LONDON: Three former Barclays executives lied to the market by hiding £322 million ($395 million) in extra fees that the bank paid Qatar in return for vital funding during the global credit crisis, a prosecutor told a London court on Tuesday.

The case, one of the most high-profile brought by the UK Serious Fraud Office (SFO), revolves around undisclosed payments to Qatar as Barclays raised more than £11 billion from investors in 2008 to avert a state bailout.

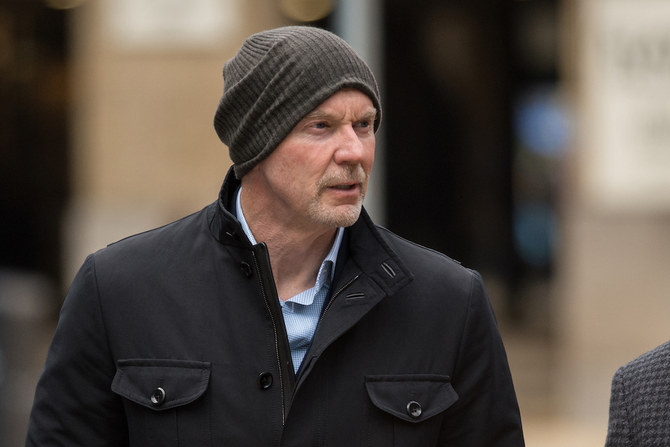

Opening the case for the prosecution, Edward Brown alleged that Roger Jenkins, Tom Kalaris and Richard Boath pretended commissions paid to Qatar in 2008 were fees for separate, commercially valuable advisory services agreements (ASAs).

“Telling lies in this way, say the prosecution, is a criminal offense,” Brown told the jury at London’s Old Bailey criminal court in a trial scheduled to last up to five months.

“It is committing fraud by false representations. They acted dishonestly, say the prosecution, in order to preserve the future of the bank and to preserve their own positions.”

The men, aged between 60 and 64, deny wrongdoing.

The case hinges on what Barclays told the market in public documents, such as the prospectuses and subscription agreements that outlined the fees and commissions that the bank paid to investors, including former Qatari prime minister Sheikh Hamad bin Jassim bin Jabr Al-Thani.

HIGH STAKES

Brown alleged that Barclays swept aside established banking practices of telling the truth in public documents about the terms on which investors were backing the bank as the credit crunch roiled markets, in order to secure around four billion pounds of investment from wealthy Qatar over 2008.

He alleged that the defendants used a “carefully contrived mechanism” to hide the additional fees with two Advisory Service Agreements that were not genuine, but a dishonest way of paying the Qataris extra and hiding the fees from the wider world.

The men sat impassively in the narrow, raised glass-surrounded dock.

The seven-year case is a rare example of a criminal prosecution of senior bankers at a global bank over conduct during the credit crunch more than a decade ago — and a high stakes trial for the SFO.

Jenkins is the former chairman of investment banking in the Middle East and north Africa, Kalaris headed the bank’s wealth division at the time and Richard Boath was the investment bank division’s head of corporate finance in EMEA.

Jenkins, 64, Kalaris, 63, and 60-year-old Boath are each charged with substantive fraud and conspiracy to commit fraud by false representation.

The three men each face both charges over the June capital raising, which include an allegation they conspired with former finance director Chris Lucas to make dishonest representations in public documents for profit or to expose others to loss.

Jenkins also faces both charges over the second fundraising four months later.

Lucas has not been charged because he is too ill to stand trial, the jury was told. Qatar, a major investor in Britain, has not been accused of wrongdoing.

Former Barclays bankers lied about Qatari fees in 2008, fraud trial hears

Former Barclays bankers lied about Qatari fees in 2008, fraud trial hears

- The 3 have been charged with conspiracy to commit fraud over a June 2008 bid to raise capital

- Allegations include conspiring to make dishonest representations in public documents for profit or to expose others to loss

First EU–Saudi roundtable on critical raw materials reflects shared policy commitment

RIYADH: The EU–Saudi Arabia Business and Investment Dialogue on Advancing Critical Raw Materials Value Chains, held in Riyadh as part of the Future Minerals Forum, brought together senior policymakers, industry leaders, and investors to advance strategic cooperation across critical raw materials value chains.

Organized under a Team Europe approach by the EU–GCC Cooperation on Green Transition Project, in coordination with the EU Delegation to Saudi Arabia, the European Chamber of Commerce in the Kingdom and in close cooperation with FMF, the dialogue provided a high-level platform to explore European actions under the EU Critical Raw Materials Act and ResourceEU alongside the Kingdom’s aspirations for minerals, industrial, and investment priorities.

This is in line with Saudi Vision 2030 and broader regional ambitions across the GCC, MENA, and Africa.

ResourceEU is the EU’s new strategic action plan, launched in late 2025, to secure a reliable supply of critical raw materials like lithium, rare earths, and cobalt, reducing dependency on single suppliers, such as China, by boosting domestic extraction, processing, recycling, stockpiling, and strategic partnerships with resource-rich nations.

The first ever EU–Saudi roundtable on critical raw materials was opened by the bloc’s Ambassador to the Kingdom, Christophe Farnaud, together with Saudi Deputy Minister for Mining Development Turki Al-Babtain, turning policy alignment into concrete cooperation.

Farnaud underlined the central role of international cooperation in the implementation of the EU’s critical raw materials policy framework.

“As the European Union advances the implementation of its Critical Raw Materials policy, international cooperation is indispensable to building secure, diversified, and sustainable value chains. Saudi Arabia is a key partner in this effort. This dialogue reflects our shared commitment to translate policy alignment into concrete business and investment cooperation that supports the green and digital transitions,” said the ambassador.

Discussions focused on strengthening resilient, diversified, and responsible CRM supply chains that are essential to the green and digital transitions.

Participants explored concrete opportunities for EU–Saudi cooperation across the full value chain, including exploration, mining, and processing and refining, as well as recycling, downstream manufacturing, and the mobilization of private investment and sustainable finance, underpinned by high environmental, social, and governance standards.

From the Saudi side, the dialogue was framed as a key contribution to the Kingdom’s industrial transformation and long-term economic diversification agenda under Vision 2030, with a strong focus on responsible resource development and global market integration.

“Developing globally competitive mineral hubs and sustainable value chains is a central pillar of Saudi Vision 2030 and the Kingdom’s industrial transformation. Our engagement with the European Union through this dialogue to strengthen upstream and downstream integration, attract high-quality investment, and advance responsible mining and processing. Enhanced cooperation with the EU, capitalizing on the demand dynamics of the EU Critical Raw Materials Act, will be key to delivering long-term value for both sides,” said Al-Babtain.

Valere Moutarlier, deputy director-general for European industry decarbonization, and directorate-general for the internal market, industry, entrepreneurship and SMEs at European Commission, said the EU Critical Raw Materials Act and ResourceEU provided a clear framework to strengthen Europe’s resilience while deepening its cooperation with international partners.

“Cooperation with Saudi Arabia is essential to advancing secure, sustainable, and diversified critical raw materials value chains. Dialogues such as this play a key role in translating policy ambitions into concrete industrial and investment cooperation,” she added.