DETROIT: The United Auto Workers (UAW) said on Sunday that its roughly 48,000 hourly workers at General Motors Co. facilities would go on strike after US labor contract talks reached an impasse, the first nationwide strike at GM in 12 years.

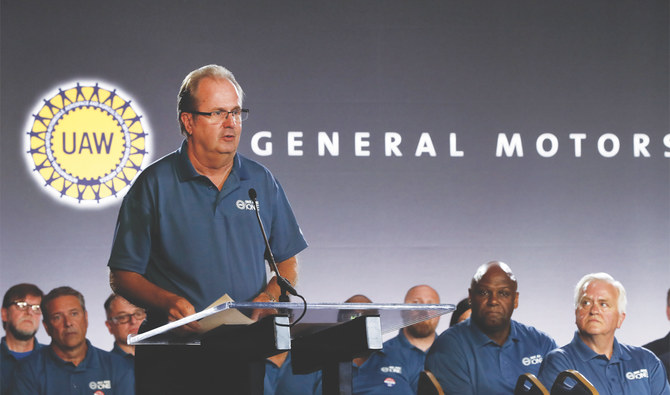

“We do not take this lightly,” Terry Dittes, the UAW vice president in charge of the union’s relationship with GM, said at a press conference in downtown Detroit. “This is our last resort.”

GM said in a statement that its offer to the UAW during talks included more than $7 billion in new investments, 5,400 jobs — a majority of which would be new — pay increases, improved benefits and a contract ratification bonus of $8,000.

“We have negotiated in good faith and with a sense of urgency,” the automaker said.

A strike will very quickly shut down GM’s operations across North America and could hurt the broader US economy.

A prolonged industrial action would also cause hardship for GM hourly workers on greatly reduced strike pay.

GM’s workers last went out on a brief two-day strike in 2007 during contract talks. A more painful strike occurred in Flint, Michigan, in 1998, lasting 54 days and costing the No. 1 US automaker more than $2 billion.

As of Sunday, talks between GM and the UAW had been suspended, according to people familiar with the matter.

The union has been fighting to stop GM from closing auto assembly plants in Ohio and Michigan and arguing workers deserve higher pay after years of record profits for GM in North America. GM argues the plant shutdowns are necessary responses to market shifts, and that UAW wages and benefits are expensive compared with competing non-union auto plants in southern US states.

In its statement, the automaker said its offer to the union included solutions for the Michigan and Ohio assembly plants currently lacking products.

A person familiar with GM’s offer said that could include producing a future electric vehicle in Detroit.

It could also include turning a plant in Lordstown, Ohio, into an electric vehicle battery plant or going through with the proposed sale of the plant to a group affiliated with electric vehicle start-up Workhorse Group Inc.

A new battery plant could give some UAW workers at Lordstown the chance to remain with GM.

The closure of Lordstown drew widespread criticism, including from US President Donald Trump. Ohio is crucial to Trump’s re-election bid in 2020.

The union has framed the plant closures as a betrayal of workers who made concessions in 2009 to help GM through its government-led bankruptcy.

“General Motors needs to understand that we stood up for GM when they needed us,” Ted Krumm, head of the union’s bargaining committee in talks with GM, said at the press conference Sunday. These are profitable times ... and we deserve a fair contract.”

The UAW says significant differences remain between both sides over wages, health care benefits, temporary employees, job security and profit sharing.

The strike will test both the union and GM Chief Executive Mary Barra at a time when the US auto industry is facing slowing sales and rising costs for launching electric vehicles and curbing emissions.

Kristin Dziczek, vice president of industry, labor and economics at the Ann Arbor, Michigan-based Center for Automotive Research (CAR), said the strike at GM’s US facilities will also shut its plants in Canada and Mexico as the automaker’s supply chain is so integrated.