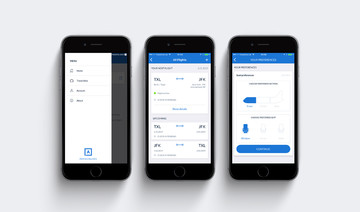

The airline industry’s US trade group is predicting another record for summer travel.

Airlines for America forecast Tuesday that 257.4 million people will fly on US carriers between June 1 and Aug. 31.

That’s a 3.4 percent increase over last summer, and it works out to about 2.8 million travelers a day.

The trade group says airlines are adding 111,000 seats per day, more than the predicted 93,000 increase in daily passengers.

According to the US Bureau of Transportation Statistics, the average inflation-adjusted price for a domestic ticket has dropped for four straight years to the lowest level since the agency began tracking the fare prices in 1995. But those numbers don’t include all the extra fees that airlines now charge.

Airline group predicts another record for summer travel

Airline group predicts another record for summer travel

- Airlines for America forecast that 257.4 million people will fly on US carriers between June 1 and August 31

- The trade group says airlines are adding 111,000 seats per day

Global conference in Riyadh spotlights procurement and supply chain challenges

RIYADH: Key issues concerning procurement and supply chains will take center stage at a global conference in the Saudi capital, featuring over 35 international speakers.

The upcoming CIPS MENA Conference and Excellence in Procurement Awards, slated to be hosted by the Government Expenditure and Projects Efficiency Authority on May 16 at the Hilton Riyadh Hotel and Residences, reflects the Kingdom’s position as a hub of expertise in procurement and supply chains, according to the Saudi Press Agency.

The agenda will address critical topics, including building sustainable supply chains, enhancing local content, and promoting industry localization. It will also tackle current supply chain challenges and discuss the digital transformation in procurement and corruption in public procurement.

The conference will also focus on building partnerships between organizations in the private sector and government agencies, targeting specialists in the field of procurement and supply chains in the public and the private sectors, decision-makers in the field, and procurement technical systems companies.

Oil Updates – prices rise on US inventories drawdown expectations, CPI focus

SINGAPORE: Oil prices rose on Wednesday on expectations for higher demand as the US dollar weakened and a report showed US crude and gasoline inventories fell while the release of inflation data may point to a more supportive economic outlook, according to Reuters.

Brent crude futures were up 51 cents, or 0.6 percent, at $82.89 a barrel at 9:30 a.m. Saudi time. US West Texas Intermediate crude futures rose 55 cents, or 0.7 percent, to $78.57 a barrel.

US crude oil inventories fell 3.104 million barrels in the week ended May 10, according to market sources citing American Petroleum Institute figures on Tuesday. Gasoline inventories fell by 1.269 million barrels and distillates rose by 673,000 barrels.

US government inventory data is due later on Wednesday and are likely to also show a drop in crude stockpiles as refineries increase their runs to meet increased fuel demand heading into the peak summer driving season.

“Expectations of another drawdown in US oil inventories should support oil prices,” ANZ Research said in a note.

US consumer price index data is also due on Wednesday and should give a clearer indication whether the Federal Reserve may cut interest rates later this year, which could spur the economy and boost fuel demand.

Oil prices also found support from a softer US dollar and stimulus measures from China, said independent market analyst Tina Teng, with a weaker greenback making dollar-denominated oil cheaper for investors holding other currencies.

Teng was referring to China’s plans to raise 1 trillion yuan ($138.39 billion) in long-term special treasury bonds this week to raise funds to stimulate key sectors of its flagging economy, which is the world’s largest oil importer.

“The US CPI and China’s economic data are key to driving oil prices for the rest of the week,” she added. China will release economic activity data on Friday.

Prices were also supported by concerns around Canadian oil supply, a key exporter to the US

A large wildfire is approaching Fort McMurray, the hub for Canada’s oil sands industry that produces 3.3 million barrels per day of crude, or two-thirds of the country’s total output.

Saudi inflation steady at 1.6% in April, driven by housing prices

RIYADH: Saudi Arabia’s inflation remained steady at 1.6 percent in April for the second month in a row, driven by changes in housing prices.

The latest report from the General Authority for Statistics indicated that the Kingdom’s Consumer Price Index experienced a marginal increase of 0.3 percent in April compared to March.

The monthly inflation index was impacted by a 0.4 percent increase in the prices of housing, water, electricity, gas, and other fuels, which was primarily due to a 0.4 percent rise in actual housing rents and prices.

Additionally, the prices of personal goods and services increased by 1.2 percent. Similarly, food and beverage prices rose by 0.2 percent, clothing and footwear by 0.6 percent, and recreation and culture by 0.7 percent.

Conversely, prices in the furnishing and home equipment category declined by 0.5 percent, driven by a 0.5 percent decrease in the prices of furniture, carpets, and flooring.

However, the prices of services such as education, communications, health, and tobacco products did not show any significant change in April.

Annual inflation rises

However, on a yearly basis, the Kingdom’s CPI increased by 1.6 percent in April compared to the same period last year.

This rise is primarily attributed to a 9.4 percent increase in villa rents and a 0.8 percent rise in food and beverage prices.

Prices in restaurants and hotels also rose by 2 percent, driven by a 1.8 percent increase in food service prices. Meanwhile, the education sector witnessed a 1.1 percent increase, driven by a 4.1 percent rise in fees for intermediate and secondary education.

In contrast, prices for furnishings and home equipment decreased by 3.9 percent, influenced by a 6.0 percent decline in the prices of furniture, carpets, and flooring.

Similarly, prices in clothing and footwear decreased by 4.2 percent, influenced by a 6.6 percent decline in ready-made clothing prices. Transportation prices also decreased by 1.6 percent, affected by a 2.9 percent decrease in vehicle purchase prices.

According to GASTAT, rental prices were the main driver of inflation in April compared to the corresponding period in 2023.

“Actual housing rents increased by 10.4 percent in April 2024, influenced by the increase in villa rents by 9.4 percent. The increase in this category had a significant impact on maintaining the annual inflation rate for April 2024, given the weight this group represents (21.0 percent),” stated the GASTAT report.

Wholesale price index

In another report, GASTAT noted that Saudi Arabia’s wholesale price index rose by 3.4 percent in April compared to the same month in 2023.

This rise in the WPI was driven by a 14.5 percent increase in the prices of basic chemicals and a 12 percent jump in the prices of refined petroleum products.

In the fourth month of the year, prices for food products, beverages, tobacco, and textiles increased by 2.4 percent. This was primarily due to a 10.1 percent increase in the prices of leather, leather products, and footwear, and a 5 percent rise in the prices of grain mills, starch, and other food products.

Additionally, prices for agricultural and fishery products rose by 0.2 percent, driven by a 2.0 percent increase in prices for live animals and animal products.

Conversely, prices for ores and minerals dropped by 2.2 percent, largely due to a 2.2 percent decline in the prices of stone and sand.

Additionally, prices for metal products, machinery, and equipment fell by 0.6 percent. Significant decreases were observed in the prices of radio, television, and communication equipment by 6.7 percent, and office, accounting, and computing machinery by 2.7 percent.

The WPI decreased by 0.4 percent in April compared to March, primarily due to a 0.9 percent drop in the prices of other transportable goods, driven by an 8.0 percent decrease in the prices of basic chemicals.

Prices for agriculture and fishery products fell by 0.1 percent, influenced by a 0.4 percent decline in the prices of live animals and animal products. Ores and minerals saw a 0.1 percent decrease, mainly due to a 0.1 percent drop in the prices of stone and sand.

Conversely, prices for food products, beverages, tobacco, and textiles rose by 0.1 percent, due to a 0.2 percent increase in prices for meat, fish, fruit, vegetables, oils, and fats, along with a 0.1 percent rise in grain mills, starch, and other food product prices.

Additionally, prices for metal products, machinery, and equipment increased by 0.1 percent, driven by a 0.8 percent rise in the prices of basic metals.

Average prices up

In a separate analysis, GASTAT noted that in April, Abu Sorry Egyptian orange and Turkish plums saw the most significant upticks compared to the prior month, with increases of 18.09 percent and 12.82 percent, respectively.

Additionally, Pakistani mandarin and Lebanese grapes also experienced notable increases, rising by 9.11 percent and 5.88 percent, respectively.

Conversely, the goods and services showing substantial percentage drops in April, compared to March, were local and imported onions, experiencing decreases of 12.15 percent and 9.13 percent, respectively.

Additionally, local cucumbers and yellow apples also saw notable declines, with decreases of 6.35 percent and 5.40 percent, respectively.

Saudi-UK partnerships drive trade surge with over 60 initiatives across 13 sectors

RIYADH: Partnerships between Saudi Arabia and the UK cover over 60 initiatives across 13 sectors, with trade between the countries up a third since 2018, according to a top official.

Speaking during the opening remarks of the GREAT Futures Initiative Conference held in Riyadh, the Kingdom’s Minister of Commerce, Majid Al-Qasabi, noted that bilateral trade surged between 2018 and 2023, exceeding £79 billion ($99.12 billion).

With over 1,100 active licenses for UK investors, developments such as the giga-projects in Saudi Arabia and policy reforms are strengthening business opportunities in the Kingdom.

“The growth and the inflow of trade is matched by the growth in foreign direct investment. In 2022 alone, the inflow of British investment into (the) Saudi economy reached more than £4.3 billion,” Al-Qasabi said.

He added: “Our strong bilateral economic ties are underpinned by strong educational and cultural ties. In the academic years of 2020 to 2023, 14,000 Saudi students were pursuing their higher education in the UK.”

The UK’s Deputy Prime Minister Oliver Dowden used his appearance on a panel alongside Al-Qasabi to say that he is “particularly excited about sports and tourism” when it comes to increased cooperation with the Kingdom.

“We will enhance decision-making and collaborations across various sectors, which is wonderful and amazing, enhancing our prosperity as two countries. We also look forward to these collaborations,” he said.

Highlighting the UK as the second largest exporter of services in the world, Al-Qasabi stated that Saudi Arabia is looking into new trade across the cultural, sports, and entertainment areas, as well as financial and insurance spheres.

However, Dowden noted that a few additional sectors, including technology and artificial intelligence, were not covered.

“I think there’s a lot more we can do to collaborate together because there’s huge expertise in artificial intelligence in Saudi Arabia,” Dowden said.

He also flagged up education as an area for growth, saying that by 2030 there should be 10 British schools in the Kingdom.

“Having a presence in Saudi Arabia has always been a strength to the British education system, so that’s a tremendously exciting area for us,” Dowden said, adding that healthcare is also an area for expansion.

Additionally, Saudi Minister of Investment Khalid Al-Falih highlighted that the second largest investor in Saudi Arabia is the UK, which has accumulated about $16 billion in investment stock.

He continued: “I will also mention our regional headquarters program where we have attracted over 400 global multinational companies to choose Saudi Arabia as their hub, I’d say as their home countries. I am proud and happy that 52 of those are from the UK and we are happy to offer this platform to grow and prosper.”

Al-Falih also stated that Saudi Arabia needs to develop a new economy, focusing on sectors that have been historically under-invested in, while also tackling global challenges.

The minister emphasized that the UK and Saudi Arabia, as leading G20 economies, are experiencing significant changes driven by megatrends such as energy and technological transitions, as well as challenges like AI and disruptions in global supply chains.

However, he said: “There needs to be green energy embedded in our supply chain. What we want to do is build these new supply chains that are built on … efficient logistics, technology, automation, Fourth Industrial Revolution, accessing critical materials, not only in the Kingdom but in Africa."

On a hosting front, Minister of Tourism Ahmed Al-Khatib stated that the Kingdom has witnessed a remarkable 390 percent increase in demand for tourism activity licenses, with over 165,000 British travelers visiting Saudi Arabia in the first quarter of this year.

“The issuance of 560,000 electronic visas to the UK tourists since 2019 underscores the growth in a growing interest in visiting our Kingdom. Our aim is to further increase connectivity and expand the presence of traditional sales operators,” Al-Khatib said.

Furthermore, the Secretary of State for Culture, Media and Sport of the UK, Lucy Frazer, stated that in 2022, the nation welcomed over 200,000 visitors from the Kingdom.

She quoted the UK’s national tourism agency VisitBritain’s latest forecast, which predicts 240,000 visits from Saudi Arabia this year.

“This is another area where you are testing the fundamentals. Looking up the tourism infrastructure needed to make Saudi Arabia a magnet for visitors doing what is needed to increase the number of annual travelers to the Kingdom from 14 million to 60 million in the next five years,” Frazer continued.

She also stated that many British sports stars will soon start playing in Saudi Arabia.

On the first day of the event, Red Sea Global CEO John Pagano stated that the first phase of project work will be completed in 2025, as the company is “currently working on the Red Sea International Airport project and have operated eight flights to Riyadh, Jeddah, and Dubai.”

Chemicals firm to open Saudi office

Maurits van Tol, CEO of Catalyst Technologies for Johnson Matthey, has announced that the company will open its office in Riyadh

“We traditionally have catered to the Kingdom from our offices in Bahrain and Abu Dhabi. But what we are also now, we will announce this week, is that we will open our office in Riyadh,” van Tol told Arab News.

“We just signed all the paperwork, and we will have the first people starting to work in the office very soon, and then we have a little bit of a bigger opening somewhat later in the year,” he said.

Van Tol said the office is set to open sometime between late summer and autumn with staff members from Saudi Arabia and the UK.

The company’s expansion is a part of Johnson Matthey’s aim to enhance local and regional collaboration.

Van Tol discussed the company’s expansion during a panel discussion titled “Powering a Greener Future” at the GREAT Futures event in Riyadh on May 13.

During the session, he highlighted Johnson Matthey’s technologies and their role in developing sustainable aviation fuel and other low-carbon solutions.

Van Tol said: “JM technologies will support KSA as it seeks to diversify its energy sources and reach its sustainability goals. We can and will help it make its vision to lead the world in making a circular carbon economy a reality.”

He said Johnson Matthey has been working in the region for 35 years, including collaborating with the King Abdullah University of Science and Technology.

“When you look at the Kingdom’s Vision 2030, there is a lot about reduce, reuse, recycle and remove … it’s also that place at the heart of what we do at Johnson Matthey,” Van Tol said.

“We design intrinsically energy-efficient technologies, but also we have a very broad suite of technologies that can convert renewables, including CO2, with renewable hydrogen, into synthetic aviation fuel,” he added.

Closing Bell: TASI edges down to close at 12,120 points

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Tuesday, losing 138.69 points, or 1.13 percent, to close at 12,120.91.

The total trading turnover of the benchmark index was SR7.31 billion ($1.94 billion) as 30 stocks advanced, while 200 retreated.

Similarly, the MSCI Tadawul Index decreased by 16.46 points, or 1.07 percent, to close at 1,519.37.

Also, the Kingdom’s parallel market, Nomu, slipped by 200.31 points, or 0.75 percent, to close at 26,659.06. This comes as 17 stocks advanced, while as many as 41 retreated.

The best-performing stock of the day was Al-Jouf Agricultural Development Co., whose share price surged by 7.58 percent to SR66.70.

Other top performers included Basic Chemical Industries Co. and Al-Babtain Power and Telecommunication Co., whose share prices soared by 5.36 percent and 3.91 percent, to stand at SR36.35 and SR46.50 respectively.

In addition to this, SAL Saudi Logistics Services Co. and Jadwa REIT Saudi Fund also fared well.

The worst performer was Saudi Public Transport Co. whose share price dropped by 9.92 percent to SR18.16.

On the announcements front, Hail Cement Co. announced its interim financial results for the period ending March 31, with revenues amounting to SR73.7 million, up from SR61.8 million in the corresponding period in 2023.

The company attributed the 19.2 percent growth to the increase in quantity of sales and average selling price.

On the contrary, net profits decreased to SR15 million in the first three months of 2024 from SR18.5 million in the same period in 2023, due to an increase in the cost of sales, zakat expense and selling and distribution expenses.

Taiba Investments Co. also announced its financial results for the same period with revenues amounting to SR332.07 million, up from SR110.96 million in the first three months of 2023.

In a statement on Tadawul, the company announced record revenue growth during the first quarter, attributed to Taiba Investment Co.’s acquisition of Dur Hospitality Co., which contributed to the rise in operational revenues.

It added that quarterly operating revenues rose up by SR221.1 million representing a 199.3 percent increase in comparison to the same quarter of the previous year.

Net profits also rose in this period reaching SR110.5 million, marking a 78 percent year-on-year increase.

This was attributed to higher hospitality revenues that were helped by the growth in the number of pilgrims and visitors, rising demand from the institutional sector, and the occurrence of numerous events and conferences in Riyadh during this period.

Rabigh Refining and Petrochemical Co.’s revenues in this period dipped by 27.2 percent to SR7.9 billion compared to SR10.9 billion in the first quarter of 2023.

This fall was attributed to lower sales volumes, due to the unplanned shutdown of the High Olefins Fluid Catalytic Cracker units for necessary repairs and maintenance work.

The company’s net loss surged to SR1.3 billion compared to SR964 million in the corresponding period last year.

The Saudi Public Transport Co.’s revenues slightly increased by 0.2 percent to SR308.5 million in the first quarter this year, compared to SR307.6 million in the corresponding period in 2023.

The increase in revenues in the current quarter compared to the same quarter of last year is attributed to increased operations during Ramadan, the company said in a statement.

Its net loss surged by 2.5 percent to reach SR48.6 million due to the recognition of loss in the joint venture, as well as the recording of a higher amount of impairment on trade receivables, and an increase in cost of finance.

Revenues of Emaar, The Economic City decreased sharply in the first three months of 2024 to SR75 million, down from SR157 million in the same period last year.

This 52 percent decline was mainly attributable to the decline in operational revenues, due to lower lease revenues resulting from the termination of certain leases.

The company’s net loss increased by 105.8 percent to reach SR352 million this year up from SR171 million in the first quarter of 2023.

It attributed this surge to a revenue decline, increased operational expenses, higher finance costs, and updated zakat expenses, with the latter being a one-time adjustment.