LONDON: The plunge in the value of the Turkish lira has fueled a foreign investor buying spree for Istanbul apartments, with the most interest coming from Gulf countries, according to market observers interviewed by Arab News.

Investors from the region are seeking to exploit the near 40 percent depreciation of the local currency against the dollar since January as a political spat with the US and market concern about the fragile Turkish economy has stoked a massive sell-off of the lira.

In an interview with Arab News, Cameron Deggin, founder of PropertyTurkey.com said: “In the last few weeks, unique visitor traffic to our site has more than doubled to over 5,000 a day. We can see from the data that most of the interest is from GCC countries, with Saudi Arabia — as the most populous GCC state — in the lead by a significant margin.”

Some of the Saudi interest, but not all, was from people who originally came from other Middle East states such as Jordan, Iraq and Tunisia, but who have had residency rights in KSA for many years, and in some cases are the children of families who arrived one two generations ago.

Over the past five years, Deggin said that Gulf investors had flocked to Istanbul, buying up apartments as second homes. This was more because they felt an affinity with Turkey as a Muslim country with a cultural vibe that they found appealing, rather than because they saw real estate as a canny investment, although the weakening lira has helped. That trend has accelerated this year as the currency crisis has intensified.

“You ask why GCC nationals are buying apartments that may fall further in value, and have already dropped about 35 percent? Well, my answer is that it’s because GCC investors are buying from the heart,” Deggin said. “At each training session, I tell my guys that GCC buyers might be saying they want an investment, but for 90 percent of them, the real motive is lifestyle. They just want a place in Istanbul. Investment is a secondary motive.

“Turkey is a stable country socially, culturally and demographically.”

Deggin predicted that when the lira stabilizes, the buying surge from outside the country will double as some investors with deep pockets were waiting on the sidelines as they were more risk averse.

Up to 2017, he said “if you had dollars in your pocket your investment was going up in value because the price increase was on average higher than the depreciation of lira.”

The big question now is what happens if the crisis worsens with a further cranking up of tensions between the US and Ankara.

Kate Everett-Allen, of global property consultancy Knight Frank, told Arab News: “Turkey has faced a number of political, economic and financial crises in recent years and yet, despite this, foreign interest has proved largely stable.”

Between January and March 2017, there were 4,316 sales to foreign buyers, in the same three-month period in 2018 this figure increased to 5,367 according to data from the Turkish Statistics Office, Turkstat.

For foreign investors, a 10 million-lira villa that would have cost roughly $1.9 million a few weeks ago, would now set them back only $1.57 million, a hypothetical saving of more than $300,000, according to Julian Walker, director of Spot Blue International Property, a London-based Turkish real estate portal, cited in a report by Mansion Global.

Walker said that tourism fuels the property market and this year had already been exceptional in spite of the state’s woes. Turkey logged a record 11.5 million foreign tourists in the first five months of 2018, a 30 percent jump over the same period last year, according to the Culture and Tourism Ministry.

Turkey saw a 22 percent spike in home sales to foreign buyers in 2017, according to a year-end report from the Turkish Statistical Institute.

However, not everyone is relaxed about the Turkish property market. The Guardian warned in a report on Aug. 23 that Turkey’s construction boom was built on cheap foreign loans and that with many construction materials sold in dollars, a crash could be round the corner with developers going bust.

Citing Kajin Bulut, who has worked in senior positions in forecasting and sales for a number of Turkish construction firms, told the Guardian: “The construction sector is like the head of a train — if it goes, the whole country goes.”

Turkish lira plunge sees Gulf property investors flock to Istanbul

Turkish lira plunge sees Gulf property investors flock to Istanbul

Closing Bell: Saudi benchmark index edged down to close at 12,381

RIYADH: Saudi Arabia’s Tadawul All Share Index slipped on Sunday, losing 102.46 points, or 0.82 percent, to close at 12,381.95.

The total trading turnover of the benchmark index was SR3.64 billion ($972 million), as 29 of the stocks advanced while 201 retreated.

Nomu, the Kingdom’s parallel market, also dropped 414.9 points, or 1.55 percent, to close at 26,277.06. This comes as 11 of the stocks advanced while as many as 50 retreated.

Meanwhile, the MSCI Tadawul Index slipped 9.52 points, or 0.61 percent, to close at 1,553.88.

The best-performing stock of the day on the main index was Al-Baha Investment and Development Co. The company’s share price surged 7.69 percent.

Other top performers included Saudi Cable Co. as well as Fawaz Abdulaziz Alhokair Co.

The worst performer was ACWA Power Co., whose share price dropped by 5.76 percent to SR425.

Saudi Ground Services Co. as well as Al-Babtain Power and Telecommunication Co. also did not perform well.

On the announcements front, Saudi Tadawul Group approved the distribution of dividends worth SR276 million to shareholders for the fiscal year ending Dec.31, 2023, with SR2.3 per share and 23 percent share par value.

Moreover, Dr. Sulaiman Al-Habib Medical Services Group announced its interim financial results for the period ending March 31.

According to a Tadawul statement, the company’s net profit hits SR550 million in the first quarter of 2024, reflecting a 12.6 percent surge compared to the same quarter last year.

The increase was mainly driven by revenue growth due to the jump in the number of patients.

Saudi Arabian Amiantit Co. also announced its interim financial results for the first three months of 2024.

A bourse filing revealed that the firm’s net profit reached SR474 million in the first quarter of the year, up 23,672 percent from the corresponding quarter in 2023.

This climb is mainly attributed to the company’s accounting profits which amounted to SR639 million in the current quarter.

Additionally, Arab National Bank announced its interim financial results for the first quarter of the year.

According to a Tadawul statement, the firm’s net profits rose 15.73 percent against the same quarter of the prior year to hit SR1.23.

The increase is primarily linked to net special commission income, net fees and commission income, and dividend income, among other reasons.

Saudi Steel Pipe Co. also announced its interim financial results for the period ending March 31.

A bourse filing revealed that the company’s net profit reached SR76 million in the first quarter of 2024, a 1,166 percent jump from the corresponding quarter in 2023.

This rise is due to an increase in gross profit coupled with a decrease in selling, marketing, and distribution expenses and a drop in trade receivable bad debt provision.

Meanwhile, Savola Group Co. announced the submission of an application to increase its capital by offering rights issues to the Capital Market Authority.

NEOM hosts global financial institutions, showcases progress and investment opportunities

RIYADH: Saudi giga-project NEOM hosted 52 global, regional, and local financial institutions, showcasing ongoing progress across key projects and highlighting investment opportunities.

The meeting also reviewed the progress and latest developments in key NEOM undertakings, including The Line, Oxagon, Trojena, and Sindalah, scheduled to open later this year.

The event showcased the giga-project’s commitment to sustainable growth and development, underscoring its focus on environmental, social, and governance principles.

A notable aspect of the visit included a review of The Line, where dignitaries observed the rapid progress of phase one construction and gained deeper insights into the initiative’s design.

Nadhmi Al-Nasr, CEO of NEOM, said: “Since inception, we have been establishing strong partnerships to help drive this grand vision forward. NEOM’s vast scale and expertise offer strong and ongoing commercial opportunities for global organizations, including financial institutions.”

He added: “We were pleased to host guests from some of the world’s leading financial institutions in NEOM recently to discuss collaborative avenues. NEOM is open for business and we welcome all interested parties to be part of our continued success.”

The event drew representatives from 24 international banks and financial institutions, including those from Germany, Spain, and France, as well as the UK, the US, and China. Additionally, representatives from Japan and South Korea attended the event.

In addition, 13 regional banks from Qatar, Kuwait, and the UAE attended, alongside 15 financial institutions from Saudi Arabia.

In June 2023, NEOM launched the largest public-private partnership for accommodation, valued at over SR21 billion ($5.67 billion).

It also announced an SR37.5 billion joint venture with global logistics company Denmark’s DSV in October 2023 to provide logistics services for the giga-project.

These announcements, along with other NEOM partnerships, were well-received by attendees at Discover NEOM China, an event held in Beijing, Shanghai, and Hong Kong earlier this month. The event attracted more than 500 senior business and industry leaders.

SR10bn credit facility

NEOM also announced the signing of a credit facility worth SR10 billion to meet its short-term financing requirements.

The facility, structured on Murabaha principles, is aimed at supporting the developmental stages of flagship projects like The Line, Oxagon, Trojena, and Sindalah.

Al-Nasr emphasized the strategic alignment of these credit facilities with the Kingdom’s broader economic goals under Vision 2030.

In a press release, he highlighted the collaborative effort of leading Saudi financial institutions in supporting one of the world’s most ambitious projects by providing diverse financing solutions that bolster NEOM’s infrastructure initiatives.

The agreement has garnered significant attention, involving nine prominent banks such as the National Commercial Bank, Riyad Bank, and Saudi First Bank, alongside other key financial players.

Homeland economies face growing challenges amid global turmoil, WEF special meeting in Riyadh told

- Partnerships and alliances essential to restore equilibrium, protect security, experts and ministers tell panel discussion

RIYADH: Tensions in the Red are weighing heavily on Egypt, adding to the burdens caused by recent global crises such as the war in Ukraine and the pandemic, the country’s minister of planning and economic development told the World Economic Forum special meeting.

Speaking during a panel discussion on “What Homeland Economics Means for Trade,” Hala Elsaid Younes said that Egypt, like the rest of the world, has faced unprecedented crises in recent years, stemming from climate change problems, the global pandemic, the Russian-Ukraine war, and now the conflict in Gaza.

In order to combat these problems, Egypt has been focusing on controlling inflation, and investing in its labor force and infrastructure, she said.

“What is taking place in the Red Sea at the moment, where 50 percent of shipments are now rerouting, has caused a massive recedes in our profits. Regional and international tensions have also led to a rise in interest rates and soaring food prices.

“If this continues, governments will have little capacity to take care of their poor. We are working very hard on investing in our infrastructure by building more ports, and high railways to link the Mediterranean and Red Sea with inland destinations to expand our exports. We are lucky that over 70 percent of our population are less than 40 years old, so we are also investing in vocational training.”

Aloke Lohia, CEO of petrochemical firm Indorama Ventures, said that the company had to make “significant pivots” in recent years.

“We had a brilliant 20-year run where geopolitics were stable, interest rates were low, and the petrochemical business was growing. However, this all changed after COVID and current wars. Consumer demands and production are not matching anymore, and we are reducing 10 percent of our capacity.

“Homeland economies are great for countries which can leverage it, but not all countries are capable. Some countries, like my own Thailand, have to rely on tourism. So we are now looking at manufacturing our products in countries like India, where a large population resides alongside a stable government,” Lohia said.

US Congressman Brad Schneider said many countries are “looking for leadership.”

He added: “Complexities and uncertainties produce challenges for business; we need to engage in partnerships and alliances. I believe the world is safer when the US is engaged with the rest of the world. Creating equilibrium will be easier established when there are partnerships.”

Ahn Duk-geun, South Korean minister of trade, industry and energy, said that the world is “entering a dangerous phase of industrial competition, and we have to find a way to contain this race that so it won’t cause too much trouble for global trade.”

Clifford Kupchan, CEO of the consulting firm Eurasia Group, highlighted the risks posed by artificial intelligence.

“If AI gets into the wrong hands, the results will be worrisome. It will be very easy to create deepfakes and to create destructive weaponry. This will create an imbalance in world powers,” he said.

“When we talk about homeland economics, national security intervening with trade, I don’t think the prognosis is very good. This applies whether it is (Joe) Biden or (Donald) Trump who will head the presidency. We can be heading toward strategical degradation between the US and China.”

Saudi Arabia committed to green technologies, energy minister says

DUBAI: Saudi Arabia is focused on the production of green molecules, said Prince Abdelaziz bin Salman Al Saud, the Kingdom’s minister of energy.

“Our plans are clear to everyone, we are focusing on the molecule,” the prince said at a World Economic Forum meeting in Riyadh. “Being environmentally conscious is our human duty, whatever we do today should not endanger any aspirations of future generations.”

In a session focused on green molecules such as biofuels, hydrogen, and their derivatives, experts discussed various countries’ plans on how to move forward with the production of green molecules.

For his part, Prince Abdelaziz said he believed the concept should be color agnostic, because the molecule business has to do with how we produce clean energy, and that has no color.

“There is a carbon footprint that we need to manage and mitigate. I think stigmatizing things might narrow our choices rather than expand (them). We believe, as Saudis, that we require all the sources of energy, be it nuclear, hydrocarbon-based, or synthetic fuels. We are open to choices.”

The prince also said the kingdom is “libertarian” in its business approach, willing to share the expertise with other countries and that it is already in business with some European states.

“While the technology remains challenging, we continue to work on it to make it accessible and affordable to all,” he said.

The United Arab Emirate’s Minister of Energy and Infrastructure Suhail Al Mazrouei said that, as in Saudi Arabia, leaders in the UAE are aware of the need to invest in new energy.

“The region has become important in tackling problems and coming up with solutions,” Al Mazrouei said. “Clean energy is something we decided to venture into 17 years ago as we were thinking about what is going to happen when we export the last barrel of oil.”

Echoing the prince’s remarks, Al Mazrouei said consumers should not be limited to those considered ready simply because they can afford the price.

“We are working on the technology to make it accessible to all,” he said.

Amani Abou Zeid, commissioner for infrastructure and energy of the African Union, said that Africa has different levels of development and needs and expressed the need for alternative power options.

“Overall we are still electrified in only 49 percent of the continent, so more than half of the population doesn’t have electricity. Africa can’t afford to discard any solution at this point.”

Patrick Pouyanne, chairman and CEO of TotalEnergies SE, alongside Shrikant Vaidya, chairman of India’s Oil Corporation, and Erasmo Carlos Battistella, CEO of Be8, reiterated the importance of accessibility and affordability when producing green molecules.

Despite the positives from those countries engaged in the production of green molecules, such as job creation, there is still a long way to go.

Prince Abdelaziz said: “I think we should be conscious of the fact that the challenge is big, we are still talking about artificial intelligence, the component of the electrification, and what is required for it; the world will require clean molecules (and) it is our hope that we all work together to ensure this happens.”

IsDB annual meeting sees signing of several deals

RIYADH: The 2024 annual meeting of the Islamic Development Bank Group saw the signing of several agreements, boosting the telecommunications sector in its member countries.

The Islamic Corporation for the Insurance of Investment and Export Credit, known as ICIEC, which specializes in providing Shariah-compliant insurance services and is a member of the IsDB, announced the inking of a memorandum of understanding with Huawei Technologies Ltd., the Saudi Press Agency reported.

The memorandum was signed by ICIEC CEO Osama Al-Qaisi and the chief operations officer of Huawei Technologies, Silas Zhang.

Under the agreement, ICIEC continues its collaboration with Huawei to enhance the telecommunications infrastructure and leverage advanced communication technology in IsDB member countries.

According to SPA, ICIEC will provide insurance solutions to support the provision of advanced communication network equipment and offer training to key telecommunications operators in member countries.

Al-Qaisi emphasized that the MoU with Huawei represents a significant roadmap toward supporting the enhancement of vital communication framework in member countries through the integration of advanced technology, extensive expertise, and distinguished insurance solutions offered by ICIEC.

He stated: “We are laying the foundation for strong growth and a qualitative leap in the telecommunications sector in member countries, where this collaboration rises to the level of partnership, enabling member countries to harness their full potential to establish a better and more innovative communications sector.”

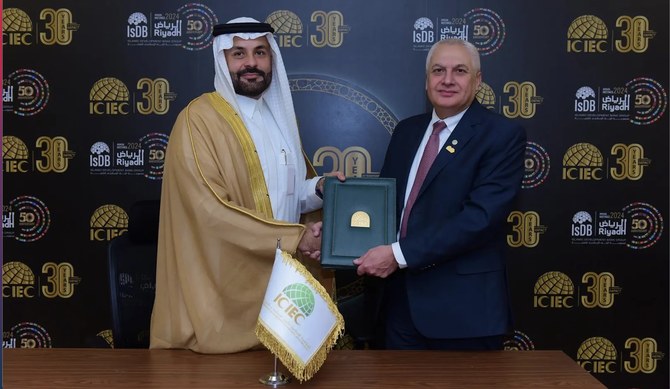

The ICIEC also signed a MoU with the Federation of Contractors in Islamic Countries, known as FOCIC.

It was signed by Al-Qaisi, and FOCIC President Zakaria Abdul Rahman Al-Abdul Qadir on the sidelines of the IsDB event.

Al-Qaisi explained that the memorandum stems from the institution’s commitment to enhancing understanding and implementation of Islamic insurance in all member countries, aiming to establish a comprehensive framework for cooperation in the areas of knowledge exchange and technical capabilities in the insurance and contracting sectors.