KABUL: A US military aircraft crashed in eastern Afghanistan on Monday, a Taliban spokesman and Afghan journalist affiliated with the militant group said.

Tariq Ghazniwal, a journalist in the area, said that he saw the burning aircraft. In an exchange on Twitter, he told The Associated Press that he saw two bodies and the front of the aircraft was badly burned. He added that aircraft's body and tail were hardly damaged. His information could not be independently verified.

Taliban spokesman Zabihullah Mujahid said a US airforce plane crashed in the Ghazni province. He claimed the crash killed “lots" of US service members. The militant group often exaggerates casualty figures.

Ghazniwal said the crash site was about 10 kilometers from a US military base.

US Army Maj. Beth Riordan, a spokeswoman for US Central Command, declined to comment when told about the Taliban claim. She earlier acknowledged American military officials were investigating reports of a crash in Afghanistan. She said that it remained unclear whose aircraft was involved in the crash.

Riordan declined to immediately comment further.

However, pictures on social media purportedly from the crash site showed what could be the remains of a Bombardier E-11A aircraft, which the US military uses for electronic surveillance over Afghanistan.

Images on social media purportedly of the crashed plane showed an aircraft bearing US Air Force markings similar to other E-11A surveillance aircraft photographed by aviation enthusiasts. Visible registration numbers on the plane also appeared to match those aircraft.

The so-called Battlefield Airborne Communications Node can be carried on unmanned or crewed aircraft like the E-11A. It is used by the military to extend the range of radio signals and can be used to convert the output of one device to another, such as connecting a radio to a telephone.

Colloquially referred to by the US military as “Wi-Fi in the sky,” the BACN system is used in areas where communications are otherwise difficult, elevating signals above obstacles like mountains. The system is in regular use in Afghanistan.

Local Afghan officials had said earlier on Monday that a passenger place from Afghanistan's Ariana Airlines had crashed in the Taliban-held area of the eastern Ghazni province. However, Ariana Airlines told The Associated Press that none of its planes had crashed in Afghanistan.

The conflicting accounts could not immediately be reconciled. The number of people on board and their fate was not immediately known, nor was the cause of the crash.

Arif Noori, spokesman for the provincial governor, said the plane went down around 1:10 pm local time (8:40 am GMT) in Deh Yak district, some 130 kilometers (80 miles) southwest of the capital Kabul. He said the crash site is in territory controlled by the Taliban. Two provincial council members also confirmed the crash.

But the acting director for Ariana Airlines, Mirwais Mirzakwal, dismissed reports that one the company's aircraft had crashed. The state-owned airline also released a statement on its website saying all its aircraft were operational and safe.

The mountainous Ghazni province sits in the foothills of the Hindu Kush mountains and is bitterly cold in winter. The Taliban currently control or hold sway over around half the country.

The last major commercial air crash in Afghanistan occurred in 2005, when a Kam Air flight from the western city of Herat to Kabul crashed into the mountains as it tried to land in snowy weather.

The war, however, has seen a number of deadly crashes of military aircraft. One of the most spectacular occurred in 2013 when an American Boeing 747 cargo jet crashed shortly after takeoff from Bagram airbase north of Kabul en route to Dubai in the United Arab Emirates. All seven crew member were killed. The US National Transportation Safety Board investigation found that large military vehicles were inadequately secured and had shifted during flight, causing damage to the control systems that "rendered the airplane uncontrollable."

US army investigating plane crash in Taliban-held area

https://arab.news/6pukb

US army investigating plane crash in Taliban-held area

- The Taliban said it had shot down a US military plane

- US officials said they were still investigating the cause of the crash

Muslim school student loses UK court bid over prayer rituals ban

- The High Court in London hearing the case was told the ban introduced last year stemmed from several dozen students beginning to pray in the school’s yard

LONDON: A Muslim pupil lost a UK court challenge Tuesday against a top London school’s ban on prayer rituals, in a case about freedom of religion in schools that captured national attention.

The student, who cannot be named, took legal action against Michaela Community School in northwest London, claiming the policy was discriminatory and “uniquely” affected her faith due to its ritualized nature.

She argued the school’s prohibition of on-site prayer unlawfully breached her right to religious freedom and was “the kind of discrimination which makes religious minorities feel alienated from society.”

The school — state-funded but independently run and renowned for its academic achievement record and strict rules — countered that the policy imposed last year was justified.

The High Court in London hearing the case was told the ban introduced last year stemmed from several dozen students beginning to pray in the school’s yard, using blazers to kneel on, the BBC reported.

It then imposed the new rules due to concerns about a “culture shift” toward “segregation between religious groups and intimidation within the group of Muslim pupils,” the court reportedly heard.

In a written ruling, judge Thomas Linden dismissed the pupil’s arguments, ruling that by enrolling at the school she had effectively accepted being subject to restrictions on manifesting her faith.

He concluded that the prayer ritual policy was “proportionate” and that its aims and ability to achieve them “outweighs” any “adverse effects” on the rights of Muslim pupils at the school.

Responding to the decision Katharine Birbalsingh, headteacher of Michaela Community School, said “a school should be free to do what is right for the pupils it serves.”

“The court’s decision is therefore a victory for all schools,” she added on X (formerly Twitter).

“Schools should not be forced by one child and her mother to change its approach simply because they have decided they don’t like something at the school.”

Education Secretary Gillian Keegan also welcomed the ruling, saying “headteachers are best placed to make decisions in their school.”

“Michaela is an outstanding school and I hope this judgment gives all school leaders the confidence to make the right decisions for their pupils.”

At least 66 killed in Afghanistan as heavy rains set off flash floods

- Number of reported casualties has doubled since Sunday

- Many were killed when their homes collapsed on them

Kabul: Extreme rainfall in Afghanistan and devastating flash floods have killed at least 66 people and damaged homes, infrastructure, and farmlands across most of the country’s provinces, authorities said on Tuesday.

The storms, which started over the weekend, are adding to the challenges facing Afghanistan, which is still recovering from decades of conflict and natural disasters, including unprecedented droughts in the past four years, as well as a series of deadly earthquakes.

“According to primary reports from the provinces, at least 66 people lost their lives, and 36 others are injured,” Janan Sayeq, spokesperson of the National Disaster Management Authority, told Arab News on Tuesday.

The number of reported casualties has doubled since Sunday, raising fears the actual toll could be higher. Many of the victims were killed when their homes collapsed on them.

Sayeq said that 1,235 houses were destroyed.

Flash floods were reported in 23 of the country’s 34 provinces, damaging crops ahead of the harvest season, and further affecting food security in the country as UN agencies estimate that more than half of its population has been in need of humanitarian assistance.

“The wheat crops will be ready for collection in a few weeks. But the rainfalls could destroy most of it,” said Gul Hussain, a farmer from the eastern Laghman province, which is one of the main agricultural regions.

The impact of drought, and now also floods, has been devastating for rural families struggling with access to water.

“The floods have had severe effects on the lives of people in the southeast, southwest and east of the country and have caused loss of life and damage to houses, as well as economic and agricultural effects as crops are destroyed and livestock are killed,” Najibullah Sadid, a hydromophologist, told Arab News.

The country’s mountainous topography and reduced vegetation left little to no space for people to escape flood events, as preparedness and prevention in the face of the changing climate are almost nonexistent.

Water management infrastructure — such as check dams, trenches, terraces, and reservoirs that could help reduce flooding — is insufficient.

“For instance, Afghanistan has 22 percent less water storage compared to Iran and 13 percent less compared to Pakistan, making the country more vulnerable to floods during rainfalls,” Sadid said.

“Considering the increasing climate change effects as well as frequency and intensity of rainfalls, steps taken during the past two decades and now are limited and are not sufficient to control the situation.”

Indonesian coffee takes lead in Egyptian market

- Indonesia is the world’s 4th-largest coffee producer and Asia’s second-biggest

- Egypt was second-biggest export destination for Indonesian coffee in 2023, behind the US

JAKARTA: Indonesia has become Egypt’s main source of coffee, authorities said on Tuesday, as annual exports reached nearly $93 million, or about 43 percent of the market.

Indonesia is the world’s fourth-largest coffee producer and Asia’s second-biggest. In 2023, the Southeast Asian nation exported around 276,000 metric tons of the commodity worth almost $916 million, according to the Central Statistics Agency.

Egypt was the second-biggest export destination for Indonesian coffee, just behind the US, accounting for about 5.2 percent of the country’s total coffee exports.

“Indonesian coffee has successfully dominated the Egyptian market. Total export value reached $92.96 million, making Indonesia the biggest coffee-exporting country to Egypt in 2023,” Indonesian Ambassador in Cairo Lutfi Rauf said in a statement.

“This shows how Indonesian coffee products are loved by Egyptian consumers. The unique aroma and flavor are the main factors attracting consumers from Egypt.”

Indonesian officials held an annual meeting with Egyptian coffee buyers in Damanhour over the weekend, as they seek to foster good trade relations.

“We hope to continue and to improve trade relations. If there are any challenges, everything can be discussed well for the prosperity and welfare of the people of both countries,” Rauf said.

Indonesian officials have been increasing trade engagement with Egypt as a gateway for exports to other African countries in recent years, while Indonesian coffee producers are seeking to further their exports to the Middle East amid rising interest from the region.

Hariyanto, a coffee exporter from East Java province, said promotion efforts by the Indonesian Embassy in Cairo have helped boost the popularity of Indonesian coffee in Egypt.

“Egypt is a great market, and now there is a high demand for Indonesian-origin coffee products,” Hariyanto, a coffee exporter from East Java province, told Arab News.

“Egyptians found a match in Indonesian-origin coffee, as there is a good fit in terms of price and taste.”

UK MPs vote down plan to protect Afghan ‘heroes’ from deportation

- 10B amendment seeks to exclude Afghan veterans from removal to Rwanda

- Top military officials warn of ‘grave damage to our ability to recruit local allies in future military operations’

London: Conservative MPs in the UK have voted against a plan to prevent Afghan veterans who served alongside British soldiers from facing deportation to Rwanda.

An amendment to the controversial Rwanda bill was overturned by 312 votes to 253 on Monday, in a rejection of plans to exempt agents, allies and employees of the UK from being deported to the African country, The Independent reported.

The House of Lords’ amendment 10B is part of the larger bill, which seeks the deportation of illegal migrants to Rwanda.

Several amendments set in the House of Lords have sought to prevent Afghan veterans who fought alongside the British military in the decade-long war from being included in deportation orders.

The 10B amendment included people eligible to enter the UK under the Afghan Relocations and Assistance Policy, which supports Afghans who helped the British campaign in their country and who are at risk under the Taliban government.

After the vote, the Rwanda bill will now return to the House of Lords for new scrutiny.

UK Prime Minister Rishi Sunak had told Conservative MPs to vote against all amendments to the bill, including 10B.

The move to exclude Afghan veterans from potential deportation to Rwanda has received support from the highest levels of Britain’s military establishment.

Thirteen senior military officials, two former chiefs of defense staff, a former defense secretary and a former UK ambassador to the US have supported the amendment.

The Sunday Telegraph carried a letter from top military officials ahead of Monday’s vote. They warned that a rejection of the amendment would cause “grave damage to our ability to recruit local allies in future military operations.”

The letter added: “It is essential that those who have made it to British shores are not unduly punished by being removed to Rwanda when the government’s scheme is up and running.”

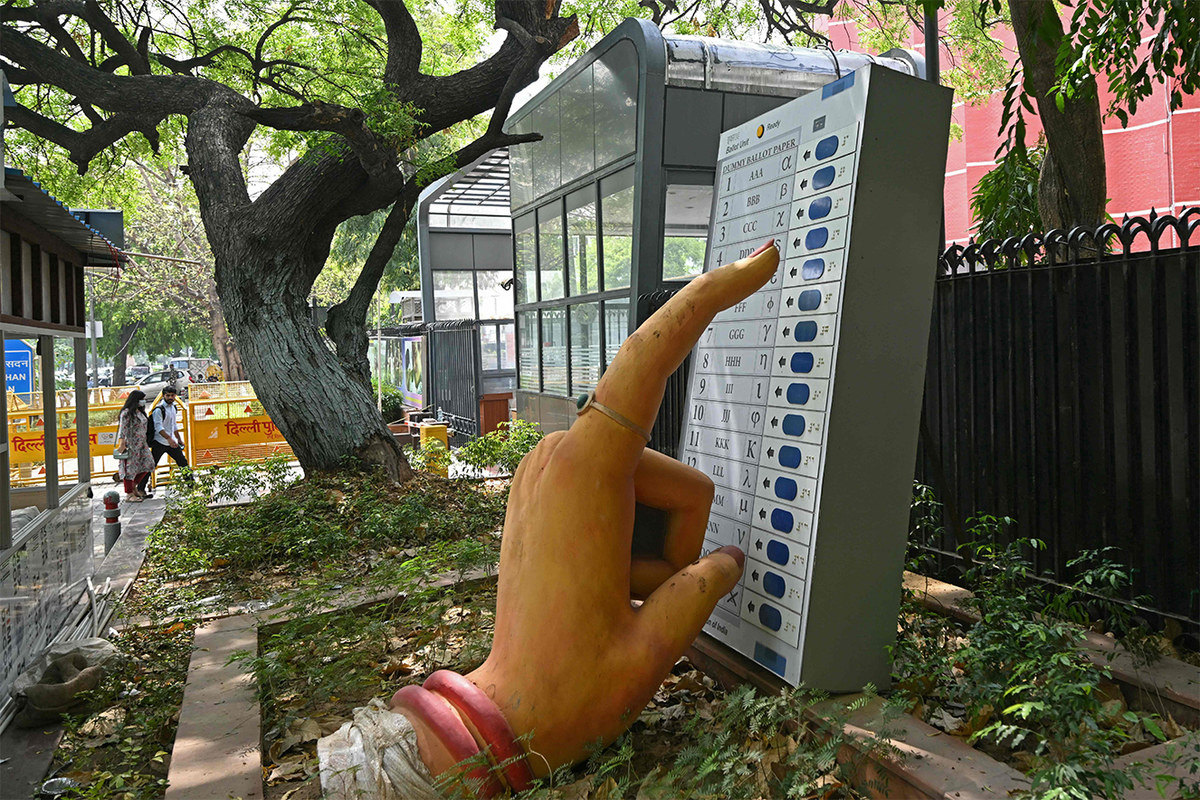

India’s Lok Sabha election 2024: What you need to know

- India is holding the world’s biggest election starting this month, with nearly one billion people eligible to vote

- Votes to be counted on June 4 after polling done on April 19, April 26, May 7, May 13, May 20, May 25, June 1

India is holding the world’s biggest election starting this month, with nearly 1 billion people eligible to vote and Prime Minister Narendra Modi in the pole position.

WHAT IS IT?

Elections to the 543 contested seats in the lower house of parliament, called the Lok Sabha, for a term of five years. To rule, a party or a coalition needs a simple majority of 272 seats. Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) won 303 seats the last time, followed by 52 for the main opposition Indian National Congress (INC).

In addition to the contested seats, India’s president can nominate up to two Anglo-Indians to the Lok Sabha.

The Bharatiya Janata Party, BJP, won 303 seats in 2019 general election. The second largest party, the Indian National Congress, INC, won 52 seats. The Dravida Munnetra Kazhagam, DMK, emerged as the third largest party.

WHERE AND WHEN IS IT TAKING PLACE?

The elections will be conducted in seven phases partly to ensure sufficient security at polling booths across the vast country. Voters can make their choice by pressing a button on an electronic voting machine, first used in India in 1982 and more widely since the early 2000s.

Votes will be counted on June 4 after polling is done on April 19, April 26, May 7, May 13, May 20, May 25 and June 1.

The elections in the world’s largest democracy for 543 seats will be held in 7 phases.

HOW DOES IT WORK?

The world’s most populous nation follows the first-past-the-post system, where voters cast a vote for a single candidate in a constituency and the candidate with the most votes wins the seat. The voting age is 18 years and contestants need to be at least 25 years old.

A total of 968 million voters are registered, out of which 497 million are men and 471 million are women. A higher percentage of women voters than men are likely to vote for the second time in a row.

WHO ARE THE MAIN CANDIDATES?

Modi headlines the race, followed by his de facto deputy Amit Shah and the main opposition face, Rahul Gandhi of the Congress party. Gandhi’s mother Sonia, the matriarch of the Nehru-Gandhi dynasty, is not contesting this time.

WHY IS IT IMPORTANT?

Modi is chasing a record-equalling third straight term like India’s first prime minister, Jawaharlal Nehru. Modi says another overwhelming victory for the National Democratic Alliance, led by the BJP, is crucial to meet his goal of lifting India to a developed economy by 2047 from middle-income levels. The world’s fifth-largest economy has grown fast in the past few years and Modi has “guaranteed” to take it to the third position if he wins the election.

The BJP draws its support mainly from Hindus, who form 80 percent of the country’s 1.42 billion people and for whom Modi earlier this year delivered on a key party promise of building a grand Hindu temple on a disputed site.

The opposition “INDIA” alliance, largely a center-left grouping of more than two dozen disparate parties, says a victory for it is essential to save the country’s democratic and secular setup, lift its marginalized communities, raise prices for farmers and create jobs for its young. Opinion polls, which have a mixed record in India, predict another thrashing of the Congress alliance at the hands of the BJP.