BEIJING: Chinese imports of American goods plunged in July as a tariff war with Washington intensified. Imports of US goods fell 19 percent from a year earlier to $10.9 billion, customs data showed Thursday, though that was an improvement over June’s 31.4 percent fall. Exports to the US declined 6.5 percent to $38.8 billion.

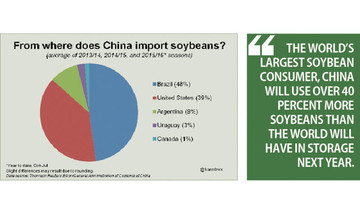

Beijing has retaliated for US tariff hikes in a dispute over trade and technology by imposing its own punitive duties and suspending purchases of American soybeans and other goods.

The latest data follow President Donald Trump’s threat last week to extend punitive duties to an additional $300 billion of Chinese imports. China’s total exports rose 3.3 percent over a year earlier to $221.5 billion, rebounding from June’s 1.3 percent contraction amid weakening global consumer demand. Imports shrank 5.6 percent to $176.4 billion, an improvement over the previous month’s 7.3 percent decline.

“Shipments in and out of China held up better than expected last month, but a sustained turnaround still looks unlikely in the near-term,” said Julian Evans-Pritchard of Capital Economics in a report.

China’s central bank rattled global financial markets this week by allowing its yuan to weaken to an 11-year low against the US dollar. That would make Chinese goods less expensive abroad but the currency’s 5 percent decline this year against the dollar is too small to completely offset US tariffs of 25 percent.

China’s global trade surplus widened by 60 percent over a year ago to $45.1 billion.

The surplus with the US was little changed but stood at $28 billion, a level that might fuel American pressure for Chinese concessions in trade talks.

Washington and Beijing are locked in an increasingly costly tariff war over US complaints China steals or pressures companies to hand over technology. The US and other Chinese trading partners complain Beijing’s plans for government-led development of global competitors in robotics and other fields violates its market-opening commitments.

Trade has weakened since Trump started hiking tariffs on Chinese goods last June. Beijing retaliated with its own penalties and ordered importers to find non-US suppliers.

Trump and President Xi Jinping agreed in June to resume negotiations but talks last week in Shanghai ended with no sign of agreement. Envoys are due to meet again next month.

Economists warn the truce is fragile because the two sides still are separated by the disagreements that caused talks to break down in May.

Trade weakness has added to pressure on Xi’s government to shore up economic growth and avoid politically dangerous job losses.

Beijing agreed last year to narrow its trade surplus with the US by buying more American natural gas and other exports but scrapped that plan after one of Trump’s tariff hikes. The Chinese government said in June that any purchases must be at a reasonable level, suggested Beijing was becoming more cautious about making big commitments before it sees what Washington offers in exchange.