TUNIS: Tunisia’s state airline wants to lay off 1,200 workers to ease financial difficulties which have led to flight delays and the grounding of aircraft due to lack of spare parts, its chief executive told Reuters on Friday.

Tunisair, which has a fleet of 30 aircraft, employs 8,000 staff, part of a bloated public service which the government has failed to trim due to resistance from labor unions.

By comparison Morocco’s state-owned Royal Air Maroc, which has more than 50 aircraft, has some 3,300 workers, according to its website.

“The company is suffering from major financial difficulties because of the high number of workers and the wage bill of the company,” Elyess Mankabi, the company’s chief executive, said in an interview.

“We’ve proposed to lay off 1,200 workers and we await the government’s approval for this program, which will help the company ease its financial burden and get out of its crisis,” he said.

“In all parts of the world, each plane is supposed to have about 80 employee but at Tunisair, each plane has 165 workers, which is hitting the company’s balance sheets,” Mankabi said.

The company has been suffering losses since the ousting of autocrat Zine El-Abidine Ben Ali in 2011 sent Tunisia into turmoil, deterring tourists and investors.

It faces increased competition as Tunisia has been negotiating an Open Skies agreement with the European Union.

Tunisair has been expanding to Africa to tap new markets in anticipation of growing competition at home.

RESTRUCTURING PLAN

Angry passengers have recently vented frustration on social media about delays, which Mankabi blamed on a shortage of aircraft — the fleet of serviceable planes has shrunk to 24 from 30 as Tunisair lacks funds to carry out maintenance, Mankabi said.

There was no immediate reaction from the government and labor unions which have failed to agree on restructuring of Tunisair or other public sectors which have high numbers of staff.

Some Tunisian lawmakers have demanded a sale of the firm instead.

The Afek Tounes party, which is not part of the ruling coalition, said in a statement the government needed to intervene urgently to rescue Tunisair.

The Open Skies agreement with the European Union will open all airports except Tunisair’s main base in the capital to foreign carriers, but after four years Tunis airport will also be included.

“It will not be easy for the company after Open Skies, (which could come into force this year), But we have a reform program for the company. If implemented, we will be in the right direction,” Mankabi said.

He said the restructuring plan would cost about one billion Tunisian dinars ($363 million).

Mankabi expects the company to lease six aircraft to boost its fleet in 2019 as the airline launches two new routes in Africa by the end of this year, to Sudan and Cameroon, bringing the number of African routes to 10.

($1 = 2.7547 Tunisian dinars)

Tunisair wants government backing to lay off 1,200 workers

Tunisair wants government backing to lay off 1,200 workers

Saudi POS transactions see 20% surge to hit $4bn: SAMA

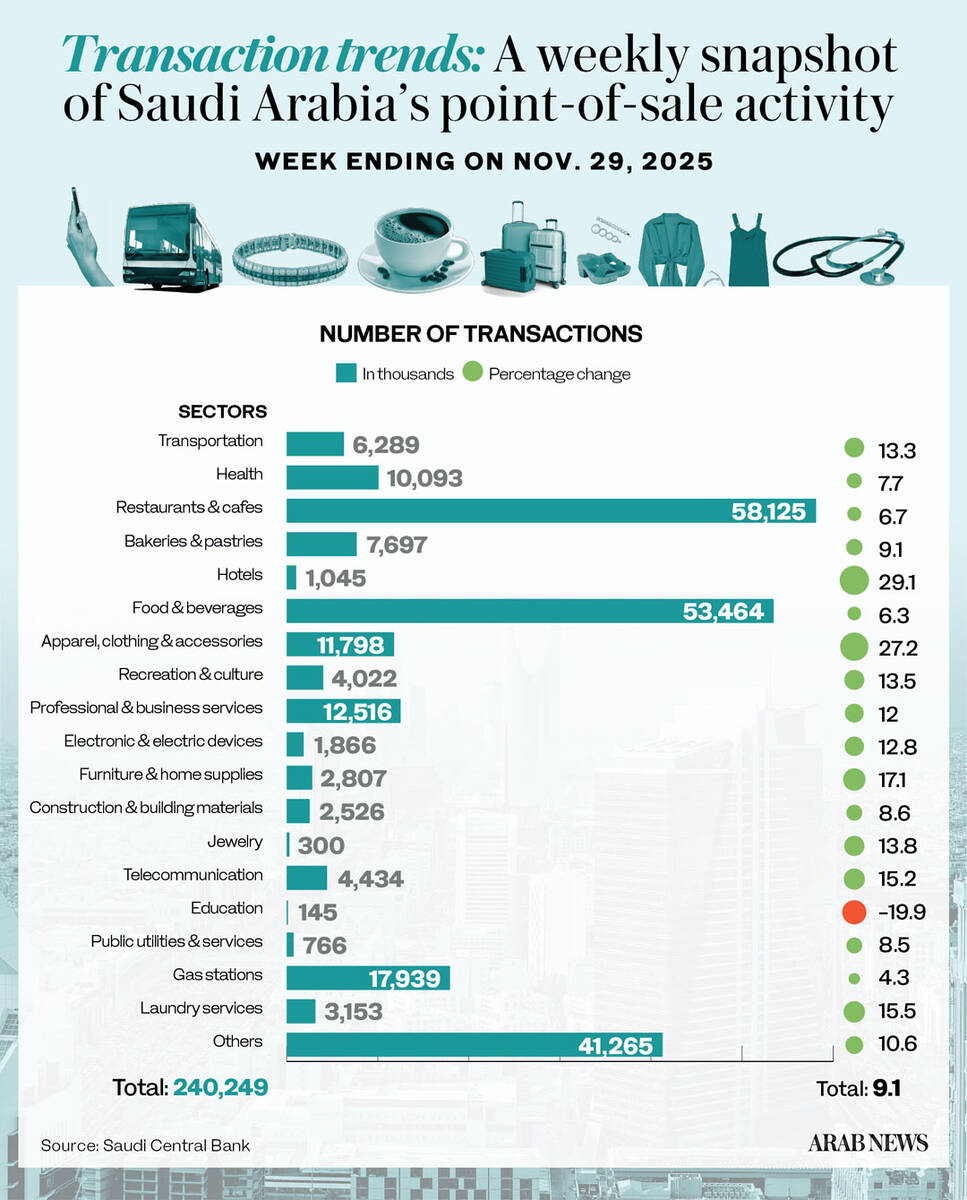

RIYADH: Saudi Arabia’s total point-of-sale transactions surged by 20.4 percent in the week ending Nov. 29, to reach SR15.1 billion ($4 billion).

According to the latest data from the Saudi Central Bank, the number of POS transactions represented a 9.1 percent week-on-week increase to 240.25 million compared to 220.15 million the week before.

Most categories saw positive change across the period, with spending on laundry services registering the biggest uptick at 36 percent to SR65.1 million. Recreation followed, with a 35.3 percent increase to SR255.99 million.

Expenditure on apparel and clothing saw an increase of 34.6 percent, followed by a 27.8 percent increase in spending on telecommunication. Jewelry outlays rose 5.6 percent to SR354.45 million.

Data revealed decreases across only three sectors, led by education, which saw the largest dip at 40.4 percent to reach SR62.26 million.

Spending on airlines in Saudi Arabia fell by 25.2 percent, coinciding with major global flight disruptions. This followed an urgent Airbus recall of 6,000 A320-family aircraft after solar radiation was linked to potential flight-control data corruption. Saudi carriers moved swiftly to implement the mandatory fixes.

Flyadeal completed all updates and rebooked affected passengers, while flynas updated 20 aircraft with no schedule impact. Their rapid response contained the disruption, allowing operations to return to normal quickly.

Expenditure on food and beverages saw a 28.4 percent increase to SR2.31 billion, claiming the largest share of the POS. Spending on restaurants and cafes followed with an uptick of 22.3 percent to SR1.90 billion.

The Kingdom’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 14.1 percent surge to SR5.08 billion, up from SR4.46 billion the previous week. The number of transactions in the capital reached 75.2 million, up 4.4 percent week-on-week.

In Jeddah, transaction values increased by 18.1 percent to SR2.03 billion, while Dammam reported a 14 percent surge to SR708.08 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with the Kingdom’s Vision 2030 objectives, promoting electronic transactions and contributing to the nation’s broader digital economy.