities of the WEF, and has been hosted in several different countries, including Cambodia, India, Jordan and Vietnam.

The panels will feature government officials, artists, civil-society leaders, entrepreneurs, and CEOs of multinationals.

This year’s speakers include Yazeed A. Al-Humied, deputy governor and head of MENA investments at the Saudi Pubic Investment Fund; Princess Reema Bandar Al-Saud, Saudi Arabia’s ambassador to the US; and Princess Beatrice, founder of the Big Change Charitable Trust and a member of the British royal family.

Michele Mischler, head of Swiss public affairs and sustainability at the WEF, said in a press release that the participation of the public in Open Forum sessions “fosters diverse perspectives, enriches global dialogue, and empowers collective solutions for a more inclusive and sustainable future.”

Meituan looks to hire in Saudi Arabia, indicating food delivery expansion

SHANGHAI: Chinese food delivery giant Meituan is seeking to hire staff for at least eight positions based in Riyadh, in a sign it may be looking to Saudi Arabia to further its global expansion ambitions, according to Reuters.

The jobs ads, which is hiring for KeeTa, the brand name Meituan uses for its food delivery operations in Hong Kong, is seeking candidates with expertise in business development, user acquisition, and customer retention, according to posts seen by Reuters on Linkedin and on Middle Eastern jobs site Bayt.com.

Meituan did not immediately respond to a request for comment by Reuters on its plans for Saudi expansion.

Bloomberg reported earlier on Friday that the Beijing-based firm would make its Middle East debut with Riyadh as the first stop.

Since expanding to Hong Kong in May 2023, Meituan’s first foray outside of mainland China, speculation has persisted that its overseas march would continue as the firm searches for growth opportunities, with the Middle East rumored since last year to be one area of possible expansion.

“We are actively evaluating opportunities in other markets,“ Meituan CEO Wang Xing said during a post-earnings call with analysts last month.

“We have the tech know-how and operational know-how, so we are quietly confident we can enter a new market and find an approach that works for consumers there.”

IMF opens first MENA office in Riyadh

RIYADH: The International Monetary Fund has opened its first office the Middle East and North Africa region in Riyadh.

The office was launched during the Joint Regional Conference on Industrial Policy for Diversification, jointly organized by the IMF and the Ministry of Finance, on April 24.

The new office aims to strengthen capacity building, regional surveillance, and outreach to foster stability, growth, and regional integration, thereby promoting partnerships in the Middle East and beyond, according to the Saudi Press Agency.

Additionally, the office will facilitate closer collaboration between the IMF and regional institutions, governments, and other stakeholders, the SPA report noted, adding that the IMF expressed its appreciation to Saudi Arabia for its financial contribution aimed at enhancing capacity development in its member countries, including fragile states.

Abdoul Aziz Wane, a seasoned IMF director with an extensive understanding of the institution and a broad network of policymakers and academics worldwide, will serve as the first director of the Riyadh office.