RIYADH: Saudi Aramco shares opened at 35.2 riyals ($9.39) on Wednesday at the Kingdom’s stock exchange, 10 percent above their IPO price of 32 riyals, in their first day of trading following a record $26.5 billion initial public offering.

Aramco had earlier priced its IPO at 32 riyals ($8.53) per share, the high end of the target range, surpassing the $25 billion raised by Chinese retail giant Alibaba in its 2014 Wall Street debut.

Aramco’s earlier indicative debut price was seen at 35.2 riyals, 10 per cent above IPO price, raising the company’s valuation to $1.88 trillion, Refintiv data showed.

At that price, Aramco is world’s most valuable listed company. That’s more than the top five oil companies – Exxon Mobil, Total, Royal Dutch Shell, Chevron and BP – combined.

“Today Aramco will become the largest listed company in the world and (Tadawul) among the top ten global financial markets,” Sarah Al-Suhaimi, chairwoman of the Saudi Arabian stock exchange, said during a ceremony marking the oil giant’s first day of trading.

“Aramco today is the largest integrated oil and gas company in the world. Before Saudi Arabia was the only shareholder of the company, now there are 5 million shareholders including citizens, residents and investors,” said Yasir Al-Rumayyan, the managing director and chief executive of the Saudi Public Investment Fund.

“Aramco’s IPO will enhance the company’s governance and strengthen its standards.”

Amin Nasser, the president and CEO of Saudi Aramco, meanwhile thanked the new shareholders for their confidence and trust of the oil company.

The sale of 1.5 percent of the firm, or three billion shares, is the bedrock of Crown Prince Mohammed bin Salman’s ambitious strategy to overhaul the oil-reliant economy.

Riyadh’s Tadawul stock exchange earlier said it will hold an opening auction for Aramco shares for an hour from 9:30 a.m. followed by continuous trading, with price changes limited to plus or minus 10 percent.

The company said Friday it could exercise a “greenshoe” option, selling additional shares to bring the total raised up to $29.4 billion.

The market launch puts the oil behemoth’s value at $1.7 trillion, far ahead of other firms in the trillion-dollar club, including Apple and Microsoft.

Two-thirds of the shares were offered to institutional investors. Saudi government bodies accounted for 13.2 percent of the institutional tranche, investing around $2.3 billion, according to lead IPO manager Samba Capital.

The IPO is a crucial part of Prince Mohammed’s plan to wean the economy away from oil by pumping funds into megaprojects and non-energy industries such as tourism and entertainment.

Watch the video marking Aramco’s opening trading:

Saudi Aramco shares soar at maximum 10% on market debut

https://arab.news/8pgf7

Saudi Aramco shares soar at maximum 10% on market debut

- Company is now world’s largest publicly traded company, bigger than Apple

- More than top five oil companies combined

ilmi, PNU launch museum studies program

- New micro-credential courses open to all high-school graduates, undergraduates

- Program includes Arabic, English, in-person, remote, long and short-term courses

RIYADH: A new museum studies program in Saudi Arabia has opened for registration, offering micro-credential and long-term courses.

It is the result of a partnership between ilmi, a center for science, technology, reading, engineering, arts and mathematics learning, and Princess Nourah bint Abdulrahman University.

ilmi — meaning “my knowledge” in Arabic — is a science and innovation center that aims to empower young people in Saudi Arabia.

A philanthropic NGO initiative created by Princess Sara bint Mashour bin Abdulaziz, wife of Crown Prince Mohammed bin Salman, ilmi is incubated, supported and funded by the Mohammed bin Salman Foundation, Misk, as a subsidiary, and operates in partnership with Mohammed bin Salman Nonprofit City.

The museum studies program includes micro-credential, diploma, minor and elective courses.

It is open to recent high-school graduates and university undergraduates keen to secure entry-level positions in museums, as well as professionals seeking new skill sets and career paths.

Created by ilmi and PNU experts from Saudi Arabia and around the world, the program offers a blend of online and in-person learning, alongside Arabic and English tuition options.

Micro-credential courses will blend online and in-person learning, and are available to applicants over the age of 18.

Courses include museum impact studies, museum education and awareness, an introduction to museum technologies, fundamentals of museum management and integrating digital technology.

Courses on offer for PNU students include an introduction to museums elective and specialist minors in museums and digital technology, exhibit design and content development.

A two-year diploma in museum management will also be available for both PNU students and recent high-school graduates.

Registration has opened for the first online micro-credential course starting this month: Fundamentals of museum management.

All further micro-credential courses will take place in May and June, with the diploma, minor and elective programs starting in September at the beginning of the academic year 2024/25.

Program graduates can also apply to work alongside ilmi experts as they design and launch unique, informal learning programs across the Kingdom.

For more information and registration, visit the link below:

https://www.pnu.edu.sa/ar/Deanship/Devandskilldean/Pages/cent.aspx

KSrelief, WFP to support malnutrition treatment in Yemen

- Allocation of $4.85 million to treat malnutrition in children aged under five as well as pregnant and lactating women in Yemen

- Agreement was signed by Dr. Abdullah Al-Rabeeah, adviser at the Royal Court and KSrelief’s supervisor general, and WFP Executive Director Cindy McCain

PARIS: Saudi Arabia’s King Salman Humanitarian Aid and Relief Center signed a joint cooperation agreement with the World Food Programme allocating $4.85 million to treat malnutrition in children aged under five as well as pregnant and lactating women in Yemen.

The signing took place on the sidelines of the International Conference for Sudan and Neighboring Countries, which was organized by France and the EU in Paris.

The agreement was signed by Dr. Abdullah Al-Rabeeah, adviser at the Royal Court and KSrelief’s supervisor general, and WFP Executive Director Cindy McCain.

It aims to improve the nutritional situation for Yemen’s most impoverished people by providing supplements in targeted areas, benefiting 86,985 people.

Rare cameras reveal history of Saudi media at Hasma Museum in Tabuk

RIYADH: A fine collection of rare cameras, print and audiovisual artifacts at the Hasma Museum in Tabuk offers visitors a unique experience.

Among items in the collection are vintage treasures such as old box cameras, 16 mm to 35 mm cinema cameras, underwater cameras, and flash cameras from 100 years ago.

The museum also has a display of historical audio and video equipment, while visitors can explore the earliest editions of local and other Arab newspapers.

Odeh Al-Atwi, who is from the Tabuk region, created the museum near the Hasma desert to offer a memorable experience to visitors.

Antique collector and museum owner Al-Atwi, telling the Saudi Press Agency of his journey to preserve these media artifacts in the museum, said: “It’s been a profound experience and a significant milestone in my life. The media plays a pivotal role in shaping social consciousness and documenting newsworthy events, particularly those that reverberate through the media landscape.”

Al-Atwi meticulously curated a remarkable collection of tools at his museum, providing visitors a captivating journey through the history of classic cameras, broadcast equipment, satellite linking machines and an array of visual and audio devices.

Each artifact, he said, acts as a window into the evolution of media technologies.

He expressed his gratitude to the Museum Commission for their encouragement in establishing the museum and their efforts in organizing the museum sector. Al-Atwi also acknowledged the support from the Saudi leadership, emphasizing their commitment to initiatives that benefit citizens and the nation.

The Ministry of Culture facilitates the endeavors of private museum owners by licensing their establishments through the Abdea platform. This initiative is an enabler for those in the museum sector, supporting its development and contributing to the realization of the cultural goals outlined in the Saudi Vision 2030.

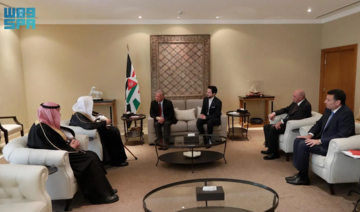

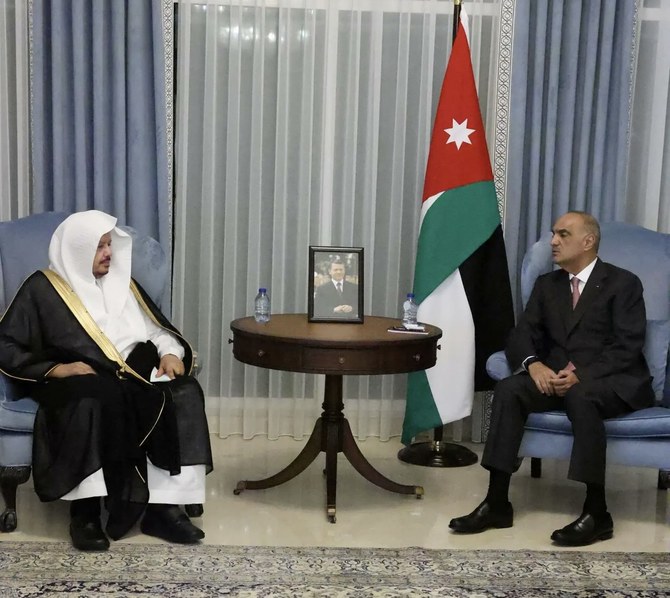

Saudi Shoura Council speaker holds meetings during official trip to Jordan

- Gatherings attended by several officials from the 2 sides

RIYADH: The Speaker of the Saudi Shoura Council Sheikh Abdullah Al-Sheikh met Jordanian Prime Minister Bisher Khasawneh on Wednesday as part of his official visit to Jordan, the Saudi Press Agency reported.

The discussion emphasized the strong and deep-seated relations between Saudi Arabia and Jordan, highlighting their extensive coordination and cooperation across various sectors.

Both officials explored ways to enhance bilateral ties, with a particular focus on strengthening parliamentary relations.

Al-Sheikh also held discussions with Faisal Akef Al-Fayez, president of the Jordanian Senate, on the same day.

He highlighted Saudi Arabia’s rapid economic growth and development, attributing this progress to the leadership of the Kingdom.

Al-Sheikh expressed gratitude for Jordan’s unwavering support and spoke of the consistent backing the Kingdom has provided to Jordan.

The meeting also focused on ongoing cooperative efforts between the Shoura Council and the Jordanian Senate, along with discussions on various other subjects.

Both meetings were attended by several officials from the two sides.

Saudi artist embraces the unconventional with anti-aesthetic artworks

RIYADH: In a world fixated on beauty and aesthetic perfection, Saudi artist Asrar Al-Qarni is boldly producing anti-aesthetic and unsettling art.

Through her work, the 33-year-old challenges traditional notions of beauty and protests conformity. She compels viewers to confront uncomfortable truths and explore darker aspects of society.

This unconventional approach to art can be seen as a romantic rebellion against society’s constraints, as well as a celebration of individuality and freedom of expression.

Al-Qarni told Arab News that anti-aesthetic art encourages people to look beyond the surface and find beauty in the unexpected and the unconventional. It seeks to disrupt the status quo and provoke thought and discussion about the nature of art itself: “Instead of being visually appealing and comforting, anti-aestheticism prioritizes evoking emotions and disturbing expression within the artwork,” the artist said.

This can lead to anti-aesthetic works being labeled ugly, jarring, or anti-art by those who prefer more aesthetically focused works.

By highlighting discord and dissonance in her paintings, Al-Qarni, a self-taught artist, creates a unique and thought-provoking experience for those who encounter her work. “Incorporating elements of chaos, ugliness and discomfort forces viewers to confront their preconceived notions about what art should be,” she added.

Al-Qarni became interested in anti-aesthetic art because of its raw human expression and beauty hidden by imperfections.

She uses bold colors and abstract shapes to create pieces that challenge viewers’ preconceptions and provoke a strong emotional response.

“I use various materials for my art, including mixed media, oil paint, acrylic paint and watercolor. My choice of materials depends on the specific technique or effect I want to achieve in my artwork,” Al-Qarni said.

By breaking free from the constraints of conventional beauty, the artist is pushing boundaries and inspiring others to think outside the box.

Al-Qarni said she cultivated her style through dedicated practice. She started copying and sketching cartoons from her favorite television shows as a child. “As I got older, I got into realistic portrait painting, trying to capture the world around me, but I soon realized that realism did not allow me to express my emotions deeply enough,” she added.

The Saudi artist eventually resorted to a more liberated method, allowing her to follow her instincts and let her brush strokes guide her: “When I hold the brush against the canvas, it becomes a way to quieten the noise of life and connect with my inner self, providing a source of relaxation and tranquility.”

The artist maintains a multi-purpose space where she paints, serving as both a studio and a cozy personal area.

“It is where I sleep, read and spend most of my time. Waking up surrounded by the creative mess of my art provides me with a sense of passion and inspiration to continue my artistic journey each day.”

Ten years ago, Al-Qarni decided to pursue art professionally, and she has not looked back since. Her work has been featured in galleries and exhibitions across Saudi Arabia, earning her recognition and acclaim from critics and audiences.

Al-Qarni’s first showing was in 2016 in Jeddah with Behance, the world’s largest network for showcasing and discovering creative work.

“Facing the audience, I received both compliments and critiques. The experience was helpful and encouraging, inspiring me to create more and improve my art,” she said.

She has taken part in several art exhibitions, such as the Misk Art Institute in 2019, which provides a platform for creative individuals to influence present-day discussions.

Al-Qarni also showcased her work at Grey Art Gallery in Alkhobar, and Zawaya Art Gallery and Sensation Art Gallery in Jeddah.

The artist gives each painting a title that reflects the overarching emotion or story behind the artwork. The title can be inspired by a novel, a song, or a personal experience related to the painting.

“How someone perceives and feels about a painting can vary depending on the person looking at it,” she added. “We all bring our own thoughts and experiences, which adds to the richness and meaning of any artist’s work.”

To aspiring artists who might be intimidated to share their artwork and innermost emotions with an audience, Al-Qarni preaches that the world needs art.

“Embrace the opportunity for growth and connect with other artists through feedback and experiences, and remember that every artist starts somewhere, and sharing your work is a step toward achieving your goals.”