KARACHI: Makkah and Karachi chambers of commerce and Industry have agreed to offer each other their respective premises for promotion of bilateral trade and investment, officials told Arab News on Tuesday.

“We have decided to sign an MoU under which the KCCI (Karachi Chamber of Commerce and Industry) will utilize the facilities of MCCI (Makkah Chamber of Commerce and Industry) in Saudi Arabia and the MCCI will utilize KCCI facilities for growth of bilateral trade and investment,” Junaid Ismail Makda, president of the KCCI told Arab News from Makkah who is on official visit of kingdom.

The two sides also agreed to exchange trade delegations to explore existing trade and investment opportunities in both countries, Makda said.

The Saudi delegation was led by Hisham Muhammad Kaaki, Chairman of the MCCI and also comprised of Ibrahim Fuad Bardeesi, secretary General of the Makkah Chamber and Fahad S. Damanhouri, Director of International Relations department of Makkah Chamber.

Makda who met with the officials of Saudi Export Development Authority (SEDA) on Monday, said that the authority had expressed its desire to host Pakistani importers of assorted products including construction and PVC pipes.

Earlier on Friday, the MCCI chief met with his Pakistani counterpart in Karachi to explore ways of jointly developing the business sector of the two countries.

The meeting, headed by the visiting Saudi official, aimed at strengthening bilateral ties and to mull over areas of shared interests for the business community in Saudi Arabia and Pakistan, the Saudi Press Agency (SPA) reported.

Kaaki said that the visit to KCCI would help strengthen mutual cooperation, exchange of expertise, arrange bilateral visits and events, in addition to organizing forums and exhibitions to help develop private sector and result in strong ties between the entrepreneurs on both sides.

He added that interaction between the Saudi and Pakistani business community can be enhanced through various mutual activities, exhibitions and joint investments.

He lauded the relations between the two countries noting that he highly valued his visit to KCCI, which was Pakistan’s largest business body.

Ismail highlighted that Pakistan had a well developed textile and military industry, in addition to offering prospects in technology sector, civil engineering and other scopes of mutual interest. Organizing exhibitions would help strengthen bilateral ties indeed, he said.

The non-oil Saudi exports to Pakistan in the last five years are estimated at SR17 billion ($4.42 billion), including food items and construction material estimated at SR191 million and SR965 million respectively.

The Kingdom is one of the top exporters to Pakistan, while the latter exports textile goods, cloth, processed cotton, rice, meat, fruits, vegetables, spices, leather products, electronic and chemicals to Saudi Arabia.

Makkah, Karachi chambers to ink MoU boosting bilateral trade

Makkah, Karachi chambers to ink MoU boosting bilateral trade

- Saudi Arabia is one of the top exporters to Pakistan

- Mutual events and joint investment can help enhance bilateral business ties, says MCCI chief

Pakistan PM, Kuwaiti emir discuss transformation of bilateral ties into economic partnership

- The meeting came on the sidelines of a two-day World Economic Forum summit in Riyadh

- PM Shehbaz Sharif assured of efficient implementation of Pakistan-Kuwait deals signed in Nov.

ISLAMABAD: Pakistan Prime Minister Shehbaz Sharif on Sunday met with Emir of Kuwait Sheikh Mishal Al-Ahmad Al-Jaber Al-Sabah in Riyadh and discussed with him transformation of Pakistan-Kuwait ties into an economic partnership, Sharif’s office said.

The meeting came on the sidelines of a two-day World Economic Forum (WEF) summit on global collaboration, growth and energy on April 28-29.

PM Sharif thanked Sheikh Mishal for his congratulatory letter upon his re-election and congratulated him on assuming the role of the emir of Kuwait.

“The Prime Minister expressed his desire to work closely with His Highness to transform bilateral ties into a mutually beneficial economic partnership that would serve the best interests of the peoples of both countries,” Sharif’s office said in a statement.

The development came months after Pakistan and Kuwait signed several trade and investment agreements worth $10 billion during the visit of caretaker Pakistan PM Anwaar-ul-Haq Kakar to the Gulf country.

Besides these agreements, the two countries had signed three memorandums of understanding (MoUs) in the fields of culture, environment and sustainable development.

Pakistan’s army chief, General Asim Munir, had also accompanied the caretaker prime minister on the Kuwait visit in November, which was part of the Pakistani leadership’s ambitious plan to attract investment from the Middle East amid an economic slowdown at home.

“The Prime Minister assured the Kuwaiti leadership that these MoUs and agreements would be implemented in an efficient and timely manner,” the statement added.

“In addition to bilateral ties, the regional situation, particularly with regards to the crisis in Gaza, was also discussed.”

PM Sharif, IMF chief discuss Pakistan’s new loan program on WEF sidelines in Riyadh

- Pakistan’s $3 billion IMF loan program, which helped Islamabad avert a default last year, is due to end this month

- Pakistan faces a chronic balance of payments crisis, with nearly $24 billion to repay in debt over next fiscal year

ISLAMABAD: Pakistan Prime Minister Shehbaz Sharif on Sunday met with International Monetary Fund (IMF) Managing Director Kristalina Georgieva in Riyadh, where the two figures discussed a new loan program for the cash-strapped South Asian country, Sharif’s office said.

The meeting between PM Sharif and the IMF managing director took place on the sidelines of a two-day World Economic Forum (WEF) summit on global collaboration, growth and energy in the Saudi capital on April 28-29.

Sharif thanked Georgieva for her support to Pakistan in securing a $3 billion IMF loan program last year that is due to expire this month. The IMF executive board is expected to meet on Monday to decide on the disbursement of the final tranche of $1.1 billion to Pakistan.

“MD IMF shared her institution’s perspective on the ongoing program with Pakistan, including the review process,” PM Sharif’s office said in a statement.

“Both sides also discussed Pakistan entering into another IMF program to ensure that the gains made in the past year are consolidated and its economic growth trajectory remains positive.”

Sharif informed the IMF chief that his government was fully committed to put Pakistan’s economy back on track, according to the statement.

He said he had directed his financial team, led by Finance Minister Muhammad Aurangzeb, to carry out structural reforms, ensure strict fiscal discipline and pursue prudent policies that would ensure macro-economic stability and sustained economic growth.

Pakistan secured the $3 billion IMF program in June last year, which helped it avert a sovereign default. Islamabad says it is seeking a loan over at least three years to help achieve macroeconomic stability and execute long-overdue reforms.

Finance Minister Aurangzeb has said Islamabad could secure a staff-level agreement on the new program by early July, though he has declined to detail what size of the program it seeks. If secured, it would be Pakistan’s 24th IMF bailout.

The $350 billion South Asian economy faces a chronic balance of payments crisis, with nearly $24 billion to repay in debt and interest over the next fiscal year — three-time more than its central bank’s foreign currency reserves.

Pakistan’s finance ministry expects the economy to grow by 2.6 percent in the fiscal year ending in June, while average inflation for the year is projected to stand at 24 percent, down from 29.2 percent the previous fiscal year.

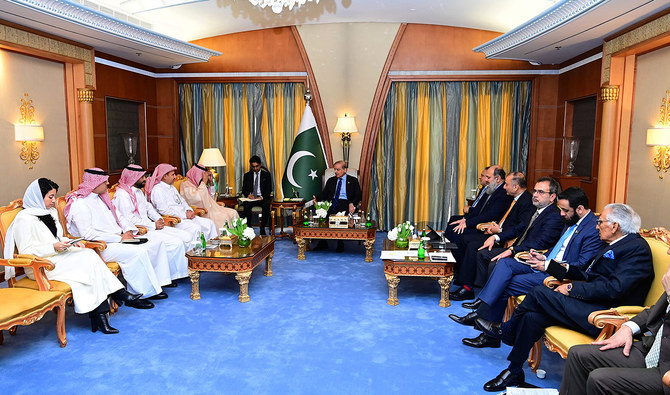

Saudi ministers assure PM Sharif of support for Pakistan’s development — PM’s office

- PM Shehbaz Sharif is in Riyadh to attend WEF meeting on global collaboration, growth and energy

- On Sunday, he met with Saudi Arabia’s minister of finance, investment, and industry and minerals

ISLAMABAD: Prime Minister Shehbaz Sharif on Sunday met with Saudi Arabia’s ministers of finance, investment and industry in Riyadh on the sidelines of a World Economic Forum (WEF) meeting, Sharif’s office said, adding that the Saudi ministers assured him of the Kingdom’s support for Pakistan’s development.

The Pakistan prime minister arrived in Riyadh on Saturday to attend the WEF meeting on global collaboration, growth and energy on April 28-29, after being extended an invitation by Crown Prince Mohammed bin Salman and Professor Klaus Schwab, the WEF executive chairman.

On the sidelines of the WEF meeting, Sharif held separate meetings with Saudi Arabia’s Finance Minister Mohammed Al-Jadaan, Investment Minister Khalid Al-Falih, and Industry and Mineral Resources Minister Bandar Alkhorayef, according to the Pakistan PM’s office.

In his meeting with the Saudi finance minister, the two sides agreed that Saudi Arabia would explore more opportunities for investment in Pakistan.

“The Saudi finance minister reiterated Saudi Arabia’s support for Pakistan’s economic development,” Sharif’s office said in a statement.

The Saudi investment minister acknowledged PM Sharif’s efforts for Pakistan’s growth and prosperity.

“A delegation of Saudi investors will soon visit Pakistan,” he was quoted as saying by Sharif’s office.

“Pakistan is our priority in terms of investment. Both sides will continue to fully cooperate in agriculture, information technology (IT) and energy sector.”

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the top source of remittances to the cash-strapped South Asian country.

Both Pakistan and Saudi Arabia have been closely working to increase their bilateral trade and investment, and the Kingdom recently reaffirmed its commitment to expedite an investment package worth $5 billion discussed previously with Islamabad.

In his meeting with the prime minister, Saudi Arabia’s Industry and Mineral Resources Minister Bandar Alkhorayef expressed “deep interest” in cooperation with Pakistan in agriculture, minerals, IT and other sectors, according to Sharif’s office.

“I am in touch with Saudi private companies regarding investment in Pakistan and [representatives of] these companies will visit Pakistan very soon,” the Saudi minister was quoted as telling PM Sharif.

“Cooperation between private sectors of the two countries is among our top priorities.”

PM Sharif thanked Saudi Arabia’s King Salman and Crown Prince Mohammed bin Salman as well as the Saudi ministers for supporting Pakistan in every difficulty.

“During my previous government, our economic situation improved, thanks to Saudi Arabia’s support and assistance,” he said, describing both countries as strategic partners.

Pakistan’s Foreign Minister Ishaq Dar, Finance Minister Muhammad Aurangzeb and other members of PM Sharif’s cabinet were also present at the meetings.

Foreign Minister Ishaq Dar appointed deputy prime minister of Pakistan

- Dar, a chartered accountant and a seasoned politician, is considered closest ally of Nawaz Sharif, PM Shehbaz Sharif’s elder brother and three-time former PM

- Many believe Dar’s appointment indicates that Nawaz, who didn’t take PM’s office due to split mandate in Feb.8 vote, is trying to assert his control indirectly

ISLAMABAD: Pakistan Prime Minister Shehbaz Sharif has appointed Foreign Minister Ishaq Dar deputy prime minister of the country, the Pakistani government said on Sunday.

Dar, who is a former four-time finance minister of Pakistan, was earlier made the head of a special committee of PM Sharif’s cabinet on privatization.

The 73-year-old chartered accountant is considered to be the closest ally of PM Sharif’s elder brother, Nawaz Sharif, who is also a three-time former prime minister.

“The prime minister has been pleased to designate Mr.Mohammad Ishaq Dar, Federal Minister for Foreign Affairs, as Deputy Prime Minister with immediate effect and until further orders,” read a notification issued from the Cabinet Division.

Nawaz, who returned to Pakistan in October 2023 after having spent years in self-exile, was seen as the favorite candidate for the PM’s office ahead of the Feb. 8 national election and was widely believed to be backed by the country’s powerful army.

But the three-time former prime minister decided not to take the PM’s office after the Feb. 8 vote did not present a clear winner, leading to speculation that his role in the country’s politics had come to an end.

But many believe Dar’s appointment to the deputy prime minister’s slot is an indication that Nawaz is trying to assert his control of government through indirect ways.

Prior to Dar, Chaudhry Pervaiz Elahi was appointed the deputy prime minister of Pakistan in 2012.

In Pakistan’s Peshawar, famed ‘Taj Soda’ has been cooling summers for nearly 90 years

- Taj Soda in Peshawar’s historic Qissa Khwani bazaar offers raspberry, blueberry, mint and several other seasonal flavors

- For some, the establishment, set up in 1936, provides an alternative to the city’s famed ‘qahwa,’ or green tea, in summers

PESHAWAR: One is greeted by the sounds of glass bottles clinking and their brass lids pop-opening as they enter a nearly 90-year-old soft drink outlet, named ‘Taj Soda,’ in the historic Qissa Khwani bazaar in the northwestern Pakistani city of Peshawar.

The visitors are led through a three-feet-wide passage into a hall room, which boasts benches and tables for customers to sit and enjoy their favorite drinks, with its walls adorned with pictures that depict the city’s history through the ages.

Taj Soda, established by Taj Muhammad more than a decade before the partition of the Indian subcontinent, claims to be the “oldest” carbonated drink outlet in Pakistan, which few say provides an alternative to Peshawar’s famed ‘qahwa,’ or green tea, in summers.

“My grandfather’s name was Taj Muhammad, who established this business in 1936. After him, my father Mukhtar Hussain, may he rest in peace, he ran the business for his whole life for 76 years,” Waqas Hussain, Muhammad’s 33-year-old grandson who currently runs the establishment, told Arab News on Friday.

“Our work goes on in six months of summer.”

The outlet, which offers a range of flavors like raspberry, blueberry, pomegranate, apple, rose, banana, mango and mint, is mostly frequented by customers from April till September, though it offers the cherished soft drinks round the year, according to the owner.

A simple drink, made with carbonated water, sugar, sodium citrate and benzoate, is sold for Rs50, while those with the addition of milk cost Rs80.

“We start [selling] soup in winter and we do serve cold drinks, soda water, but it is not like this [as high in demand as in summers],” Hussain said.

Usman Khan, a 21-year-old resident of Peshawar who took a group of friends on a tour of the city, said he brought them to Taj Soda to introduce them to the historic establishment, which was said to be older than even 7 Up, an American brand of lemon lime-flavored, non-caffeinated soft drink.

“They all are my friends, they are from different places. One is from Balochistan and the other is from Kohistan [in Khyber Pakhtunkhwa]. I have brought all of them here,” Khan told Arab News.

“The reason is that it is an old building and was made in 1936. I heard that Taj Soda was established [even] before 7 Up, but this is our bad luck that ... Taj Soda is restricted only to this place. No one knows about it outside [the city].”

But for Hussain, Taj Soda means more than just profit. It is about keeping the legacy of his father and grandfather alive.

“We try not to spoil the name of [our] elders and make the best product, and people trust us,” he told Arab News, with a sense of pride.

“Wherever we go, people know us. We feel happy about it.”